| Key Points: – Solana’s revenue has dropped 93% from its January peak due to declining memecoin activity. – Pump.fun, a key memecoin platform, saw daily revenue collapse by 93% from its January high. – DeFi TVL on Solana has plunged nearly 50%, reflecting lower on-chain engagement. – SOL price has dropped 58% from its mid-January high as market sentiment weakens. |

Solana’s revenue has fallen 93% from its January peak, driven by waning memecoin hype and broader market downturns, impacting DeFi TVL and SOL prices.

The rapid decline in Solana’s on-chain activity raises concerns about its long-term sustainability. As memecoin speculation fades, Solana must shift focus toward core DeFi applications and real-world blockchain utility to retain investor confidence.”

Solana’s Revenue Hits New Lows as Memecoin Mania Cools

Solana’s network revenue has plunged to levels not seen since September 2024, marking a sharp decline following the peak of the memecoin frenzy in January 2025. At its height, Solana generated $55.3 million in weekly fees, fueled largely by speculative trading on memecoin platforms like Pump.fun.

However, the past week saw network revenue plummet 93% to just $4 million, reflecting a massive contraction in on-chain activity. DApp revenue has followed a similar trajectory, sinking 86% from its $238 million peak to $32 million.

Meanwhile, Solana’s DeFi total value locked (TVL) has nearly halved, dropping from over $12 billion in January to approximately $6.4 billion. The data suggests that Solana’s rapid growth, heavily reliant on memecoin speculation, has reversed sharply as investor enthusiasm fades.

Memecoin Collapse Sparks On-Chain Activity Decline

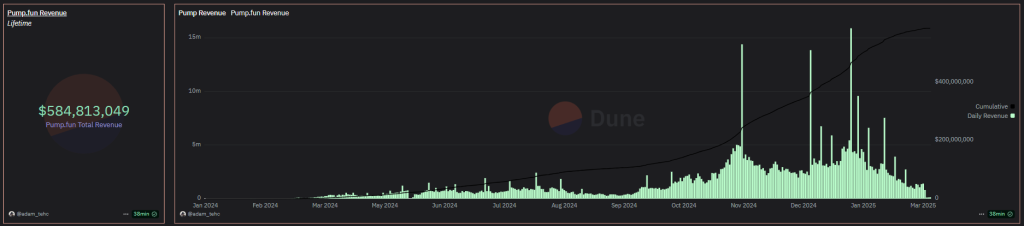

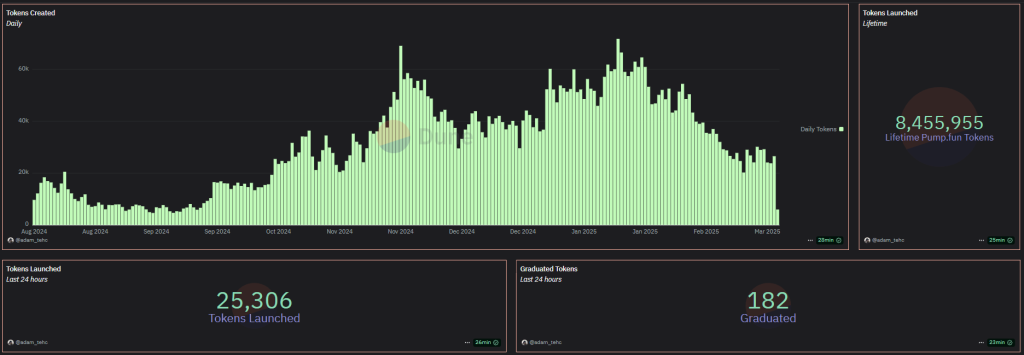

Memecoin speculation had been a key driver of Solana’s revenue surge, with Pump.fun contributing up to 80% of total fees. The platform saw record daily revenues of $15 million in late January, but as of March 7, earnings have collapsed by 95% to just $800,000.

The hype peaked when former U.S. President Donald Trump launched his TRUMP token on January 18, followed by MELANIA on January 20. While both tokens initially saw explosive gains, TRUMP has since fallen 86% from its peak, and MELANIA has crashed 95% in just seven weeks.

Beyond TRUMP and MELANIA, the broader memecoin sector on Solana has suffered a liquidity exodus. New token launches on Pump.fun has declined significantly, with only 0.73% of newly created tokens achieving “graduation” status, compared to 1.6% at the market’s peak. These figures indicate a diminishing appetite for high-risk speculative assets within the Solana ecosystem.

SOL Price Drops as Market Conditions Weaken

The downturn in Solana’s revenue and on-chain activity has coincided with a broader market correction. Bitcoin (BTC) recently dipped below $76,600, triggering a wave of selling pressure across altcoins. Solana (SOL), which reached an all-time high of $293 in mid-January, has since fallen 58%, currently trading around $123.

As memecoin-driven speculation fades, Solana now faces a pivotal moment. With decreasing transaction fees, lower validator incentives, and a cooling DeFi landscape, the network must pivot toward sustainable growth strategies to maintain its momentum.

Whether Solana can weather this shift and attract long-term builders remains a key question for its future trajectory.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |