In Brief

- $10B Bitcoin whale transfers $364M BTC to Hyperunit, echoing August’s $5B ETH buys.

- Analysts report rising sell pressure and profit-taking as BTC trades near $122K.

- Derivatives data show selling easing, hinting at renewed accumulation and market recovery.

A $10 billion Bitcoin whale has transferred another $363.9 million worth of BTC to Hyperunit, reigniting speculation about renewed Ethereum accumulation. Arkham Intelligence identified the movement less than two months after the same wallet purchased $5 billion in ETH through Hyperunit.

In August, the whale initially moved $1.1 billion in BTC to new wallets before acquiring $2.5 billion in ETH and continuing steady purchases. The latest transfer has prompted questions about whether similar buying activity is underway as Ethereum’s momentum strengthens above $4,000.

While on-chain patterns show recurring BTC-to-ETH movements, there is no confirmed evidence of active buying yet.

This renewed activity comes amid notable market shifts, with BTC/USDT falling 2.45% to around $122,240.51, according to analyst Wimar.X. Large Binance wallet outflows totalling over $29 million across BTC and ETH transactions further added to market volatility and trader caution.

Analysts Track Profit-Taking and Derivatives Flows Amid Market Pressure

Data from CoinGlass shared by analyst Ted further shows increased spot selling pressure on Binance as BTC/USDT slipped from $124,000. The Cumulative Volume Delta (CVD) dropped sharply from 11.0K to 9.98K, suggesting strong sell-side control and potential distribution by large holders.

Similarly, CryptoQuant data cited by Killa indicates Bitcoin’s Realised Profit/Loss Ratio has surged above 400, historically signalling overheated market conditions. Comparable spikes in May, July, and August preceded brief corrections, suggesting heightened profit realisation at current levels near $125,000.

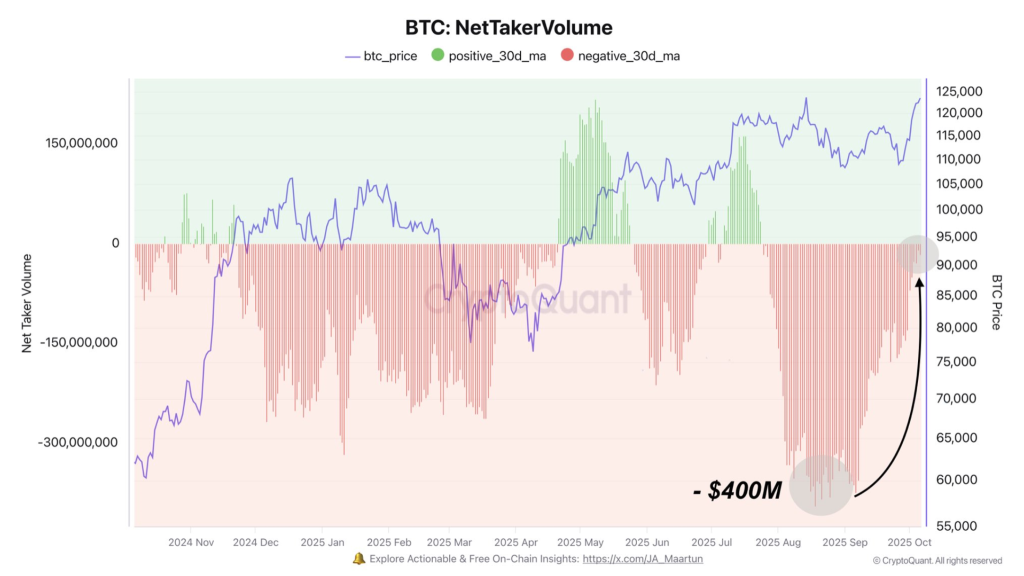

However, Darkfost highlighted a structural shift as the average net taker volume on derivatives recovered from an extreme –$400 million low to neutral. This transition signals reduced selling pressure and improved demand from derivative buyers, strengthening market stability after weeks of volatility.

As whales reposition, miners ease selling, and derivatives rebalance, analysts view current conditions as a potential setup for renewed accumulation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |