Key Points:

- Riot Platforms acquires $510 million worth of Bitcoin, acquiring 5,117 BTC at an average price of $99,669 per coin.

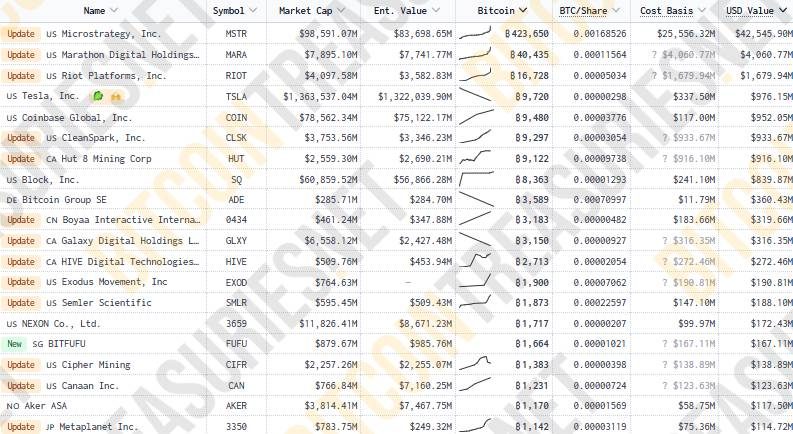

- The acquisition boosts Riot’s BTC reserves to 16,728 Bitcoin, worth approximately $1.68 billion, making it the third-largest public holder globally.

Riot Platforms acquires BTC value of $510M, raising its holdings to 16,728 BTC. The purchase strengthens its position as a leading public Bitcoin holder.

Riot Platform Acquires 5,117 BTC for $510M

Riot Platform (formerly Riot Blockchain), a leading Bitcoin mining company, recently announced a significant purchase of 5,117 Bitcoin for $510 million in cash, at an average price of $99,669 per coin.

The mining company stated that this latest Bitcoin acquisition was funded by the $525 million raised through the sale of convertible senior notes announced on December 9th.

Read more: Matrixport Predicts Bitcoin Price to Soar $160K by 2025 Amid ETF Demand

Resilience Amid Past Market Downturns

Riot Platform is a Bitcoin mining and digital infrastructure company. It operates Bitcoin mining facilities in Texas and Kentucky, along with electrical equipment manufacturing operations in Denver, Colorado.

During the crypto downturn of 2022-2023, Bitcoin mining companies faced significant challenges as profit margins shrank, forcing them to restructure their operations to survive. Industry giant Core Scientific was one of the most notable casualties, while Argo Blockchain teetered on the brink of bankruptcy.

Riot Platform also faced difficulties, having to shut down its Rockdale mining facility in Texas due to extreme weather conditions in late 2022. The snowstorm at that time tore down power lines and dangerously lowered temperatures, causing the Bitcoin hashrate to plummet by more than 30%.

Riot Platform’s Bitcoin Strategy Echoes MicroStrategy’s Approach

Riot Platforms acquires BTC’s latest mirror strategies employed by companies like MARA Holdings and MicroStrategy, the latter being the largest corporate Bitcoin holder with 423,650 BTC.

With this latest addition of BTC to its reserves, Riot Platform has increased its total Bitcoin holdings to 16,728 BTC, equivalent to $1.68 billion – ranking it third on the list of publicly traded companies with the largest Bitcoin holdings globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |