Key Insights:

- Bitcoin ETFs add $947 million in two days, fueling renewed institutional demand and price strength.

- Price holds above $114,000 with traders targeting $118K–$119K liquidity cluster as the next breakout zone.

- Support remains near $107K–$108K, but sustained ETF inflows could drive Bitcoin toward new highs soon.

Bitcoin (BTC)moved past $114,000 after a surge of buying through spot exchange-traded funds. Data shows ETFs brought in $518 million on September 29 and another $429.9 million on September 30, totaling $947.9 million in just two days. This was the strongest back-to-back inflow streak in September.

Fidelity, BlackRock, Bitwise, and Ark were the main drivers. Fidelity recorded $298.7 million on September 29 and $54.7 million on September 30. BlackRock added $199.4 million, while Bitwise and Ark also posted notable gains. These flows reversed earlier outflows seen in mid-September, pointing to renewed institutional activity.

Bitcoin Price Above $114K

Bitcoin is currently priced at $114,381, with a daily trading volume of $53.3 billion. The asset has increased 0.39% in the last 24 hours and 2% over the past week. The move above $114,000 followed a period of sideways action, where the price briefly dipped close to $107,000 in September.

Commenting on the recent buying,

market watcher Cas Abbé stated,

“In just 2 days, ETFs have bought $947 million in $BTC. This has helped push BTC above $114K.”

The strong flows have been linked directly to the rebound in price, showing the influence of ETF demand.

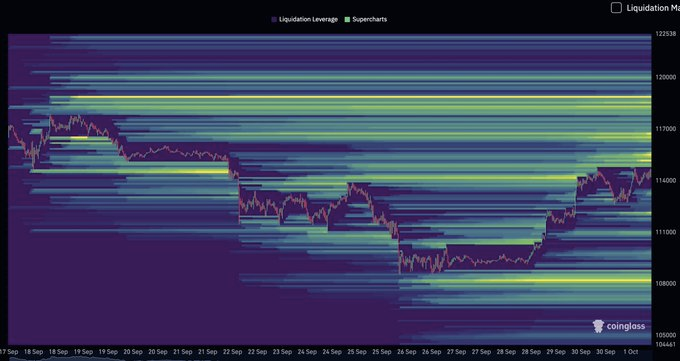

Key Liquidity Levels

Liquidity data indicates that $118,000–$119,000 is the next major zone to watch. This area contains a large cluster of orders and matches a region where heavy trading took place in earlier sessions. A clean move above this range would suggest a shift out of the current consolidation phase.

Support remains between $107,000–$108,000, the same zone that held in August and September.

Analyst Daan Crypto Trades noted,

“The $107K–$108K area has some decent liquidity which also corresponds with the August and September lows. I do think bulls have no business re-visiting this area if October & Q4 is bullish.”

October Outlook

ETF demand has re-emerged as a major factor for Bitcoin’s momentum. Nearly $1 billion of inflows in two sessions has added strength to the market, giving bulls a stronger base heading into October.

If Bitcoin clears the $118K–$119K liquidity cluster, traders will be watching for further continuation and a possible move toward new highs. For now, Bitcoin is holding above $114,000 with momentum shifting back in favor of buyers.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |