Key Insights:

- Bitcoin bounced from the $85K support zone, now aiming for resistance between $89K and $92K.

- Whale wallets added $23.3B BTC in 30 days, marking record accumulation since 2012.

- Price action remains range-bound; a move above $90K could shift short-term market trends.

Bitcoin was trading just above a key support level after a period of selling pressure. At press time, the price bounced from the $83,000–$85,000 range. As of the latest update, it stands at $87,269.48, posting a 0.3% gain in the last 24 hours.

This support zone has acted as a floor during recent sessions. Repeated attempts to push the price lower were rejected near this level. Buyers stepped in with enough strength to prevent a breakdown. The move has shifted short-term focus to the upside.

Resistance Area Between $89K–$92K in Focus

After the bounce, Bitcoin was approaching a known resistance zone between $89,000 and $92,000. This area has rejected price advances several times over the past few weeks. Traders are now watching closely to see if BTC can break above this range or face another rejection.

Charts show a possible scenario where the price may consolidate below this zone before making a stronger attempt. If buyers take control and break through resistance, the next price targets are $93,000 to $95,000, and possibly $98,000 to $102,000. If price fails to hold above $84,000, downside pressure could return, with attention shifting toward the $80,000–$81,000 area.

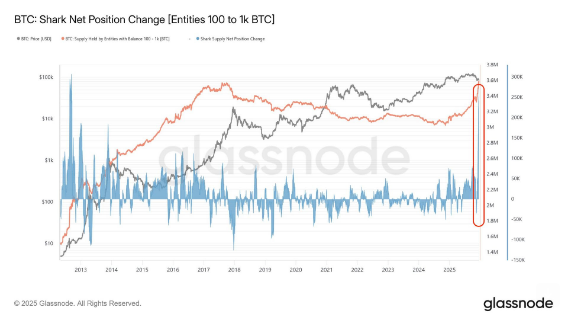

Whale and Shark Wallets Accumulate BTC

Wallets holding between 100 and 1,000 BTC have increased their holdings. Glassnode data shows a sharp rise in net inflows to these addresses. This recent spike marks the largest monthly accumulation by these entities in 13 years.

Barchart shared:

“Bitcoin whales have purchased $23.3 billion worth of BTC over the last 30 days.”

Source: Barchart/X

The data confirms this with a visible increase in the total BTC supply held by this group. These wallet sizes often reflect organized capital or longer-term holders.

Price Action at a Turning Point

Bitcoin’s ability to hold above support has shifted market focus toward the next resistance. Price remains within a well-defined range. A clear move above $90,000 could change the short-term trend. If the level fails, a return to lower support zones is possible.

In the last seven days, Bitcoin has dropped 3.4%, showing some weakness after recent highs. Volume and reaction near the $90K zone will decide the next direction. Traders are watching price levels, not just headlines.