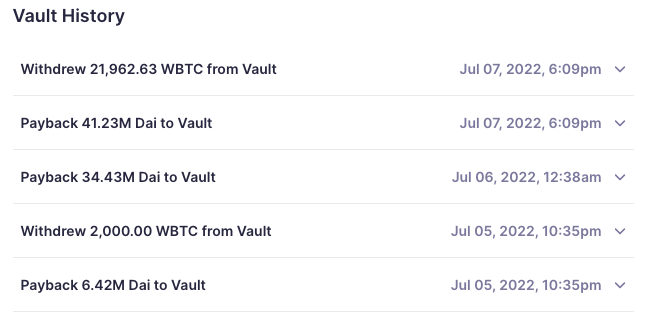

The Celsius lending platform on the afternoon of July 7 closed a huge loan on Maker and withdrew all collateral.

As reported by CoinCu, Celsius has since the beginning of July started paying off its loans on major DeFi platforms.

On July 7, this lending company completed the return of $41.23 million of stablecoin DAI to Maker and closed the vault borrowing money from this DeFi protocol. At its peak at the end of June, the loan order on Maker amounted to 224 million DAI, collateralized by 23,962 WBTC, which is Bitcoin tokenized on Ethereum.

With the debt repayment move, Celsius also withdrew 21,962 WBTC mortgaged for a loan order to a private wallet. This amount is worth up to $449 million at the time of writing. In addition to the 2,000 WBTC previously withdrawn, the company also recovered all of its collateral WBTC.

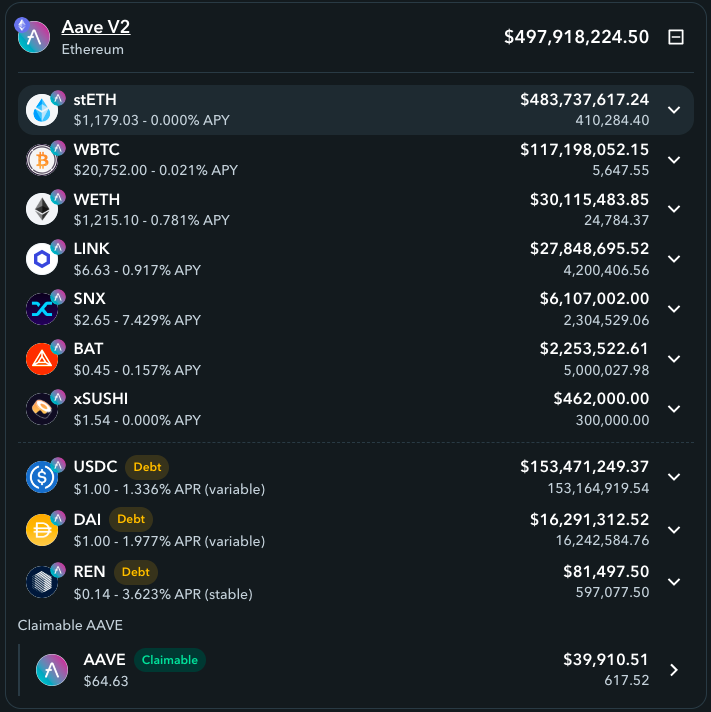

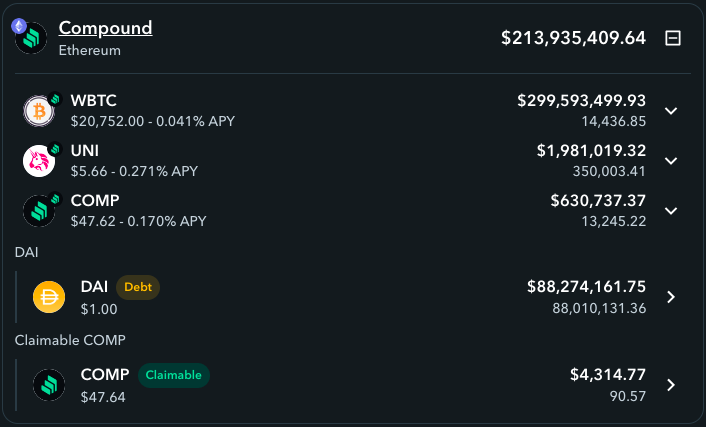

Even so, Celsius is still maintaining a loan order of 88 million DAI, collateralized with nearly $298 million of WBTC and UNI, on Compound; and a loan order of 169$ million USDC and DAI collateralized with over 650$ million stETH, WBTC, and many other tokens.

Celsius loan orders were the “big worry” of the crypto market at the end of June because of the company’s situation. If the loan orders are liquidated, a large number of tokens will continue to be dumped, threatening to bring down both Bitcoin and Ethereum through the WBTC and stETH vaults.

It is not clear what is the reason behind the repayment action, as well as the company’s next move after withdrawing the above collateral.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News