| Key Points: – Babylon integrates 250+ validators and 30+ testnet chains for Bitcoin-secured staking. – Backed by Polychain, Paradigm, Binance Labs, with $26M raised to date. – Only BTC-native, slashable, self-custodial staking protocol among modular security platforms. |

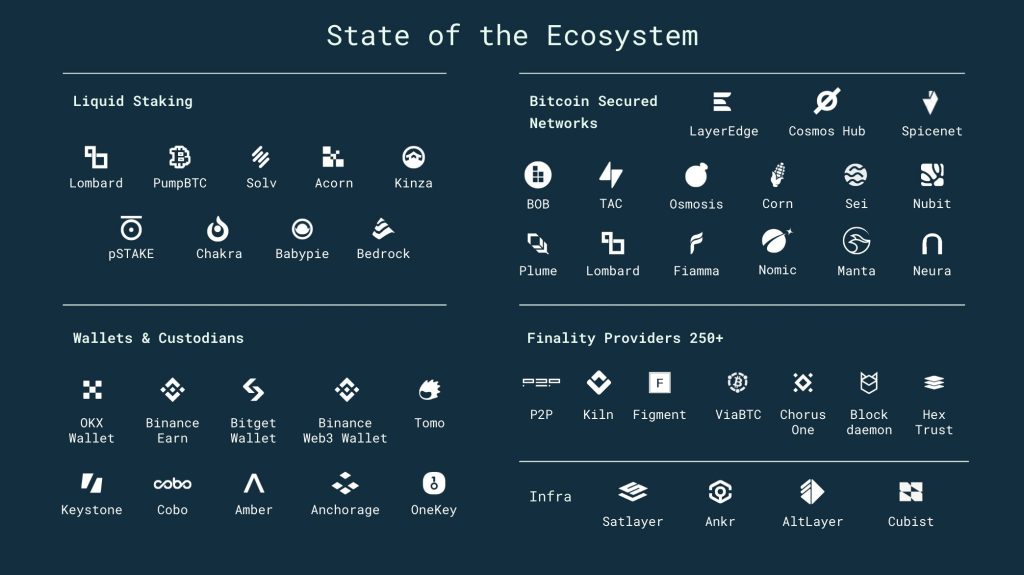

With support from 250+ finality providers, Cosmos validators, and self-custodial wallet integrations, Babylon quickly becomes the most widely adopted Bitcoin-secured infrastructure layer in the modular blockchain stack.

Backed by investors like Polychain, Binance Labs (YZi), Paradigm, and Galaxy Digital, Babylon’s trustless architecture, anchored in EOTS-powered slashing, BTC-native staking, and Genesis chain deployment, distinguishes it from competitors like Eigenlayer, Stacks, and Cosmos Mesh Security.

Babylon Secures Modular Future With 250+ Finality Providers

To support its vision of a Bitcoin-secured modular future, Babylon has rapidly built a multi-layered ecosystem that includes integrations across wallets, validator networks, and partner chains.

| Feature | Description |

|---|---|

| Wallets | BabyIon enables self-custodial staking by integrating with wallets that allow users to stake BTC directly without relinquishing control of their funds. |

| Finality Providers & Validators | More than 250 finality providers currently support BabyIon’s infrastructure by signing PoS blocks using BabyIon’s EOTS-powered system. Validators from the Cosmos ecosystem also participate in testnets to strengthen security coordination. |

| Bitcoin Secured Networks (BSNs) | More than 250 finality providers currently support BabyIon’s infrastructure by signing PoS blocks using BabyIon’s EOTS-powered system. Validators from the Cosmos ecosystem also participate in testnets to strengthen security coordination. |

Quick Take

To date, BabyIon is integrated with 30+ testnet chains, making it one of the modular blockchain stack’s most widely adopted security layers.

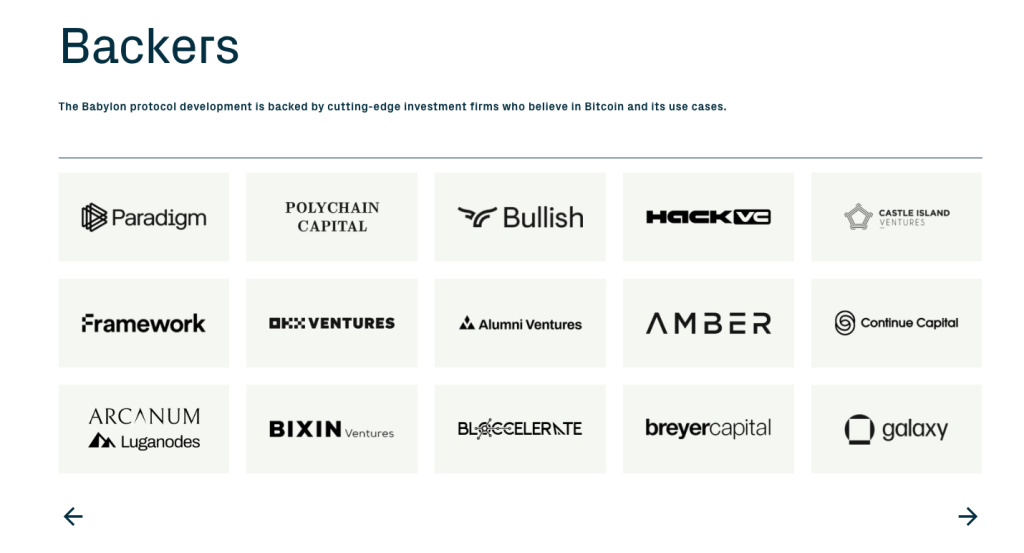

Babylon’s Investors and Fundraising Timeline

Parallel with its ecosystem expansion, Babylon has attracted a notable lineup of institutional and strategic investors who reinforce its long-term ambitions.

Funding History:

- Seed Round (March 2023): $8 million

- Led by: IDG Capital, Breyer Capital

- Series A (December 2023): $18 million

- Led by: Polychain Capital, Hack VC

- Undisclosed Rounds (2024):

- Participants: YZi Labs (formerly Binance Labs), Paradigm, Galaxy Digital, HashKey Capital, IOSG, OKX Ventures, P2 Ventures (Polygon Ventures)

Strategic Importance:

These backers bring more than just capital. They offer strategic reach across exchanges, developer platforms, DeFi protocols, and infrastructure tooling, positioning Babylon as a key player in the security economy.

Comparison With Eigenlayer, Stacks, and Mesh Security

As Babylon enters a competitive field of modular security protocols, its trustless, Bitcoin-native design provides clear technical advantages over alternatives:

| Protocol | Uses BTC? | Smart Contracts Needed? | Slashable? | Self-Custodial? |

|---|---|---|---|---|

| Babylon | Yes | No (uses Bitcoin script) | Yes (EOTS) | Yes |

| Eigenlayer | No | Yes (Ethereum) | Yes | No |

| Stacks | Yes | Yes | No (PoX model) | No |

| Cosmos Mesh Security | No | Yes | Yes | No |

Unlike its peers, Babylon does not rely on bridging, wrapping, or centralized custody, making it the only slashable and fully self-custodial Bitcoin staking protocol currently in production.

Roadmap, Phase 2, and Babylon’s “Singapore Vision”

As the ecosystem matures, Babylon continues to execute on its multi-phase roadmap, which reflects both technical milestones and community growth.

Roadmap Progression:

Q2 2025:

- Launch of Babylon Genesis as the first BSN

- Trustless BTC staking begins for Genesis chain security

- Genesis activates DEX, restaking, vault, and BABY LST minting

- BTC LST holders can bridge to Genesis and access BTCFi

Q3 2025:

- Major expansion of Genesis into a full-fledged ecosystem

- Onboarding of additional BSNs

- Integration of EVM compatibility to support liquidity primitives

- Ecosystem projects: DEXs, LSTs, Lending, Incentives, Vaults, and Reward Hub

Q4 2025:

- Trust-minimized Bitcoin-Genesis bridge launch

- Native BTC LST creation enabling on-chain liquidity while preserving self-custody

- Shared bridge for BSNs to increase liquidity across the Babylon network

The “Singapore Vision”

According to Fisher, Co-founder of Babylon, BabyIon’s goal is not to be a passive relay of value, it seeks to capture and grow economic activity, much like Singapore does in global trade. Acting as a hub between Bitcoin capital and PoS demand, BabyIon aims to:

- Aggregate cross-chain staking demand

- Accrue protocol-level fees

- Attract developers and application builders to its infrastructure layer

In doing so, Babylon aspires to become a sovereign coordination layer — a strategic channel for unlocking Bitcoin’s role in the evolving Web3 economy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |