Key Insights:

- Bitcoin falls below $66,670 daily support, shifting short-term structure toward downside pressure.

- Analysts identify $64,500 as next liquidity zone if resistance near $68,410 holds firm.

- Realized price near $55,000 remains key macro support based on past cycle behavior.

Bitcoin (BTC) trades at $65,611 after falling 2.5% in the past 24 hours. Over the last seven days, price is down 3.8%. Daily trading volume stands near $49 billion, showing active market participation during the pullback.

On the 30-minute chart, BTC recently pushed into the $68,300 to $68,400 range, where prior highs were positioned. The move cleared buy-side liquidity before price turned lower. Trader Lennaert Snyder said BTC saw a “very nice reaction after sweeping buy-side liquidity,” and noted that a break below $66,670 would confirm further downside.

Price has now moved under that daily low. The $68,410 daily high stands as near-term resistance. As long as BTC remains below this level, sellers keep control on lower timeframes.

$64.5K Level Draws Attention

With the daily low broken, focus shifts to the $64,500 area marked on the chart as a liquidity zone. Such levels often attract price during short-term downtrends as orders tend to cluster there.

Snyder wrote, “If we lose the daily low, the current ~$68,410 daily high becomes a strong pivot for the day/week.” BTC now trades below that pivot zone. Market participants watch whether price extends toward $64,500 in the coming sessions.

The short-term structure shows a lower high near $68,400 and continued rejection below resistance. Without a move back above the daily high, upward momentum remains limited.

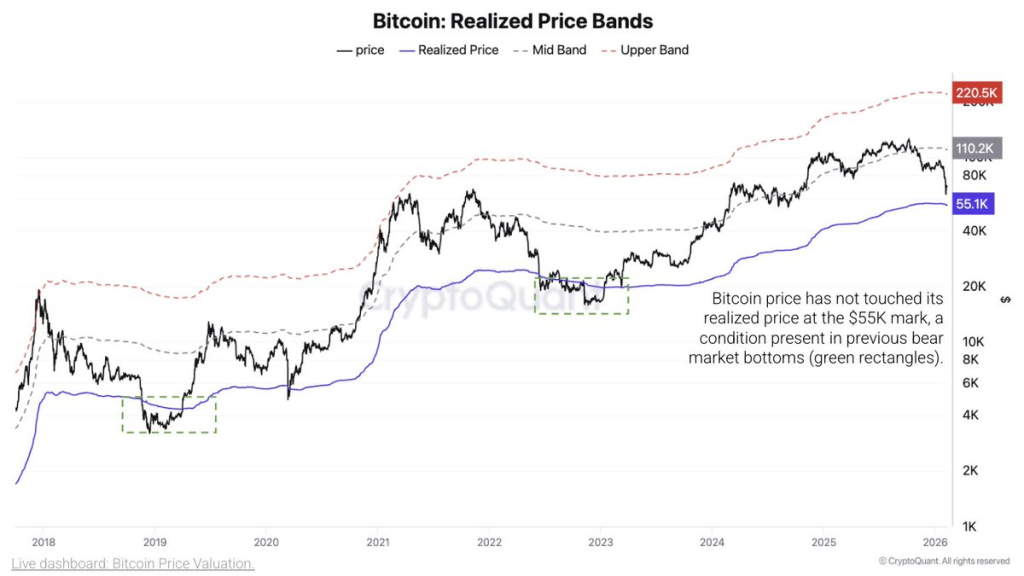

$55K Realized Price Remains Key

Data from CryptoQuant places Bitcoin’s realized price near $55,000. This metric reflects the average on-chain acquisition cost of circulating supply and has aligned with past bear market lows.

CryptoQuant stated,

“$55K marks Bitcoin’s realized price, historically tied to bear market bottoms.”

In prior cycles, BTC traded 24% to 30% below this level before stabilizing. Current price remains about 18% above $55,000.

Past patterns show that when BTC approaches the realized price, it often trades sideways for a period before recovery. At present levels, the market has not reached the deeper discounts seen in earlier cycle lows.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

Monthly EMAs Frame Broader Trend

On the monthly chart, BTC trades between the 21-Month EMA and the 50-Month EMA. Rekt Capital noted that Bitcoin could remain between these two moving averages for some time.

The analyst stated that “any relief from the 50-Month EMA would be limited and could fall short of the green 21-Month EMA.” In previous cycles, failure to reclaim the 21-Month EMA led to extended declines.

If price falls below the 50-Month EMA, historical data shows that further downside can follow. Traders now monitor $64,500 in the short term and $55,000 on the macro chart as key levels.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.