Key Insights:

- The $90K zone holds heavy liquidity and sits above weak highs, raising trap risk for breakout longs.

- Failed 4H breakout erased gains fast, catching longs off guard and preserving bearish structure.

- Short liquidations outpaced longs, but the BTC trend remains down without strong support.

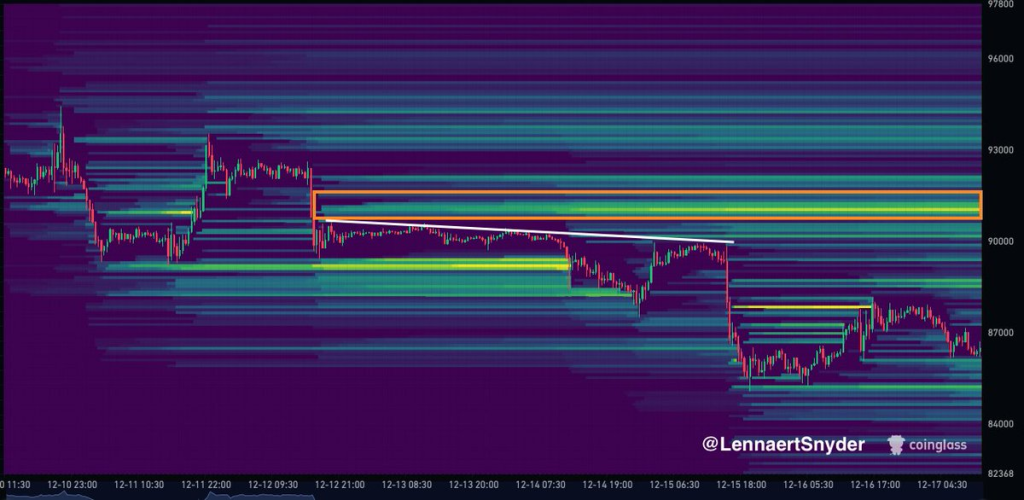

Bitcoin traders are closely watching the $90,960 price level, where a large amount of resting sell orders has built up. This zone has been marked on heatmaps as a potential turning point, based on the concentration of liquidity just above recent highs. The area was highlighted by trader Lennaert Snyder as a possible trigger for a reversal if price enters and fails to hold.

The setup shows that price may move into this level, attract breakout buyers, then reverse. These patterns are known for triggering long positions that get closed quickly, leaving buyers at a loss.

Lennaert Snyder noted,

“If price taps into that zone, traps longs and rejects, shorts after the failure could be very nice.”

Sharp Rejection After Breakout Attempt

Bitcoin recently broke above a short-term trendline on the 4-hour chart. A large bullish candle moved price above resistance, which likely triggered many long entries. However, the price quickly fell back below the trendline during the same candle, failing to hold above the breakout.

The move caught traders off guard. Market watcher KillaXBT commented, “Quite the insane 4H candle… lots of breakout longs completely destroyed.” This kind of fast reversal has not occurred often in recent months, and it left the market with no clear follow-through. The price remains below the trendline, keeping bearish pressure intact.

Liquidation Data Points to Short Squeeze

Data from Coinglass shows short liquidations totaling $78.44 million in the same period, compared to $45.82 million in long liquidations. This suggests the brief move up forced short positions to close, likely pushing the price higher temporarily.

Even with this liquidation spike, Bitcoin remains in a broader downtrend. Bitcoin price was $86,731.74, down 1.01% in the past 24 hours and 5.9% over the past week. Price remains under recent highs, with sellers still in control unless new support levels are reclaimed.

Market Watches Reaction at Key Zone

Whether Bitcoin can break through and hold above the $90,960 level remains uncertain. A strong 4-hour close above it may open the door for buyers to step in on a retest. Lennaert Snyder added, “If price prints a clear 4H gain in that level, longs on the higher low are legit.”

The level acts as both a target and a possible trap. The next reaction around $90,960 will likely decide if this zone becomes a support base for further upside or confirms a reversal back into the existing downtrend.