| Key Points: – Cboe BZX Exchange has filed a proposal with the SEC to allow staking for the Fidelity Ethereum ETF. – The SEC previously prohibited staking in Ethereum ETFs, but recent developments suggest a potential policy shift. |

Cboe BZX Exchange has filed a rule change proposal with the U.S. Securities and Exchange Commission (SEC) seeking approval to enable staking for the Fidelity Ethereum ETF (FETH).

If approved, the proposal would allow the Fidelity Ethereum ETF to stake Ether (ETH) through trusted providers, generating rewards that would be treated as income.

Cboe Seeks SEC Approval for Fidelity Ethereum ETF Staking

Staking involves participating in Ethereum’s transaction validation process, earning additional ETH as rewards. The feature was not part of the ETF’s original approval.

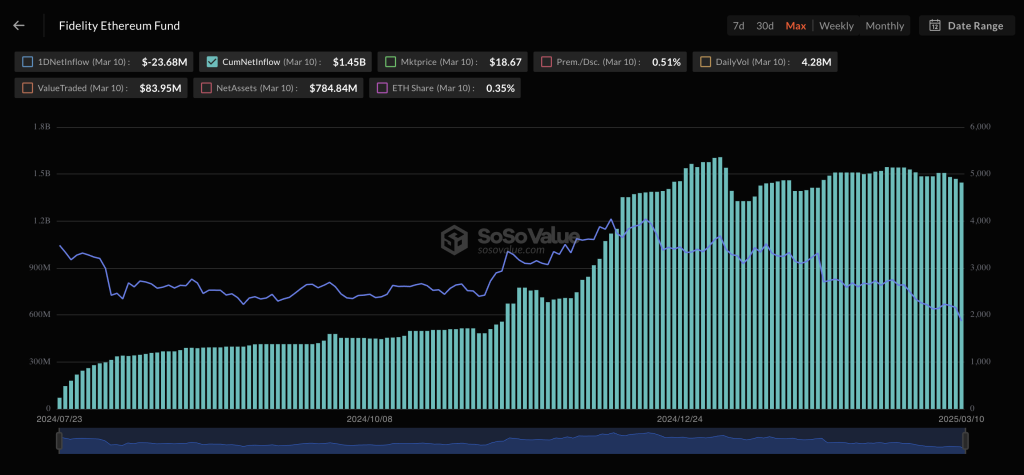

The development comes as the fund faces declining assets under management due to falling Ether prices amid a broader cryptocurrency market downturn. At the time of writing, ETH is trading around $1,920 after the $2,000 mark breached on Monday.

Fidelity Investments initially filed for its spot Ethereum ETF in November 2023, aiming to provide investors with regulated exposure to ETH without the need for direct ownership.

The SEC approved Fidelity Ethereum ETF in May 2024, alongside similar funds from other asset managers. Since its launch in July 2024, the fund has attracted significant investor interest, amassing $1.45 billion in net inflows. The SEC’s prohibition on staking limited its ability to generate additional returns.

Historically, the SEC has been cautious about allowing staking in ETFs, citing potential securities law concerns. When approving Ethereum ETFs in May 2024, the SEC mandated that these funds exclude staking, potentially costing them an estimated 3% in annual yield.

However, the regulatory landscape began shifting in early 2025. In February, the SEC acknowledged a proposal from NYSE Arca seeking approval to enable staking for Grayscale Ethereum ETF, signaling a possible softening of its stance.

The latest Cboe filing follows a similar request made for the 21Shares Core Ethereum ETF. Additionally, on Tuesday, Cboe also filed amended 19b-4 document for the Franklin Ethereum ETF (EZET) to include staking.

Crypto ETF Market Expands with New Digital Asset Offerings

These moves come after former SEC Chair Gary Gensler resigned shortly before the inauguration of President Donald Trump, who has been more supportive of cryptocurrency initiatives. Acting SEC Chair Mark Uyeda has overseen several positive developments related to crypto ETFs, raising hopes for a favorable decision on staking.

Beyond the push for staking approval, firms are actively expanding their crypto ETF offerings. Over the past week, multiple companies have established entities in Delaware for potential ETFs linked to Sui (SUI) and Aptos (APT).

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |