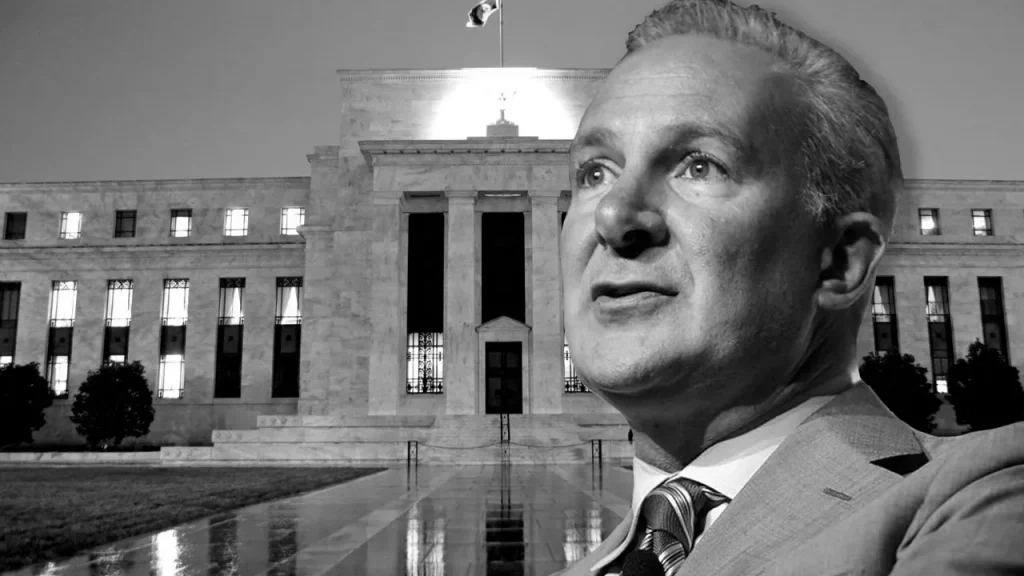

Peter Schiff Advises Investors To Liquidate Bitcoin Amid The Present “Sucker Rally”

Despite dismissing its recent short-term gains, economist and Bitcoin (BTC) skeptic Peter Schiff has continued to criticize the asset, pointing out that it’s a chance for investors to sell and quit the market.

Speaking during an interview with Kitco News on August 11, Schiff stated that Bitcoin will likely correct further to $10,000 and will unlikely experience any other high like the rally in 2021.

According to the chief market strategist of Euro Pacific Asset Management, the broader crypto market gains are not sustainable, terming it a ‘sucker’s rally’.

“The market is going to plunge. I think people should take advantage of the sucker’s rally they’ve got right now and get out. A lot of people still have profits in these tokens. People bought Bitcoin four, five, six years ago, and they have big profits. Same thing with Ethereum (ETH). People should get out, because otherwise, the market’s going to take those profits,” he said.

Bitcoin market bubble is about to pop

He emphasized further that the 2022 correction was the result of a large pump and dump and that the crypto industry is in a bubble that will soon implode. According to Peter Schiff, the market had a significant pump as a result of increasing cryptocurrency advertising, but investors were not paying attention to the dump.

Furthermore, Peter Schiff criticized organizations that bought Bitcoin, saying they will regret the decision unless they sold. Schiff recently negotiated an agreement with Puerto Rican authorities to liquidate his Euro Pacific Bank. Notably, institutional investment in Bitcoin was essential in igniting the market upswing in 2021.

Peter Schiff’s analysis of the Bitcoin losses at MicroStrategy

The economist specifically mentioned MicroStrategy and claimed that its Bitcoin approach had failed, as seen by the losses accrued.

He questioned Michael Saylor, the departing CEO of MicroStrategy, for claiming that the business is making money off of its initial Bitcoin purchase. Schiff also stated that he is open to an argument with Saylor on the business’s Bitcoin adoption approach. He asserted, however, that Saylor had declined his offers to a debate.

It’s important to note that as of Q2 2022, MicroStrategy’s Bitcoin assets were valued at roughly $2.96 billion, as opposed to the $3.975 billion acquisition value.

With several businesses like lending platform Celsius filing for bankruptcy, Schiff believes MicroStrategy is in line to collapse, noting that the stock is overvalued.

“Eventually, the price of MicroStrategy shares is going to crash, and it’s going to be way below where it was when they first started to buy Bitcoin,” he said.

It’s important to note that MicroStrategy’s 2022 Q2 sales was $122.1 million as opposed to the $126 million analysts had predicted. Additionally, the company reported a loss of $918.1 million, of which $917.8 million was attributable to its Bitcoin assets.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Annie

CoinCu News