Key Points

- Retail traders now dominate Bitcoin futures as whale activity drops sharply.

- Sell pressure returns, with BTC hovering near $115K amid weakening momentum.

- Key liquidity levels at $110K and $113K set the short-term price range.

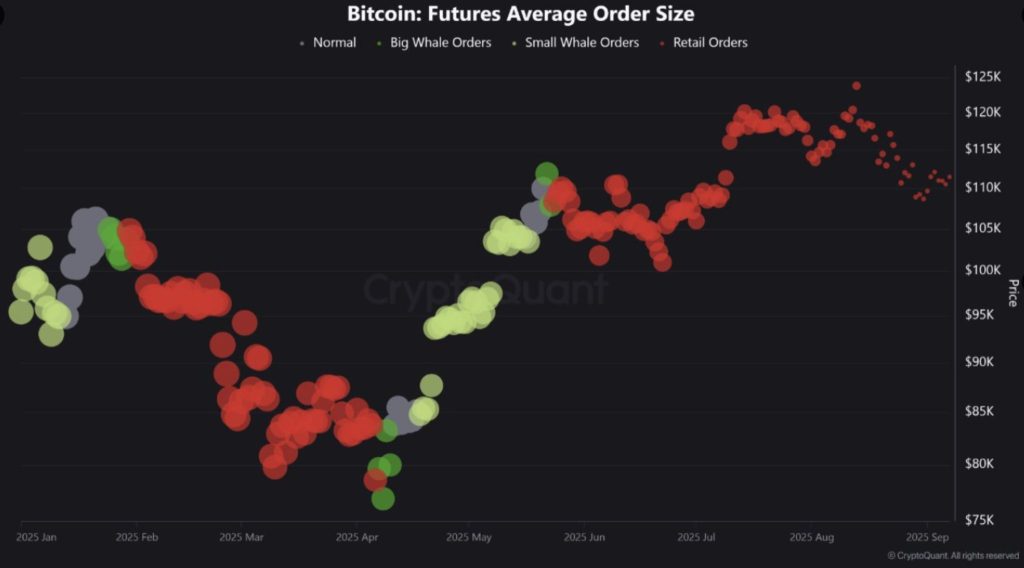

Bitcoin’s futures market has shifted in 2025 as whale activity declines and retail traders take a stronger position. Early in the year, whales dominated when BTC traded between $80K and $95K.

However, as Bitcoin moved above $100K, retail orders increased and became the majority by the mid-year peak around $125K. This transition signals reduced institutional demand, which may lead to weaker long-term support.

Retail dominance often brings volatility, as smaller traders react faster to price changes without the stability whales typically provide. The current structure reflects a market more exposed to sentiment shifts and quick momentum changes.

Momentum Weakens as Sell Pressure Returns

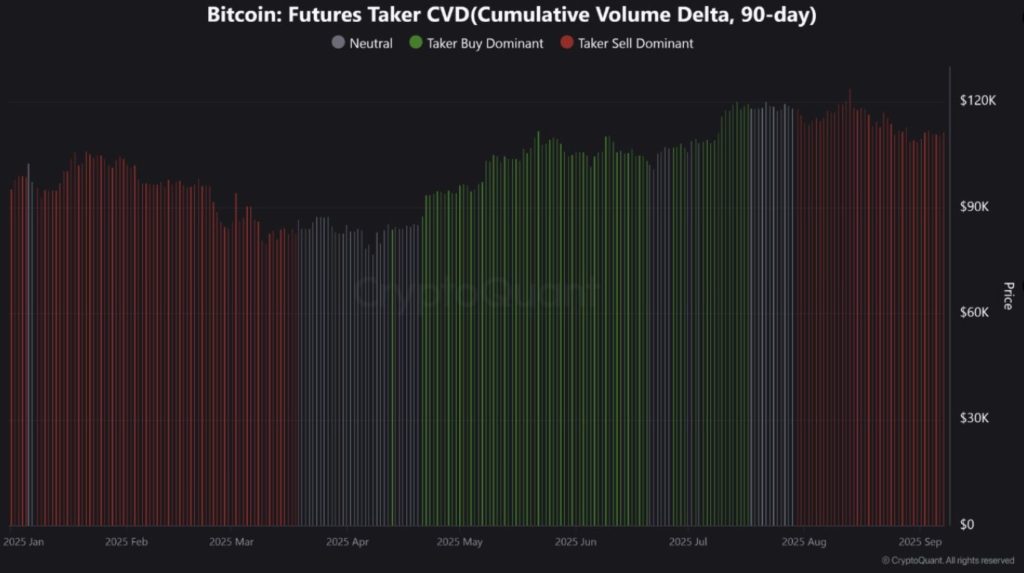

The Bitcoin Futures Taker CVD (90-day) shows early 2025 sell pressure pushed BTC down toward the $80K–$90K range. From May to July, strong buy dominance lifted the price above $110K.

Since August, red bars reappeared on the chart, reflecting renewed selling as BTC hovers around $115K–$120K. This indicates weakening bullish momentum and rising downside risk unless buyers regain control.

A bounce at $110K, which aligns with the Short-Term Holder Realized Price, currently acts as key support for market sentiment. This level helps define bullish continuation or breakdown, depending on future price behavior.

The price holding above this mark keeps short-term holders in profit, which adds incentive to defend this range.

Volume Patterns and Liquidity Zones Offer Clues

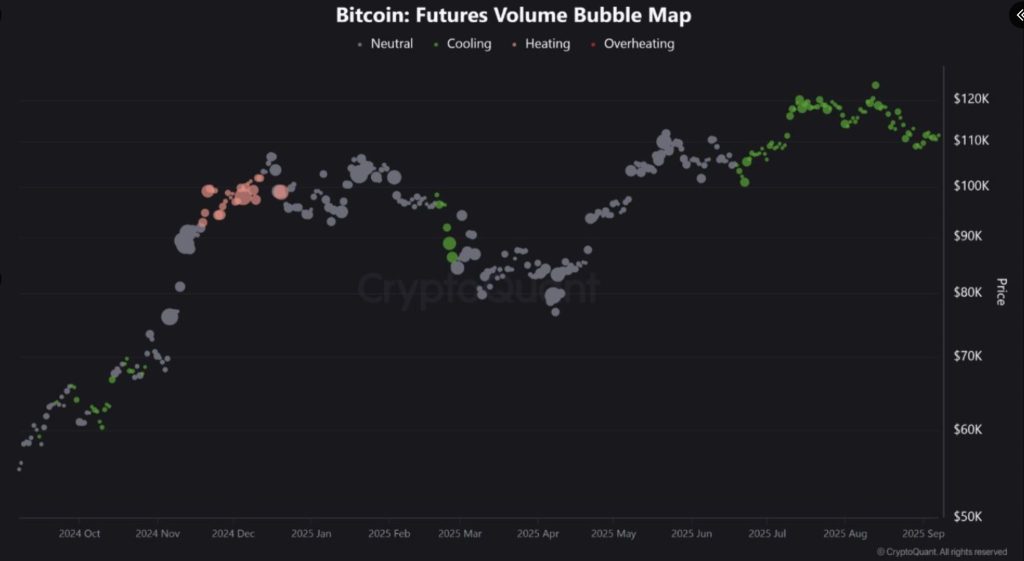

The Bitcoin Futures Volume Bubble Map shows clear cycles of overheating and cooling from late 2024 into 2025. Overheated phases near $90K–$100K were followed by corrections and cooling that fueled later rallies.

By mid-2025, volume normalized, then cooled again as BTC approached $120K, indicating reduced risk appetite. These cycles suggest that lower volume often precedes the next leg up in price.

Meanwhile, the Binance futures order book shows strong buy liquidity near $110K and key resistance around $113K. This sets up a narrow range that may define Bitcoin’s next breakout or breakdown.

BTC trades near $112,572, holding between these two levels, with price direction dependent on order flow and market reactions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |