Key Insights:

- Bitcoin tests monthly EMA-21 again, repeating a pattern that led to past multi-month rallies.

- Short-term triangle pattern holds above $89,260, with resistance at $93,570 and $100K in sight.

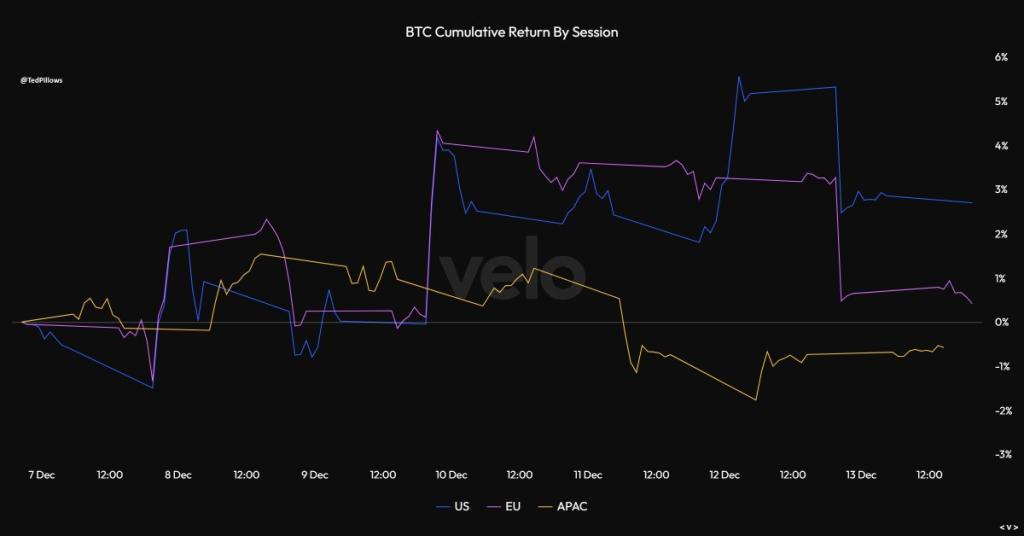

- US and EU sessions show net buying, while the APAC region remains a steady net BTC seller.

Bitcoin has tested its 21-month Exponential Moving Average (EMA-21) once more, a level that has acted as a key support in previous cycles. The EMA-21, now near $87,000, marked turning points in 2015, 2019, and 2021. Each time, the price moved higher after touching or briefly dipping below this line.

In 2015, Bitcoin rose over 100% after testing this level. A similar move occurred in 2019 with a 51% gain, while in 2021 the rebound was around 45%. The repeated reaction from this moving average suggests traders continue to view it as an area of interest during corrections.

However, Bitcoin was bouncing from the same level again. If history follows a similar path, the current rebound could push the price toward the $100,000 to $105,000 range.

Short-Term Pattern Still in Play

On lower timeframes, Bitcoin appears to be forming a triangle pattern, part of a corrective (B)-wave. This setup remains valid while price stays above $89,260, the low from Thursday. So far, that level has held.

If this support breaks, attention may shift to the December 7 low near $87,770. Below that, the support area between $85,988 and $88,912 becomes relevant. This range includes key Fibonacci levels, with the 61.8% retracement near $87,693 and the 78.6% level at $85,988.

On the upside, resistance sits near $93,570. A move above this level could open the path to $96,853, which marks a 50% extension target. Until price makes a clear move, the structure is holding but not confirmed.

Different Sessions, Different Flows

Bitcoin trading activity from December 7 to 13 shows varied behavior across global regions. Data tracking returns by session points to stronger buying during US and EU trading hours, while the Asia-Pacific (APAC) session showed steady selling.

The US session posted the strongest return, peaking over 5%. EU session returns remained in positive territory as well. In contrast, the APAC session fell as low as -2.5%.

According to Ted Pillows,

“EU and US are the net buyers this week. Asia is still the net seller of BTC.”

This pattern shows that most of the buying pressure is coming from Western markets, while distribution appears more active in Asia.

Market Conditions and Price Levels

Bitcoin is currently priced at $90,110.56, down 0.4% in the last 24 hours. Over the past week, the price was up 0.4%. Trading volume over the last day reached $56.7 billion.

Price remains above key short-term support. As long as Bitcoin holds above $89,260, the triangle pattern is still active. A move above $93,570 may signal the next leg up. Traders are watching closely to see if the current bounce will follow past cycles and target the $100,000–$105,000 zone.

Some market participants say “another move lower would still fit the wave structure,” while others note, “holding above $89,260 keeps the breakout setup alive.”

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.