$120232.534

At CoinCu News, we give both basic and in-depth articles on the latest news in the cryptocurrency and blockchain sectors.

Author

News

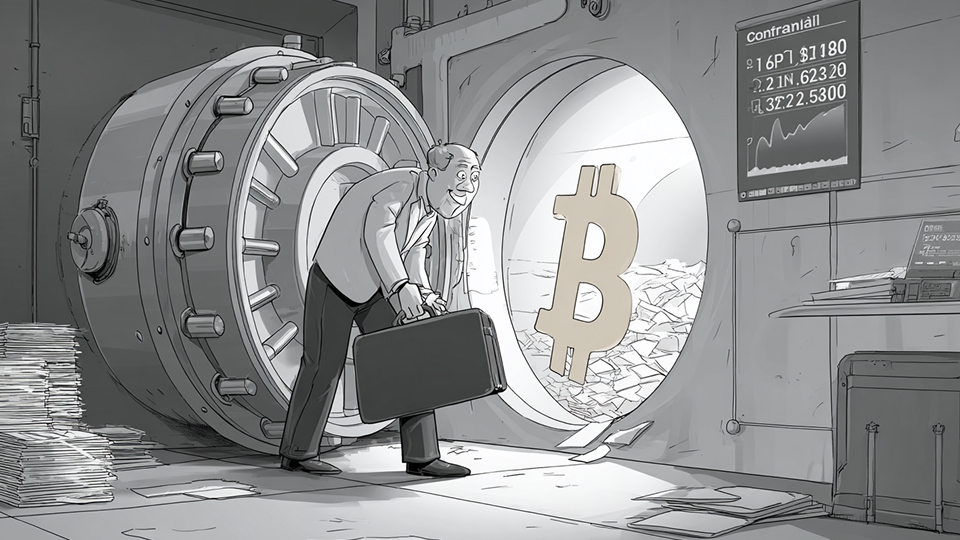

US Regulators Approve Bank Custody for Bitcoin and Crypto Assets

The Federal Reserve, OCC, and FDIC allow banks to offer custody services for crypto, with

Jul

PUMP Token Launches After Rapid $500M Sale

PUMP token launches post-$500M sale on Solana, trading starts today.

Jul

Hungary Enacts Strict Crypto Regulations, Major Fintechs Suspend Services

Hungary implements strict crypto regulations, prompting fintech giants like Revolut to suspend services, affecting millions

Jul

Crypto Firms Seek National Trust Bank Licenses in U.S.

Ripple, Circle, and BitGo pursue U.S. national trust bank licenses, seeking to enhance crypto financial

Jul

The Fed, FDIC, OCC Issue Crypto Custody Guidelines

The Federal Reserve, FDIC, and OCC release new guidelines for cryptocurrency custody by banks.

Jul

Aave Surpasses $50 Billion in Net Deposits, Leading DeFi Lending Surge

Aave, a decentralized lending protocol, achieves $50B net deposits, driving DeFi industry recovery. Explore community

Jul

Trump Threatens 100% Secondary Tariff on Russia

Trump vows severe tariffs on Russia unless an agreement is reached in 50 days.

Jul

Kazakhstan Explores National Reserve Investment in Crypto Assets

Kazakhstan's central bank considers investing gold reserves in cryptocurrency, seeking higher returns while acknowledging market

Jul

Grayscale Files Confidential IPO With SEC as Bitcoin Hits $123K

Grayscale submits draft IPO registration to SEC under JOBS Act amid surging crypto momentum and

Jul

[tptn_list how_old="7" limit="5" title_length="0" heading="0" show_date="0" ]

[tptn_list how_old="30" limit="5" title_length="0" heading="0" show_date="0" ]