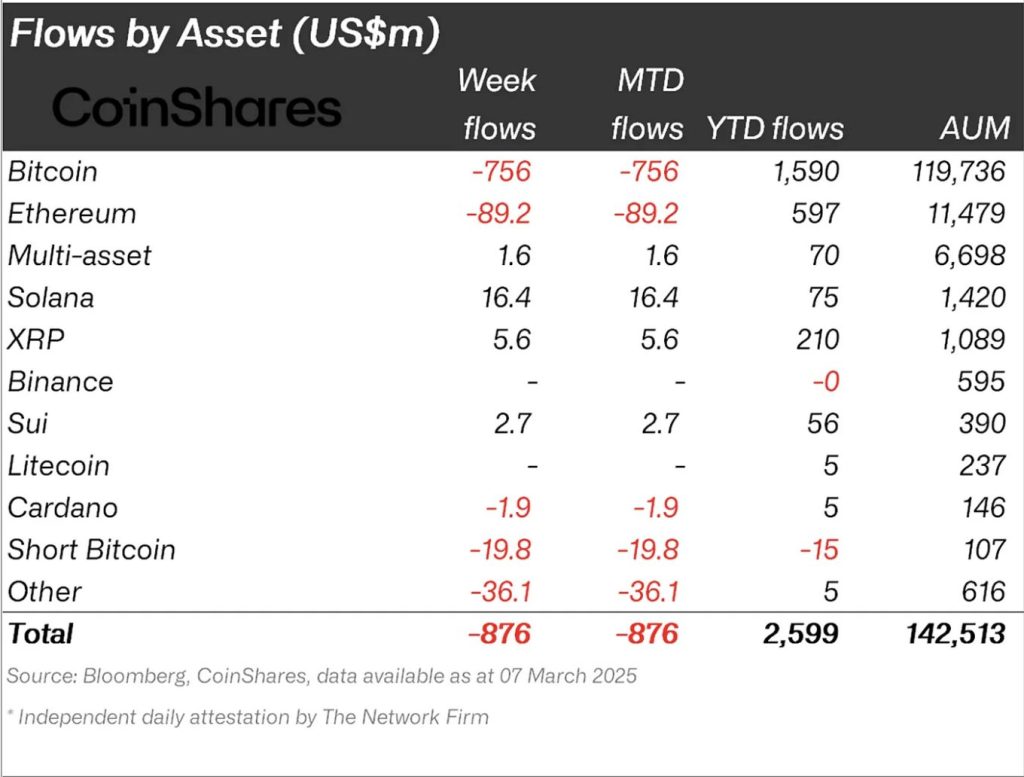

| Key Points: – Digital asset investment products saw their fourth consecutive week of outflows, totaling $876 million. – Bitcoin led the sell-off with $756 million in outflows, while short-Bitcoin products also saw withdrawals. – Despite White House efforts to support crypto, market sentiment remains bearish. |

Digital asset investment products have recorded their fourth consecutive week of outflows, with investors pulling $876 million last week, according to data from CoinShares.

The sustained sell-off has pushed total outflows over this period to $4.75 billion, reducing year-to-date inflows to $2.6 billion. As a result, total assets under management (AUM) have dropped to $142 billion, marking a $39 billion decline from their peak and the lowest level since mid-November 2024.

Digital Asset Investment Face Continued Outflows With Bitcoin Leads $756 Million

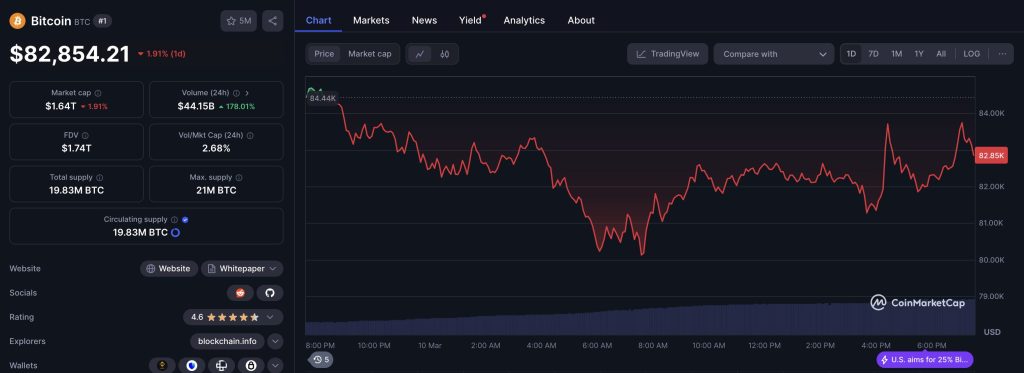

Bitcoin was at the center of the sell-off, accounting for $756 million in outflows. Notably, short-Bitcoin products also experienced withdrawals of $19.8 million, the highest since December 2024. Meanwhile, the cryptocurrency’s price has fallen back to approximately $82,000, its level from early March.

Bitcoin price has dropped to around $82,800, which is the price the coin was trading at in early March.

Investor sentiment remains bearish as broader market conditions continue to be influenced by geopolitical tensions and economic uncertainty. Despite recent efforts to bolster the crypto industry, including a White House meeting between President Donald Trump and digital asset leaders, confidence in the market has yet to recover.

Altcoins Experience Mixed Flows Amid Market Uncertainty

Trump’s executive order establishing a Strategic Bitcoin Reserve was seen as a shift from the previous administration’s stricter regulatory stance, aiming to position the U.S. as a global crypto leader.

However, the announcement led to further market turbulence, with major cryptocurrencies—including Ethereum, Ripple’s XRP, Solana, and Cardano—showing little price movement over the past week.

Altcoins also saw significant outflows, with Ethereum losing $89 million, Tron seeing $32 million in withdrawals, and Aave shedding $2.4 million. However, some assets bucked the trend, with Solana, XRP, and Sui attracting inflows of $16.4 million, $5.6 million, and $2.7 million, respectively.

Amid the ongoing digital asset investment uncertainty, Bitcoin’s role as a store of value is being questioned by investors. Many are shifting back to traditional safe-haven assets such as gold, which has surged in price as global economic instability and trade tensions escalate.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |