Key Points:

- Pump.fun’s volume nosedived from $119B in January to $44B in February, marking a 63% decline as memecoin hype fades.

- The $107M “Libragate” rug pull, involving a token endorsed by Argentine President Javier Milei, left 86% of investors with losses over $1,000.

- The SEC confirms memecoins aren’t securities but warns that fraud will be strictly enforced, adding pressure to the struggling sector.

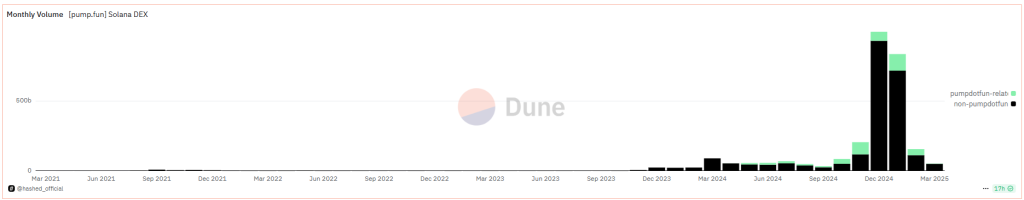

Trading volume on Pump.fun, a token launchpad in the Solana ecosystem, has plummeted 63% from January to February 2025, according to data from Dune Analytics. The sharp decline coincides with growing skepticism toward memecoins, following a series of high-profile scandals that have shaken investor confidence.

Pump.fun Trading Volume Crashes 63% Amid Memecoin Scandals

Pump.fun’s trading volume fell from $119 billion to $44 billion in the first two months of 2025, with only $2.1 billion recorded in the past four days. Additionally, new token listings on the platform have dropped significantly. After peaking at nearly 1,200 daily listings on Jan. 24, the number has now fallen below 300 per day in early March, signalling waning enthusiasm for speculative token launches.

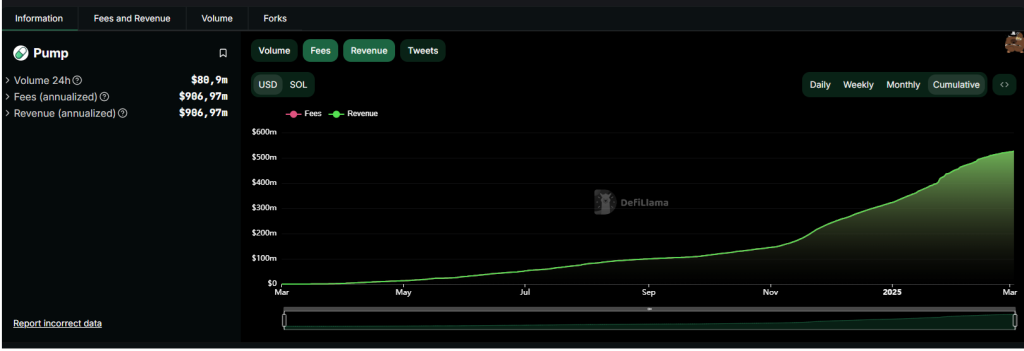

While February’s trading volume is the lowest since October 2024, Pump.fun still recorded its fourth-highest monthly volume since launching in January 2024. Despite the downturn, the platform remains profitable, generating nearly $74 million in revenue over the past 30 days, according to Dune Analytics.

Pump.fun Listings Drop 75% as Traders Flee Memecoins

The broader decline in memecoin trading comes amid increasing concerns about insider trading, rug pulls, and fraudulent schemes. These fears have been exacerbated by major incidents like the so-called “Libragate” scandal. The token, launched by a group including the now-infamous Hayden Davis, surged in popularity after receiving an endorsement from Argentine President Javier Milei.

However, it ultimately collapsed in what many call a $107 million rug pull, with 86% of investors suffering losses exceeding $1,000.

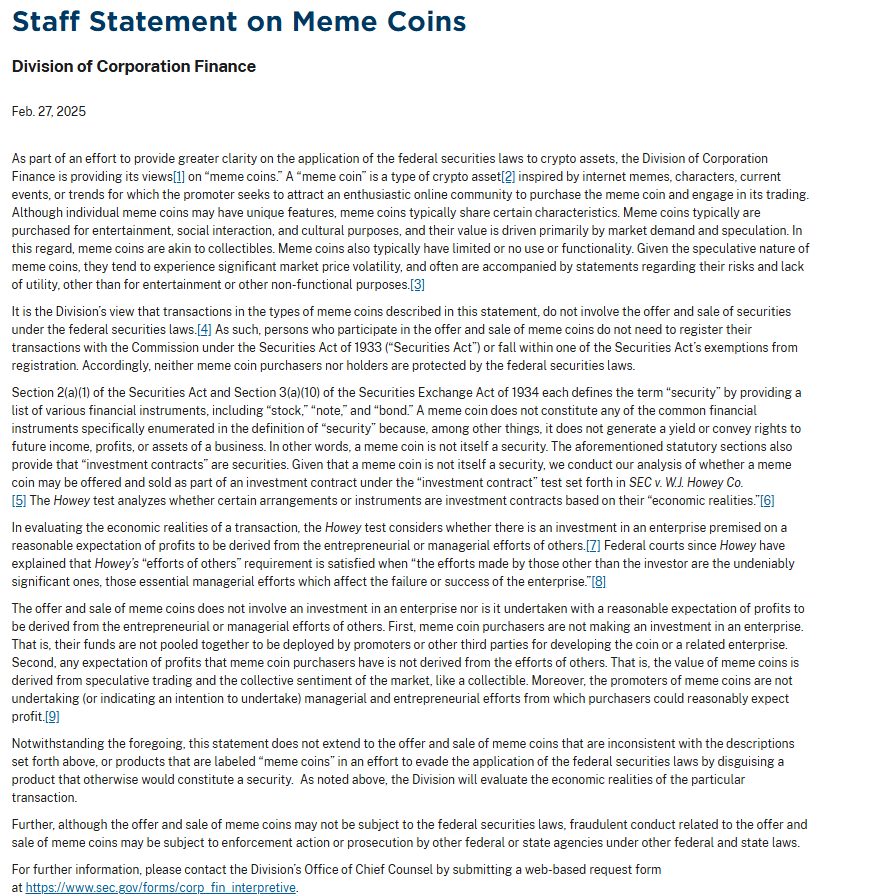

Regulators are also taking notice. On Feb. 27, the U.S. Securities and Exchange Commission (SEC) addressed the memecoin market, clarifying that meme coins are not classified as securities. However, the agency emphasized that fraudulent activities within the space would still be subject to enforcement.

As scrutiny intensifies and traders become more cautious, the future of memecoin speculation remains uncertain. Pump. fun’s recent moves, including the launch of a mobile app and plans for a native automated market maker (AMM), indicate efforts to adapt to the shifting landscape. Whether these initiatives will help the platform recover lost momentum or if the era of rampant memecoin speculation is fading remains to be seen.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |