Key Insights:

- Solana-linked treasury companies remain in downtrends with weak recovery attempts.

- BitMine continues buying Ethereum, supporting corporate demand for ETH exposure.

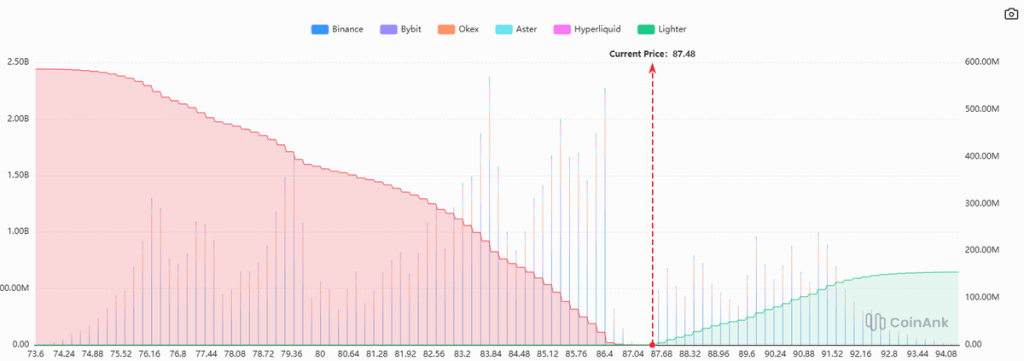

- SOL futures data show long positions outweigh shorts across major exchanges.

Solana (SOL) trades at $87.21 with daily volume near $4.13 billion. The token has slipped 0.18% over 24 hours and 1.22% over seven days. Recent commentary has focused on treasury demand and equity performance tied to major crypto networks.

Market commentator Ted wrote that “Solana Treasury companies are looking worse than Ethereum ones.” He added that while BitMine continues to buy Ethereum, “this can’t be said for $SOL.” The comparison has shifted attention toward differences in corporate demand.

Solana-Linked Equities Show Ongoing Weakness

Several companies associated with Solana exposure remain in sustained downtrends. Charts for Forward Industries, Sol Strategies, Sharps Technology, and DeFi Development Corp show repeated lower highs and lower lows. Prices have fallen sharply from prior peaks and now trade near recent lows.

Selling pressure has increased during breakdown phases, while recovery attempts have lacked strength. The price structure does not show clear basing patterns. Equity performance tied to Solana exposure has remained soft compared with earlier cycle highs.

Ethereum Treasury Activity Continues

Ethereum-linked treasury activity presents a different picture. Ted noted that “for ETH, BitMine is still buying.” Ongoing purchases from a listed company provide visible demand for Ethereum.

This contrast has fueled discussion about capital allocation between major networks. While Ethereum benefits from reported corporate accumulation, Solana-linked firms have not shown similar buying support in recent sessions.

SOL Futures Positioning Remains Long-Heavy

Derivatives data indicate that SOL positioning is tilted toward longs across major exchanges. As price moved from the mid-$80 range toward $87–$90, cumulative long exposure increased. At the same time, short exposure declined.

Analyst CW stated that “$SOL is still dominated by long positions.” The imbalance shows traders leaning toward upside continuation. If price holds above the $85–$86 area, long positioning may remain intact. A move below that zone could place pressure on crowded long exposure as traders adjust positions.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.