Key Points:

- Active profit-taking occurred from traders who bought Bitcoin between $55,000-$70,000, with increased selling pressure above $90,000.

- Approximately $2 billion worth of Bitcoin from Silk Road was transferred from U.S. government wallets to Coinbase, causing market concerns.

Bitcoin bull run shows mixed signals as price stabilizes at $96,110 after hitting $99,728. Despite record ETF inflows of $6.5B in November, profit-taking emerges above $90K, while $2B Silk Road BTC transfer adds market uncertainty.

The recent Bitcoin bull run shows uncertainty in momentum towards its $100,000 achievement. While institutional support remains strong, even from key players like MicroStrategy, capital in the cryptocurrency market seems to spread across the board.

Bitcoin Bull Run Shows Mixed Signals

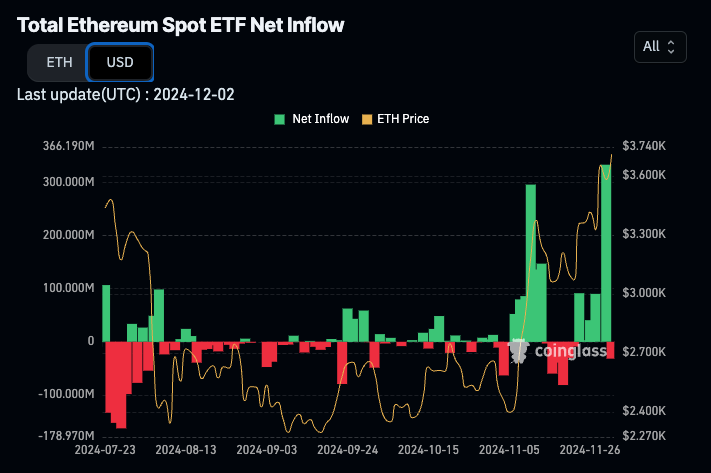

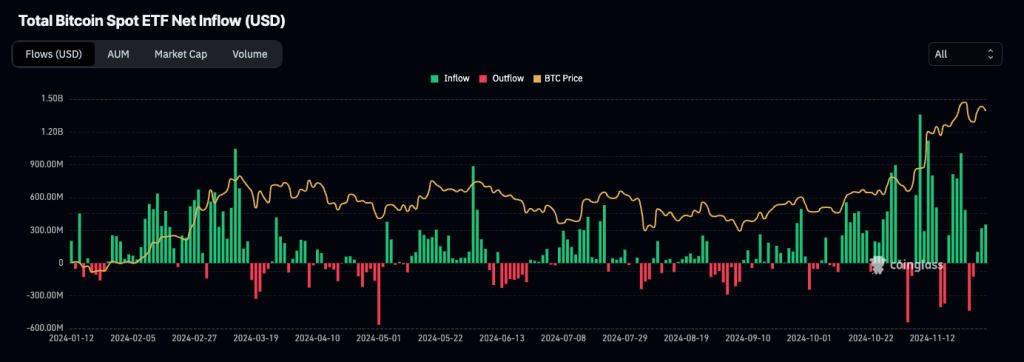

In fact, November saw significant developments in the market, with Bitcoin and Ether ETFs witnessing record monthly net inflows of $6.5 billion and $1.1 billion, respectively.

However, after six weeks of inflows, recent data is showing a move toward sales, with early investors in Bitcoin ETFs considering portfolio rebalancing post significant gains.

Read more: Bitcoin Analysis Signals 2017 Deja Vu With Volatility Rising

Market Analysis Reveals Profit-Taking

Bloomberg reported that market analysis shows active profit-taking by traders who bought Bitcoin in the range of $55,000-$70,000, and selling pressure increased when the price went above $90,000. The crypto options market has turned its bias to downside protection, while futures markets remain at moderate leverage after Bitcoin’s peak near $99,000.

Adding to the market fears, blockchain analytics firm Arkham, in a report, said around $2 billion worth of Bitcoin originating from the now-defunct website Silk Road transferred from U.S. government wallets to Coinbase exchange. Such huge transfers, as always, create apprehensions over its probable impact on the market.

Fast Check

On December 1, 2017, Bitcoin went down to $9,410 before embarking on its historic ride to $19,700, marking an incredible 109% price surge.

Bitcoin has kept an upward posture, stable at $96,110 after a fresh record high of $99,728 on Nov 22.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |