Key Insights:

- SOL breaks below $120–$85 support zone, raising chances of a potential move toward $70 levels.

- Daily chart shows oversold RSI near 27, but no clear reversal has formed at current levels.

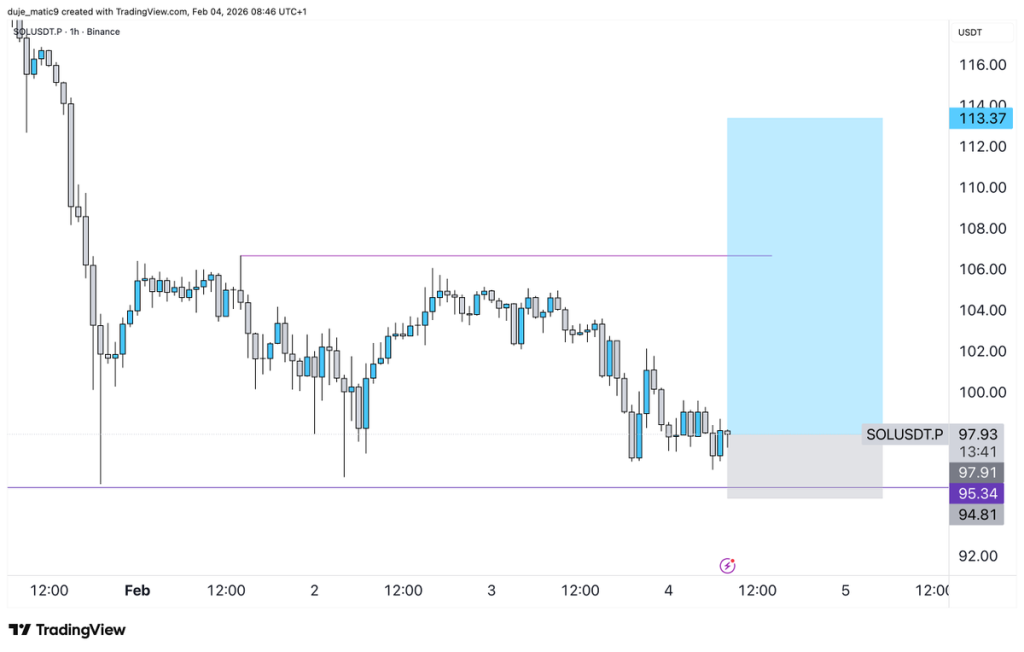

- Hourly long setup targets $113 if support holds, but drop below $94.81 invalidates the trade.

Solana (SOL) has fallen through a major support zone on the weekly chart, which ranged from $120 to $85. This zone had held for several months, acting as a base for previous moves up. The most recent weekly close is now below this area, showing a break in structure on higher timeframes.

After this move, trader BullyDCrypto pointed out that the last bounce off this zone reached $146 before losing steam. He called that push a and confirmed that momentum faded shortly after. He added, “Just wait for 20–30% lower or a reclaim,” suggesting a deeper drop into the $70s could follow unless support is quickly regained.

Daily Levels Near Exhaustion, But No Clear Reversal

On the daily chart, SOL was trading near $97.91, close to the 1.618 Fibonacci extension level at $97.19. This level often marks where strong moves start to slow down. It can be an area where price pauses, especially after large drops.

Alongside this, the RSI reading on the daily timeframe is around 27.29. That puts the asset in oversold territory. While this could lead to a short-term bounce, the chart still shows no signs of a full reversal. Price is still sitting under all major resistance levels, and buyers have not taken back control.

Hourly Trade Setup Targets Short-Term Recovery

On the lower timeframes, a new trade setup has been posted by Ezekiel. The entry was placed at $97.91, with a stop loss at $94.81 and a target of $113.40. The idea is built around price holding the local support near $95.34, which has been tested more than once in recent sessions.

This trade uses a tight stop and a wider target, creating a 5:1 reward-to-risk ratio. If price breaks above the current range, it could reach the target quickly. But if price dips below $94.81, the setup fails and the position will be closed.

Traders Waiting for Reclaim or Deeper Move

At this point, traders are watching to see whether SOL can reclaim the broken weekly zone. If it does, that would create a failed breakdown pattern, which often leads to strong upward moves. In that case, the price could aim for the $155 level again.

Until then, caution remains. A move into the $70s is possible if current levels don’t hold. For now, many are staying out of the market, waiting to see which direction takes control next.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.