Key Points:

- U.S. Treasury sanctions 49 cryptocurrency wallets linked to the Nemesis Darknet Marketplace, affecting 44 Bitcoin and 5 Monero addresses.

- Iranian national Behrouz Parsarad, alleged Nemesis administrator, was accused of laundering funds and facilitating illegal trades.

- Nemesis had 30,000 active users, processing nearly $30 million in illicit transactions before being dismantled.

- The crackdown follows Hydra Market’s 2022 closure and continued U.S. efforts to disrupt darknet marketplaces.

The U.S. Treasury’s Office of Foreign Assets Control (OFAC) has added 49 cryptocurrency wallets to its sanctions list, citing their association with the now-dismantled Nemesis Darknet Marketplace.

This latest move underscores the U.S. government’s ongoing campaign against illicit financial networks operating through cryptocurrencies. Privacy-focused digital assets like Monero (XMR) have made tracking transactions more challenging, raising concerns among regulators and law enforcement agencies. Authorities aim to curb financial flows to darknet markets by blacklisting associated wallets.

Nemesis Darknet Marketplace Wallets Blacklisted by U.S. Authorities

According to Chainalysis, the sanctioned wallets include 44 Bitcoin (BTC) addresses and 5 Monero (XMR) addresses, allegedly controlled by Iranian national Behrouz Parsarad, who is accused of operating the marketplace.

Operating for over three years, Nemesis reportedly facilitated nearly $30 million in illicit transactions, enabling users to trade:

- Narcotics

- Stolen personal data

- Forged documents

- Ransomware tools

- Cybercrime services (phishing kits, DDoS-for-hire attacks)

OFAC reports that Parsarad allegedly profited millions of dollars in transaction fees. He remains at large, though no official confirmation has been provided regarding ongoing investigations or potential arrests.

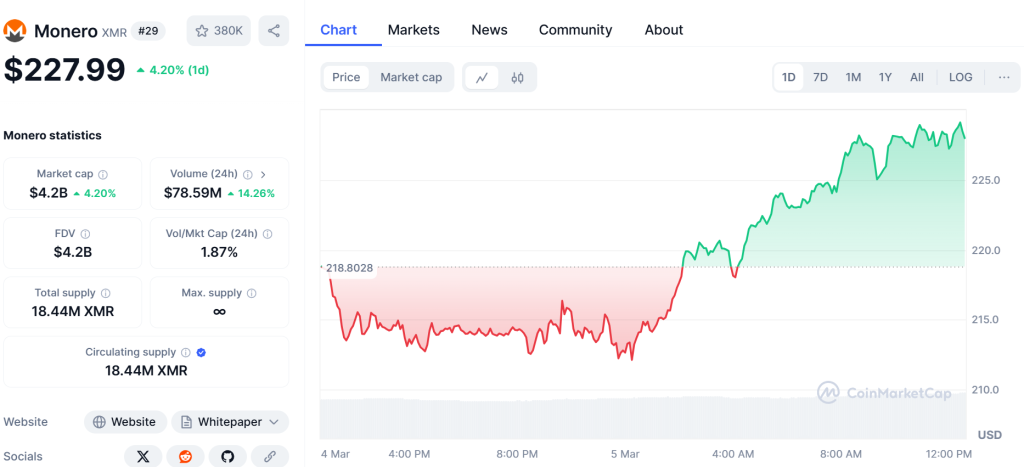

The inclusion of Monero in these sanctions is significant, as its privacy-enhancing technology makes tracing transactions nearly impossible. Blockchain analysts and law enforcement agencies have expressed concerns over Monero’s role in illicit transactions.

Following the sanctions announcement, XMR’s price did not fall but instead increased by 4.2% over the past 24 hours, despite market concerns about the possibility of regulatory scrutiny.

U.S. Targets Darknet Marketplaces Amid Growing Crypto Crime Concerns

The crackdown on Nemesis aligns with broader efforts by U.S. authorities to combat darknet financial crimes. The sanctions are reportedly tied to a U.S. President’s executive order aimed at curbing the fentanyl trade since 2023. Recent enforcement actions include:

- 2022: The U.S. and Germany shut down Hydra Market, the largest darknet market at the time, responsible for over $1.3 billion in transactions.

- 2025: Former Silk Road founder Ross Ulbricht received clemency from President Trump after serving over a decade in prison. His release reignited discussions about darknet markets and law enforcement efficacy.

Despite these takedowns, darknet markets continue to resurface under new branding. Blockchain analysts warn that privacy coins like Monero and decentralized exchanges may complicate future enforcement efforts.

The Nemesis crackdown marks another chapter in the U.S. government’s battle against illicit crypto activity. While enforcement actions have disrupted major players like Hydra and Silk Road, the rise of privacy coins, decentralized finance (DeFi), and peer-to-peer exchanges present evolving challenges for regulators.

Whether these measures will significantly curb illicit transactions remains uncertain, but authorities continue to increase pressure on financial enablers of darknet marketplaces.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |