Bitcoin Poised for Another Rally as Bullish Momentum Builds

Key Points:

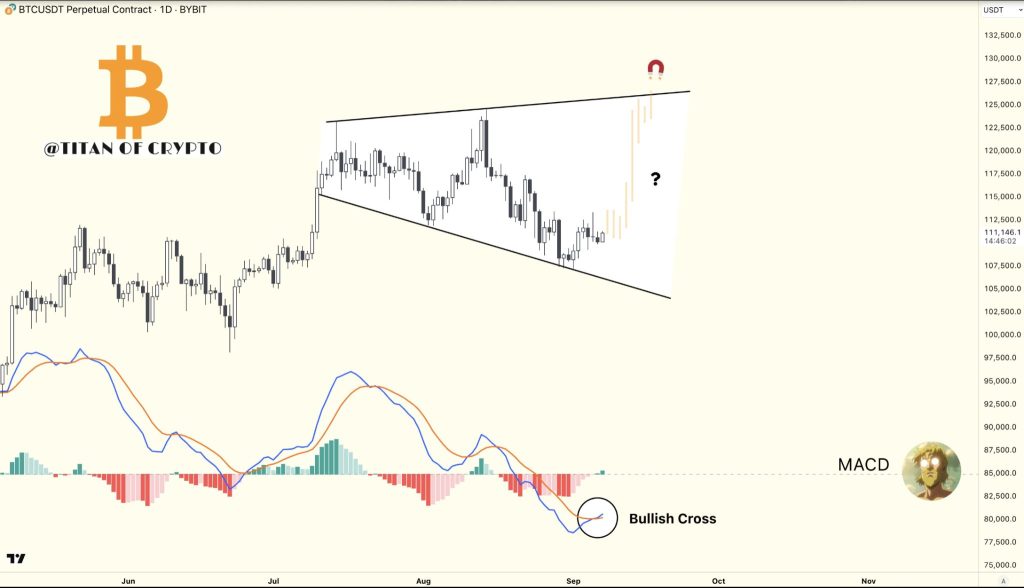

- BTC consolidates within a rising wedge, with a bullish MACD crossover signaling upward momentum.

- Elliott Wave analysis points to a potential $175K–$220K target in wave 3.

- Whale sell-off exceeds 60,000 BTC, but price remains resilient above key support zones.

Bitcoin continues to trade in a tight range, but technical patterns and momentum indicators suggest potential for another rally. Price currently holds near $111,243.19, maintaining strength despite recent whale-driven selling.

The chart by Titan of Crypto shows Bitcoin consolidating within a rising wedge pattern, typically a bullish continuation signal if confirmed. At the same time, the MACD has flashed a bullish crossover, often signaling upward momentum ahead.

If the breakout occurs, short-term targets may extend toward the $125,000–$130,000 range based on projected technical paths. However, confirmation remains essential, as rising wedges can also lead to downside moves.

Michaël van de Poppe’s analysis shows BTC forming a new higher low above the key $110,000 support zone, reinforcing bullish structure. A decisive breakout above $112,000 could open the path toward resistance at $114,700 and $116,800.

If that breakout holds, buyers may gain control and push the price further in the short term. On the downside, the $100,000 – $103,000 demand zone remains a critical area for any retracement-based entries.

Elliott Wave Structure and On-Chain Signals Suggest Strength

Hamza’s Elliott Wave mapping shows that Bitcoin may be completing a wave 1, with wave 2 bringing a healthy correction. This correction could fall into the 0.382–0.618 Fibonacci zone, potentially creating a stronger foundation for wave 3.

Wave 3 targets range from $175,000 to $220,000, aligning with the 1.618 Fibonacci extension common in Elliott Wave Theory. However, $74,500 serves as the invalidation level, below which the structure would no longer be valid.

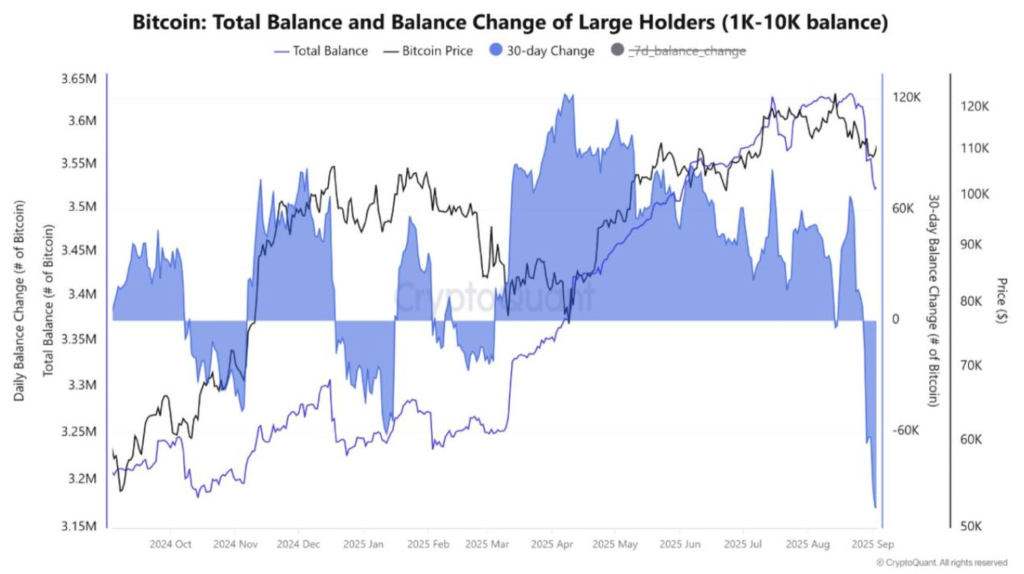

Meanwhile, on-chain data from CryptoQuant shows large whale wallets sold over 60,000 BTC recently, marking the largest distribution of this cycle. Despite the sell-off, BTC dropped only around 14% before stabilizing, showing strong market absorption.

The total balance of large holders declined by over 100,000 BTC, yet the price found support near $103,000 and rebounded quickly. This resilience suggests that institutional demand remains strong, absorbing excess supply efficiently.

BTC has gained 0.51% over 24 hours and 2.53% over the past week, maintaining weekly bullish pressure. If price holds above $111,000 and breaks key resistance, upside continuation remains likely in the near term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |