Key Points:

- MicroStrategy Bitcoin acquisition totals 331,200 BTC at $16.5 billion, showing bold crypto commitment.

- The latest purchase of 51,780 BTC boosts holdings, achieving 41.8% YTD BTC yield.

MicroStrategy Bitcoin acquisition reaches 331,200 BTC, purchased for $16.5 billion at an average of $49,874 per BTC, achieving a YTD BTC yield of 41.8%.

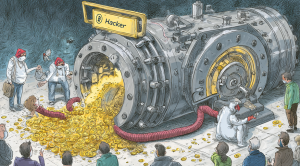

MicroStrategy Bitcoin Acquisition Hits Record Levels

MicroStrategy recently added to its stash 51,780 BTC for $4.6 billion, paying an average of $88,627/BTC, which shows that the firm is committed to growing the base of cryptocurrency reserves. This strategic step underlined the belief of the firm in Bitcoin’s long-term value driving corporate financial security.

The latest purchase reflects the aggressiveness of MicroStrategy in investing in Bitcoin, further setting its lead outpacing other corporate entities in cryptocurrency adoption. This solidifies MicroStrategy’s strategy of diversification and asset protection in an increasingly digital financial landscape by investing considerable funds into cryptocurrency.

Read more: MicroStrategy Bitcoin Holdings Exceed Nike’s Cash Reserve

MicroStrategy Now Holds 331,200 BTC Worth $16.5 Billion

As of November 17, 2024, MicroStrategy had secured an enviable 331,200 BTC that was acquired at a combined cost of $16.5 billion. The weighted average acquisition price was $49,874 per BTC, and the company remains among the top corporate Bitcoin holders in the world. Such a huge holding testifies to the firm’s confidence in Bitcoin as a strategic reserve asset.

Such a decision to amass such a huge Bitcoin reserve has turned out to be very fruitful, because the year-to-date BTC yields came to 41.8%, and quarter-to-date yields equaled 20.4%. These returns outline the efficiency of the firm’s cryptocurrency strategy and underline the role of MicroStrategy as a leading advocate of Bitcoin adoption among institutional investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |