Key Points:

- Tether Sell Bitcoin: JPMorgan warns that new US stablecoin regulations could force Tether to offload non-compliant assets, including Bitcoin.

- The STABLE and GENIUS Acts may require Tether to restructure reserves, increasing US Treasury holdings while reducing riskier assets.

US stablecoin regulations may push Tether sell Bitcoin, impacting market stability as compliance challenges rise.

Tether Sell Bitcoin? JPMorgan Flags Regulatory Pressure

A JPMorgan report suggests that Tether may need to sell Bitcoin and other non-compliant assets like corporate paper and precious metals to adhere to proposed US stablecoin laws.

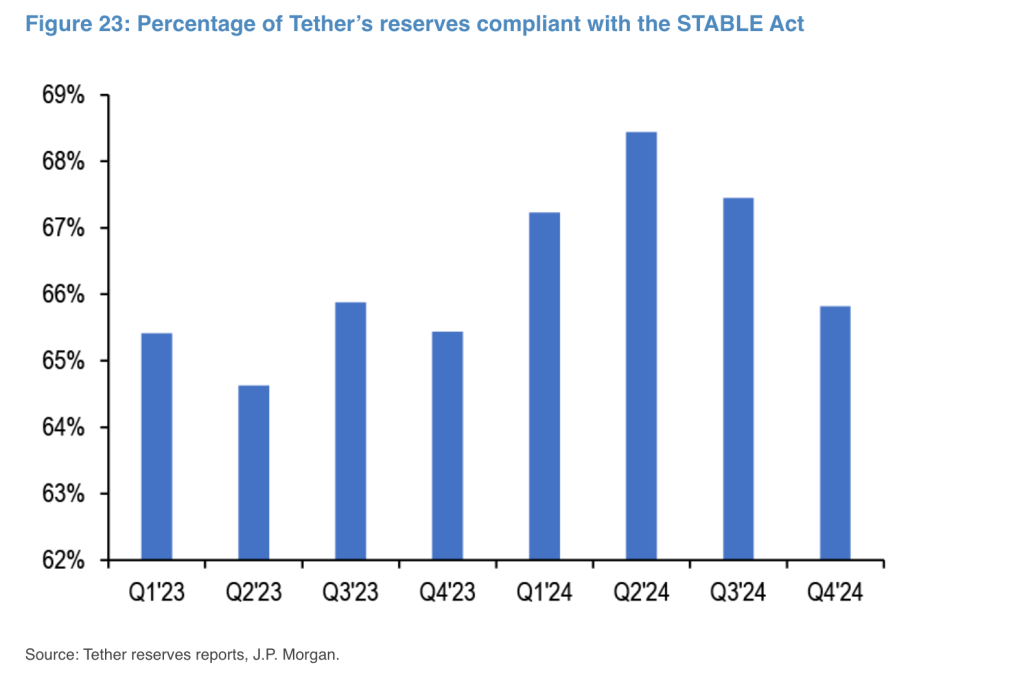

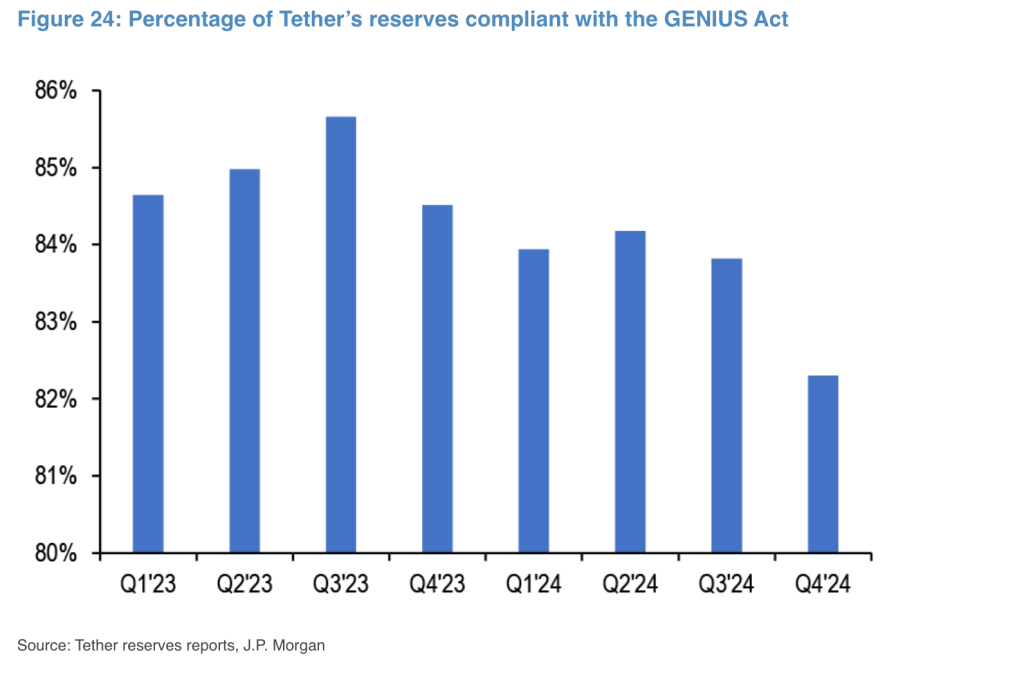

The report highlights two key legislative efforts – the STABLE and GENIUS Acts – aiming to enforce stricter licensing, transparency, and 1:1 reserve requirements for stablecoin issuers. Currently, only 66% of Tether’s reserves align with the STABLE Act, while 83% meet the GENIUS Act’s standards.

In its Q4/2024 financial report a profit of $13 billion, Tether said it was holding $7.8 billion worth of Bitcoin, equivalent to 83,758 BTC at $93,812 / BTC at that time, analysts say the company might have to liquidate Bitcoin holdings if regulators enforce asset restrictions.

Read more: Tether AI SDK Platform Enables Secure AI and Self-Custody

US Regulations Could Reshape Tether’s Reserve Strategy

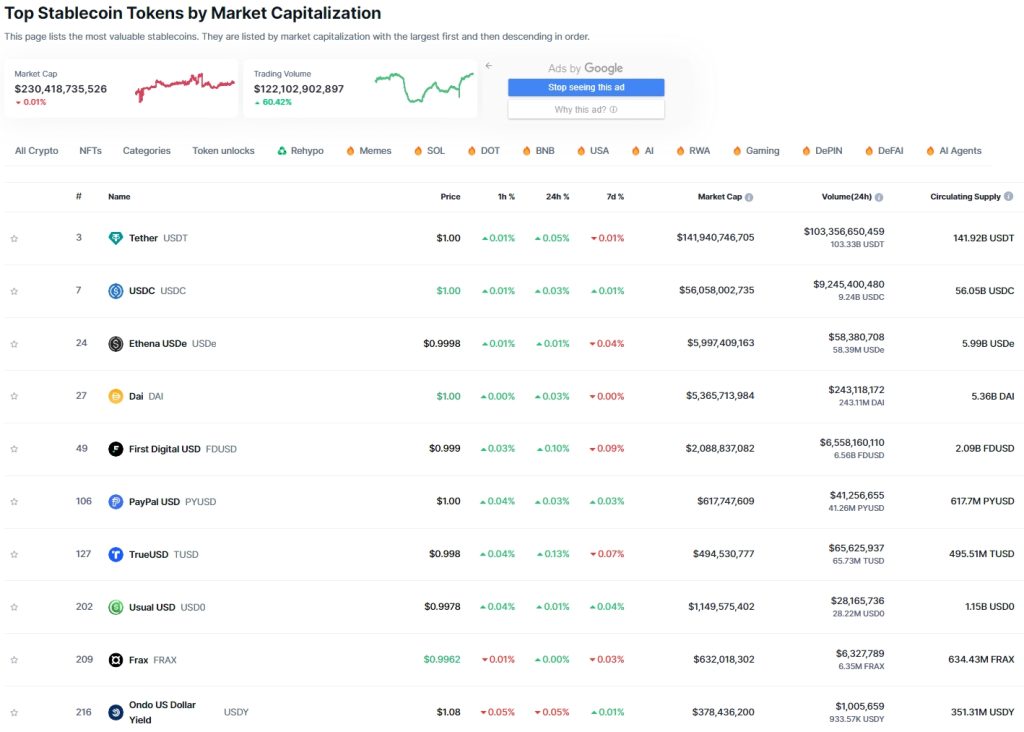

CoinMarketCap shows that Tether’s USDT currently has a market capitalization of $141.9 million, equivalent to controlling nearly 60% of the current global stablecoin market share of $230 million.

Tether dominates nearly 60% of the global stablecoin market, but upcoming regulations may shift the landscape. The STABLE Act pushes for state-level oversight and stricter reserve backing, while the GENIUS Act proposes federal control with broader asset flexibility.

Beyond the US, Tether faces regulatory hurdles in Europe, where MiCA regulations demand that 60% of reserves be held in EU banks, leading to USDT delistings from several platforms. If US lawmakers approve these stablecoin laws, Tether selling Bitcoin could become a necessary step to comply, affecting both its reserves and market positioning.

This information once again pushed investors’ psychology into a “fearful” position about the prospect of a new sell-off, since the event of the US/German Government dumping a large amount of Bitcoin in the summer of 2024.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |