Key Points:

- Bybit hack funds were laundered through THORChain, ExCH, and OKX Web3 Wallet, with $1.4 billion in ETH stolen.

- 77% of the stolen funds remain traceable, while 20% have gone dark, and 3% are frozen.

- THORChain processed 72% of the illicit funds, generating $5.5 million in fees from the laundering process.

- Community backlash grows as THORChain refuses to intervene, raising concerns about transparency and decentralization.

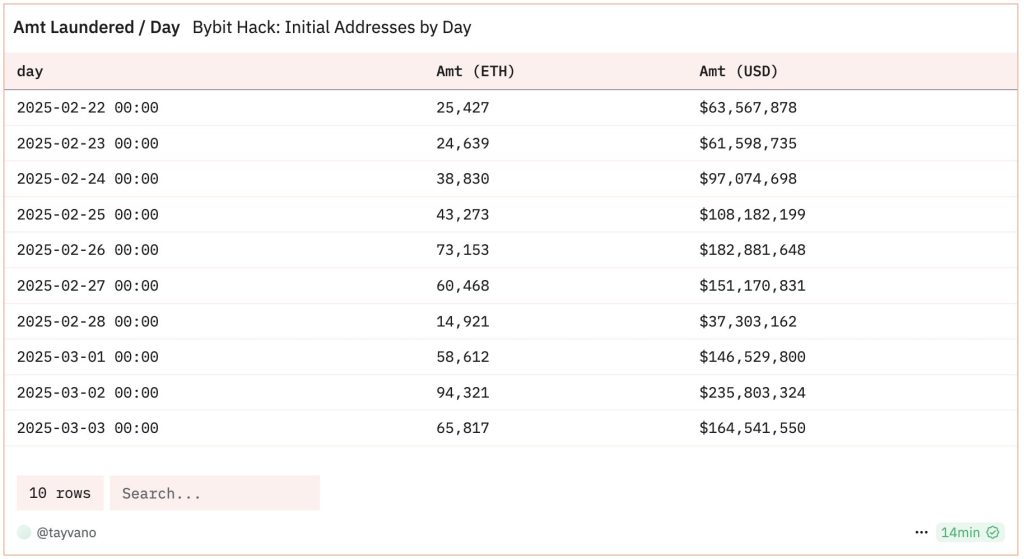

According to on-chain data, hackers successfully laundered 499,000 ETH (worth $1.4 billion) stolen from Bybit, marking one of the largest crypto heists in history. The laundering process began on February 21 and lasted 10 days.

This incident highlights the growing risks of decentralized finance (DeFi) platforms being exploited for money laundering. As regulators scrutinize protocols like THORChain, the case may set a precedent for how DeFi governance handles illicit transactions. This could prompt discussions on whether DeFi platforms should take proactive measures against unlawful activity or remain entirely permissionless.

Bybit Hack Funds Laundered Through THORChain and ExCH

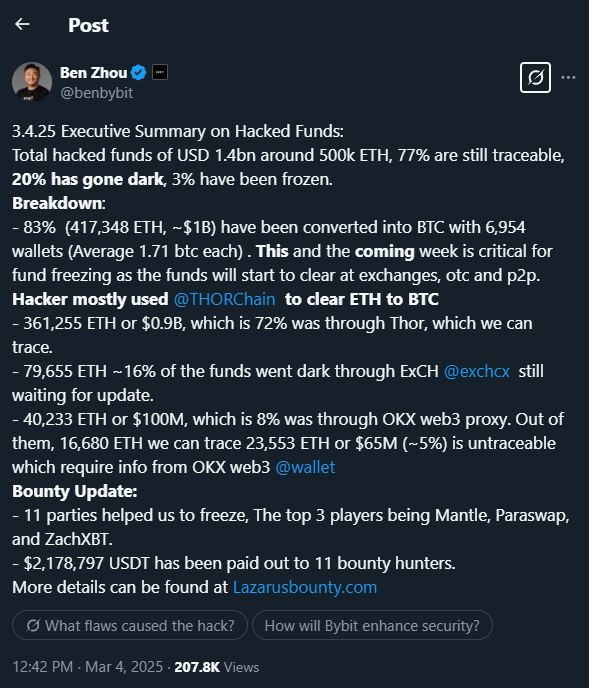

Bybit CEO Ben Zhou provided updates on the stolen funds:

- 77% of the ETH remains traceable.

- 20% (79,655 ETH) has gone dark, meaning it is untraceable.

- 3% of the funds have been frozen.

Additionally, 83% of the stolen funds (417,348 ETH or $1 billion) have already been converted into BTC, distributed across 6,954 wallets. This conversion is crucial before hackers attempt to liquidate the assets via exchanges, OTC, or P2P trading.

THORChain Under Fire for Processing 72% of Illicit Transactions

The Bybit hack funds were primarily laundered through THORChain, a decentralized cross-chain swapping protocol. According to on-chain analytics, THORChain processed:

- 361,255 ETH (~72% of the stolen funds) without intervention.

- 79,655 ETH (~16%) via ExCH, which has refused to cooperate with tracking efforts.

- 40,233 ETH (~8%) via OKX Web3 Wallet, requiring further information from OKX.

THORChain has benefited significantly from these transactions, earning $5.5 million in fees while processing $5.9 billion in total swaps. However, the protocol’s inaction against illicit activity has led to community backlash, with critics questioning its transparency, governance, and decentralization.

THORChain developers responded, stating that the protocol operates as a fully decentralized system and does not have the means to blacklist addresses. This raises broader concerns over DeFi governance: Should decentralized platforms actively prevent money laundering, or would doing so undermine decentralization principles?

Market Impact and Future Outlook

The mass liquidation of the Bybit hack funds has contributed to Ethereum’s sharp decline, with ETH prices dropping 13% from $2,526 to $2,030 during the laundering period.

As exchanges and authorities attempt to track and freeze these assets, the coming weeks will be critical in preventing further liquidation of the stolen BTC. If successful, some funds may be recovered, but the incident highlights an ongoing issue in DeFi’s role in financial crime.

The Bybit hack funds case exposes major vulnerabilities in decentralized protocols like THORChain, which allow illicit actors to exploit blockchain technology. While DeFi’s permissionless nature is a core principle, this incident raises the question: Should protocols take responsibility for preventing money laundering, or does that contradict decentralization?

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |