Key points:

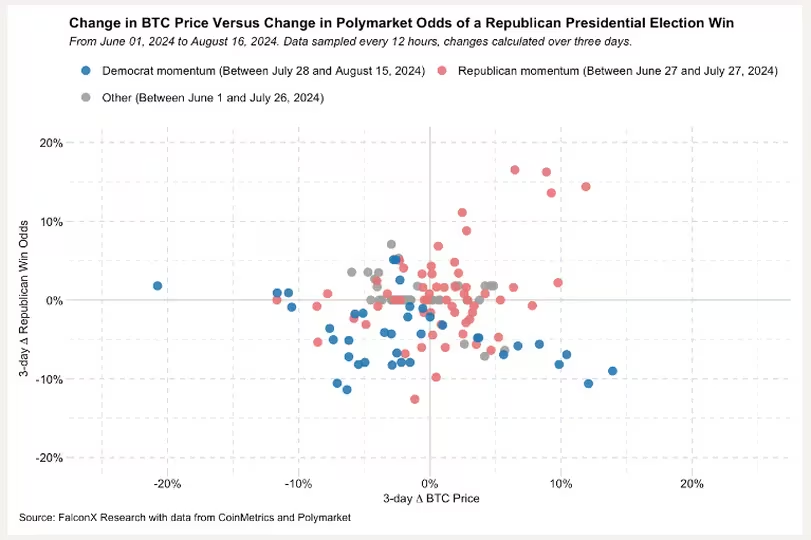

- A comparison of three-day changes in BTC’s price and Republican election odds between June 1 and Aug. 15 shows no definitive correlation between the two variables.

- A lot could change in the coming weeks, according to FalconX.

There is no strong correlation between Trump’s Election Odds and Bitcoin’s price; US monetary policy and oversupply have a greater impact on BTC.

Weak Correlation Between Trump’s Election Odds and Bitcoin Prices

Contrary to popular belief, FalconX’s analysis shows no clear correlation between Trump’s election odds and Bitcoin price changes from June 1 to August 15, 2024, according to Coindesk.

Despite market expectations, factors such as US monetary policy and oversupply impact BTC prices substantially during this period.

Read More: CEO of Cantor Fitzgerald, A Bitcoin Advocate, Now Leads Trump Transition Team

Crosscurrents Overshadowing Trump’s Election Odds Impact

FalconX research highlights that while Trump’s election odds were initially thought to impact Bitcoin’s price, the actual impact appears weak due to other factors, such as heavy selling by some entities and concerns about the possibility of increased supply.

As Election Day approaches, whether election news will become a more dominant driver of BTC’s price remains to be seen.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |