BTC Holds $68,000 Weekly EMA200 as Bulls Target Breakout Toward $80,000 Rally

Key Insights:

- Bitcoin trades near $68,000 weekly EMA200 as bulls defend key long-term technical support level.

- Apparent Bitcoin demand flips positive for the first time in three months, signaling renewed accumulation activity.

- Bitdeer sells 1,132.9 BTC holdings, redirecting capital toward data centers and AI cloud expansion.

Bitcoin is holding firm near the support level as traders watch for the next move. Market participants focus on the weekly EMA200 support while analysts point to a possible rally toward $80,000.

BTC Holds $68,000 Weekly EMA200 Support

Bitcoin trades at $68,197 with a 24-hour volume of $16.87 billion. The price is down 0.04% in the past day. Despite the small dip, bulls continue to defend the weekly EMA200 near $68,000.

Crypto analyst Captain Faibik posted that BTC Bulls are Still Defending the Crucial Weekly EMA200, adding that he is expecting a bounce toward 80k from this level. Traders monitor this level as it often acts as long-term support.

The weekly EMA200 is widely tracked by technical traders. When the price stays above this line, buyers often stay active as the current setup keeps market focus on a possible breakout toward $80,000.

Bitcoin Demand Turns Positive After Three Months

On-chain data also draws attention as Mister Crypto noted that Bitcoin Apparent Demand just flipped positive for the first time in 3 months. Positive demand suggests that buying activity now exceeds selling pressure.

This shift comes after months of weaker accumulation as market participants watch demand metrics to assess trend strength. When demand turns positive, traders often expect price stability or upward movement.

The timing aligns with Bitcoin holding above key support, with both technical and on-chain signals now shaping short-term expectations. Investors continue to monitor exchange flows, and wallet activity points out to help measure real buying interest in Bitcoin markets.

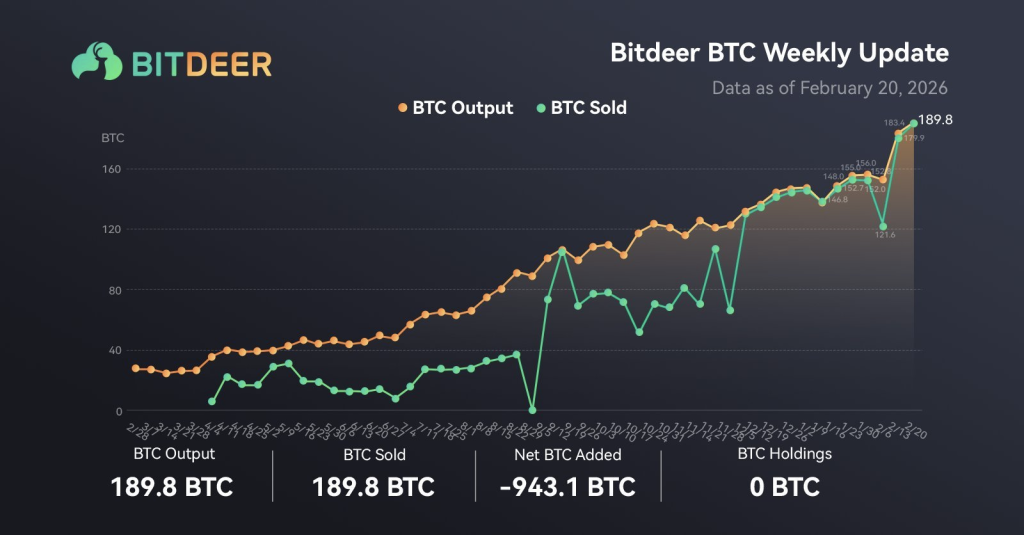

Bitdeer Sells Entire Bitcoin Treasury

Meanwhile, Corporate activity adds another layer to the market outlook. Coin Bureau highlighted that Bitdeer sold ALL its Bitcoin holdings of 943.1 BTC from reserves and 189.8 newly mined coins.

After the sale, Bitdeer reduced its Bitcoin balance to zero. The firm said capital will support data center expansion, AI cloud growth, and corporate needs. Such treasury moves can affect short-term supply dynamics as Bitcoin continues to trade near $68,000 support.

Traders now watch whether bulls can maintain control and push toward the $80,000 target. The market remains focused on price action around the weekly EMA200. As long as Bitcoin holds this level, attention stays on a possible breakout.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |