Key Insights:

- Bitcoin whales are defending $86K, forming a major buy wall at wedge pattern support.

- Monthly MACD turns bearish for first time since 2022, signaling potential deeper correction.

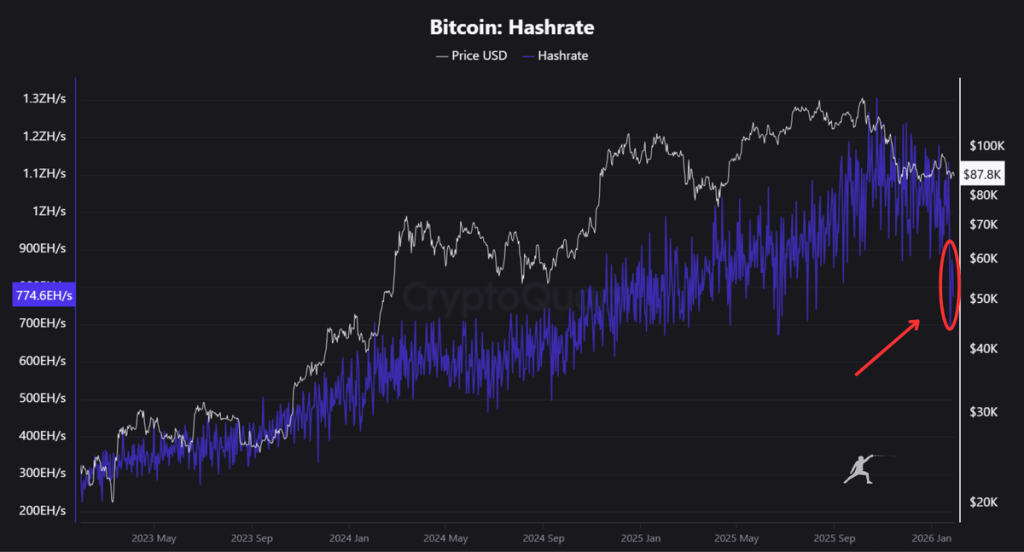

- Bitcoin hashrate falls 40% from peak, echoing miner capitulation last seen in 2021.

Bitcoin was trading around $87,900, showing a 2.4% drop over the past 24 hours and down 1.7% on the week. Traders are watching the $86,000 area, where large buy orders appear to be sitting.

Price Holds Inside Falling Wedge

The current chart shows Bitcoin locked in a falling wedge pattern, defined by lower highs and lower lows. Price recently failed to break above the top of the structure, and sellers pushed it back down. This rejection raised the chance of a move toward the lower line near $86,000.

That level matches a cluster of buying interest, according to trader CW, who said: “$BTC whales are forming a buying wall at 86k and waiting.” If price reaches this zone, buyers may step in again. Until then, the structure remains intact and is still being watched for a potential breakout.

Monthly MACD Turns Red

Bitcoin’s monthly chart is flashing a warning. The MACD has flipped bearish, marking its first cross below the signal line since January 2022. That crossover was followed by a steep drawdown. Crypto Patel, who flagged the setup, noted:

“Monthly MACD Turns Bearish For First Time Since January 2022.”

Price has also slipped under a long-term resistance band. If momentum continues to weaken, previous support zones near $54,000 and $42,000 may come back into play.

BingX: a trusted exchange delivering real advantages for traders at every level.

Hashrate Drops as Miners Exit

Alongside price action, the Bitcoin network hashrate has fallen about 40% from its peak. This marks the sharpest drop since 2021. According to Rekt Fencer,

“This is the biggest miner capitulation since 2021.”

Lower hashrate levels may signal that less efficient miners are leaving due to tighter margins. In the past, similar conditions lined up with market bottoms. If miner pressure eases and network conditions stabilize, it could lay the groundwork for a stronger recovery.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.