Market Overview (August 12 – August 18): Altcoin Season Delayed As Market Sentiment Worsens

Altcoin Season is expected to be delayed, with price reversals and worsening sentiment amid prolonged sideways movement. Investors remain cautious as market dynamics evolve.

Last week’s highlights big news (August 12 – August 18)

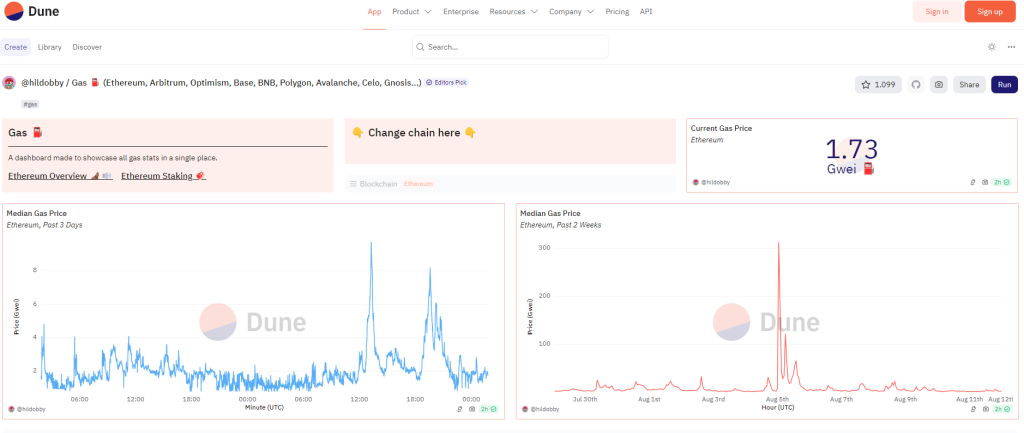

Ethereum gas fees have plummeted to a five-year low, hitting just 1.9 gwei on August 10th due to increased layer-2 network activity and the Dencun upgrade.

In a landmark decision, a Dubai court has validated cryptocurrency salary payments in employment contracts, signalling broader acceptance of digital assets in the UAE.

Bitcoin mining giant Marathon Digital Holdings has announced a $250 million convertible bond offering to acquire more Bitcoin. These bonds, set to mature in 2031, can be converted into company stocks.

Turkey’s Capital Markets Board has released updated guidelines for crypto asset service providers in light of new regulations.

Goldman Sachs‘ latest quarterly report reveals a $418 million holding in Bitcoin ETFs as of June 30. The investment bank owns nearly 7 million shares of Blackrock’s IBIT fund, making it the third-largest shareholder.

MetaMask has unveiled the beta version of its MetaMask Card, backed by Mastercard and fintech platform Baanx. This new offering enables crypto wallet users to utilize their digital assets for everyday purchases.

Binance has struck a deal with Brazil’s Securities and Exchange Commission (CVM), agreeing to pay 9.6 million reais (roughly USD 1.76 million).

Read more: Market Overview (August 5 – August 11): The Week Of Ripple and Binance, Economic Shifts Looming

Macroeconomics (August 12 – August 18)

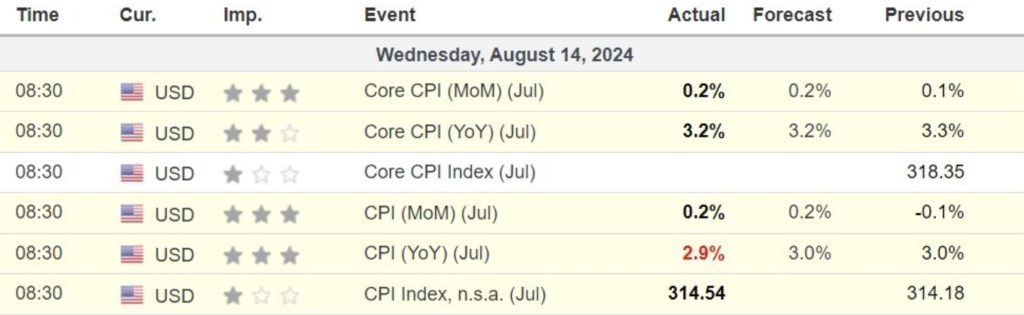

CPI data this month:

- CPI: 2.9% (Previous: 3.0%, Estimate: 3.0%)

- Core CPI: 3.2% (Previous: 3.3%, Estimate: 3.2%)

Market Overview

- Over $29 million in stablecoin netflow was withdrawn from exchanges in 24 hours.

- BTC closes the weekly candle as red Doji, indicating market indecision.

- Altcoin season is delayed as prices reverse recent gains.

- Market sentiment worsens amid prolonged sideways movement.

Bitcoin spot ETFs have pulled nearly $50B over their first six months. This influx shows clear market interest, boosting liquidity and opening up new ways to invest in crypto.

Despite this, these ETFs haven’t yet lifted the broader crypto market beyond Bitcoin. Altcoin prices have dropped sharply, going against Bitcoin’s trend.

Yet, this milestone could benefit the market in the long term. It’s helping crypto gain acceptance as a legitimate asset. If widespread adoption happens, altcoins could see big gains. Even with current downturns, it’s typical in crypto for a few strong weeks to push prices to new highs.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |