Key Points

- Fear Index hits 33, approaching extreme fear, historically linked to BTC local bottoms.

- Bullish divergence forms on 4H chart, signaling weakening bearish momentum and potential bounce.

- Analyst sees possible bottom at $106K–$102K if support breaks and STH losses increase sharply.

Bitcoin currently trades at $109,441, showing signs of a potential reversal as fear sentiment nears extreme levels. The Crypto Fear & Greed Index reads 33, approaching the critical 25 mark that previously aligned with local bottoms.

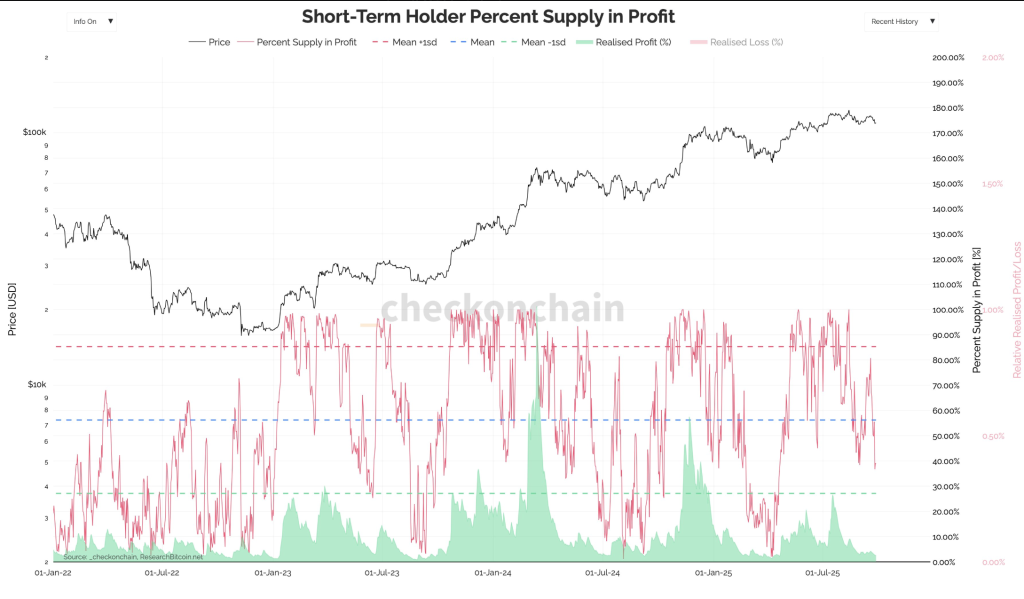

Short-term holders still retain 36% of their supply in profit, but analysts expect further downside to shake them out. Historically, such flushes have coincided with strong accumulation zones and a reset in short-term holder profitability under 5%.

Analyst Darkfost projects a bottom between $106,000 and $102,000 if sentiment weakens and losses among holders deepen. This range matches his wave C target and would likely require a break below the 200-day EMA.

Past correction phases show similar setups, including RSI resets and sharp declines below realized price levels. Bitcoin’s realized price currently stands at $111,500, and price remains slightly below that at press time.

Bullish Divergence Suggests Short-Term Relief Rally

Technical indicators now show a bullish divergence on the 4-hour chart despite the ongoing correction. Price continues to make lower lows, but momentum indicators show higher lows, suggesting declining selling pressure.

The divergence appears as momentum rises from -60 to -36.79 while price holds above a key descending support trendline. If momentum continues to shift, price could target the $112,000 to $114,000 resistance area.

Bulls must defend the support zone between $107,000 and $106,000 to avoid invalidating the bullish setup. A break below this range could push the market toward the projected $102,000 low.

However, a close above $110,500 may confirm renewed buying interest and open the door to a potential recovery. This move would also strengthen the divergence signal and could trigger a short-term relief rally.

Despite a minor 0.02% daily gain, Bitcoin has dropped 5.38% over the past seven days. Overall, sentiment, on-chain data, and technical structure now point to a possible local bottom in formation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |