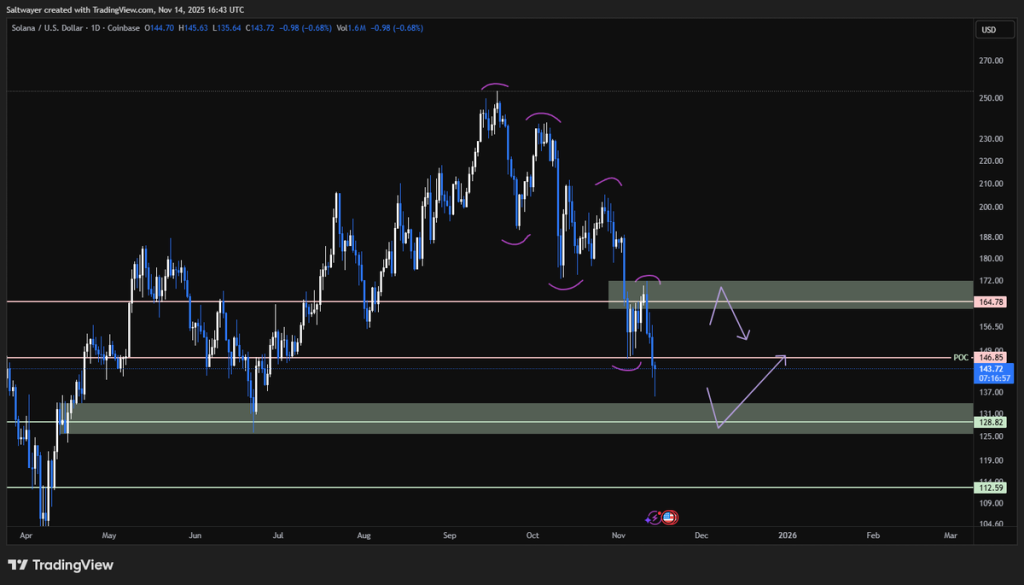

Key Insights:

- SOL stays in a downtrend, with $148.11 as short-term resistance for any possible recovery.

- The $165 zone aligns with volume control and may act as a strong supply area if tested.

- Support at $129 is key; a break below may open the way to the $113 support level.

Solana (SOL) was trading near $143.08 after a week of continued weakness. The price has slipped 0.8% in the past 24 hours and is down 11.1% over the last 7 days. The broader trend remains bearish, and the structure continues to show pressure from sellers, with no clear signs of a shift yet.

Since reaching the $250 level, SOL has been moving in a steady downtrend. The pattern is clear on the daily chart, with lower highs and lower lows forming over the past several weeks. Price action remains confined to a consolidation range, with short-term direction still unclear.

$148.11 Marks a Key Turning Point

The $148.11 level is now the first resistance to watch. More Crypto Online stated, “A break above $148.11 would indicate that at least a local low has formed.” Until price moves above this point, the potential for more downside stays in play.

The 1-hour chart shows a completed five-wave drop, followed by a small recovery. However, price has not broken out of the short-term resistance zone between $141.61 and $148.11. If the price climbs above this range, it may confirm the start of a rebound. The next resistance sits between $157 and $167.

Sellers Watching the $165 Zone

The $165 area lines up with the Point of Control (POC) from the volume profile.

Saltwayer wrote,

“If the price manages to move up toward the 165 area, it could present a good shorting opportunity.”

The level has acted as a key supply zone in the past and may do so again.

If SOL pushes higher into this zone and fails to hold, sellers could return with strength. This makes $165 a possible pivot where the trend may either extend higher or reject downward again. Until then, $148.11 remains the first level that needs to be cleared.

$129 Support Stays in Focus

On the downside, the $129 level remains a support zone to watch. This matches the 0.786 Fibonacci retracement, a level that has held in earlier moves. If the price drops toward this area again, it may attract interest from buyers looking for a reaction.

If $129 does not hold, the next support is near $113. That level could become the next target if bearish momentum returns. For now, SOL continues to range between known resistance and support, with both sides waiting for a break.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |