Exchange Flow analysis of Bitcoin and Ethereum shows opposing activity for the top two tokens.

Exchange Flow is the amount of tokens deposited or withdrawn into or out of an exchange wallet. A common on-chain metric to gauge this is Exchange Net Position Change.

Exchange Inflow is generally considered to be bearish, as the main reason for moving tokens to exchange is for sale. In contrast, Exchange Outflow (the flow of money out of exchange) is generally considered bullish, as token withdrawals are usually intended for long-term holding.

Examining the flow of money in and out of exchanges can help you determine whether investor sentiment is bearish or bullish.

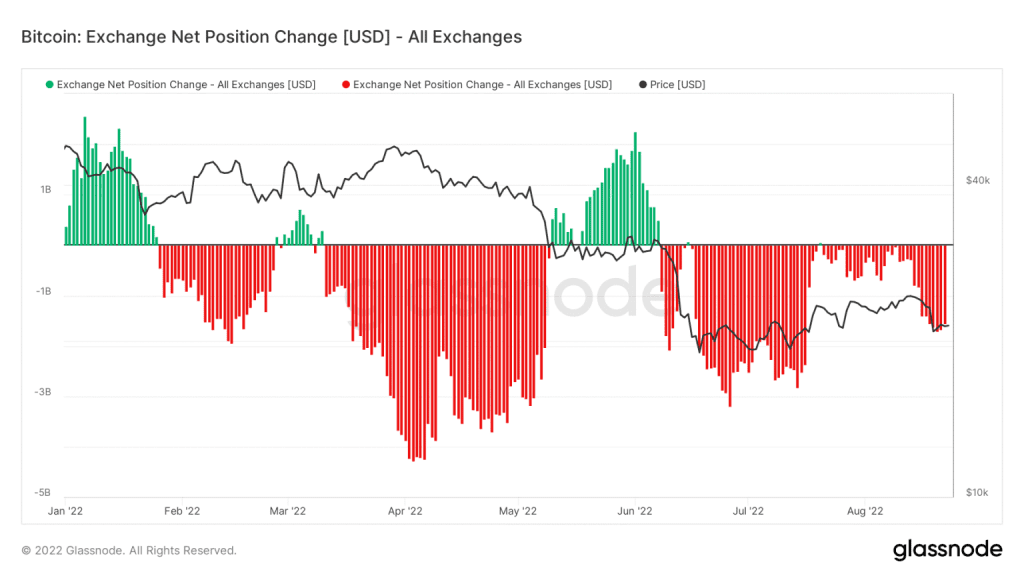

After the massive price drop due to the Terra scandal and subsequent industry-wide leverage reduction, Bitcoin bottomed on June 18 at $17,600. The chart below shows a consistent BTC outflow from the exchange since bottoming, with daily outflows averaging over $1 billion per day.

In the last week, BTC outflows from exchanges have increased significantly, even though Bitcoin fell to as low as $20,800 on Aug 19. This shows that investors see value in the current price range.

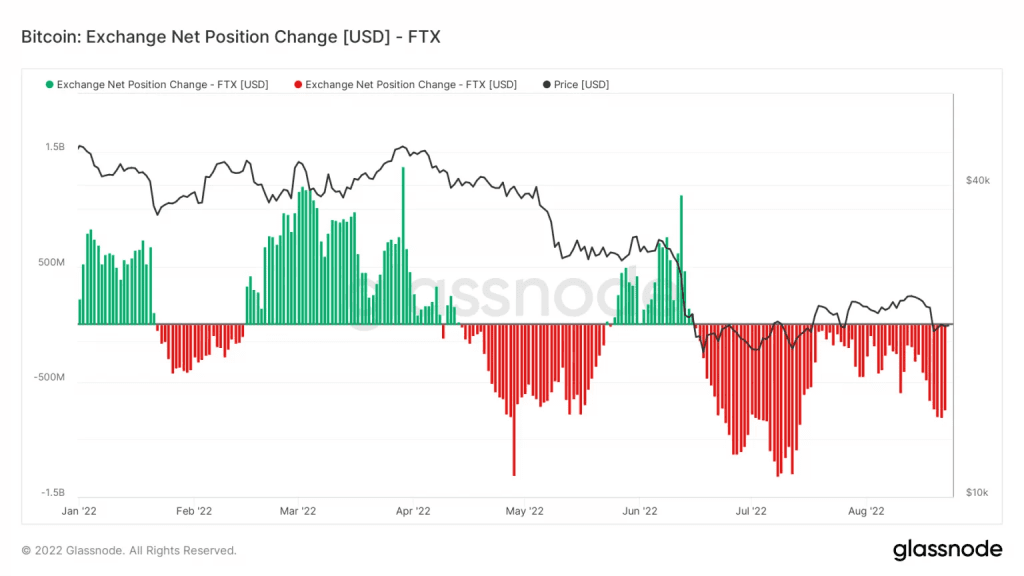

The FTX exchange accounted for more than half of all outflows last week. There is no obvious underlying reason for this occurrence. However, on August 20, “leaked documents” revealed that FTX has increased its revenue by more than 1,000%, from $90 million in 2020 to $1 billion in 2021.

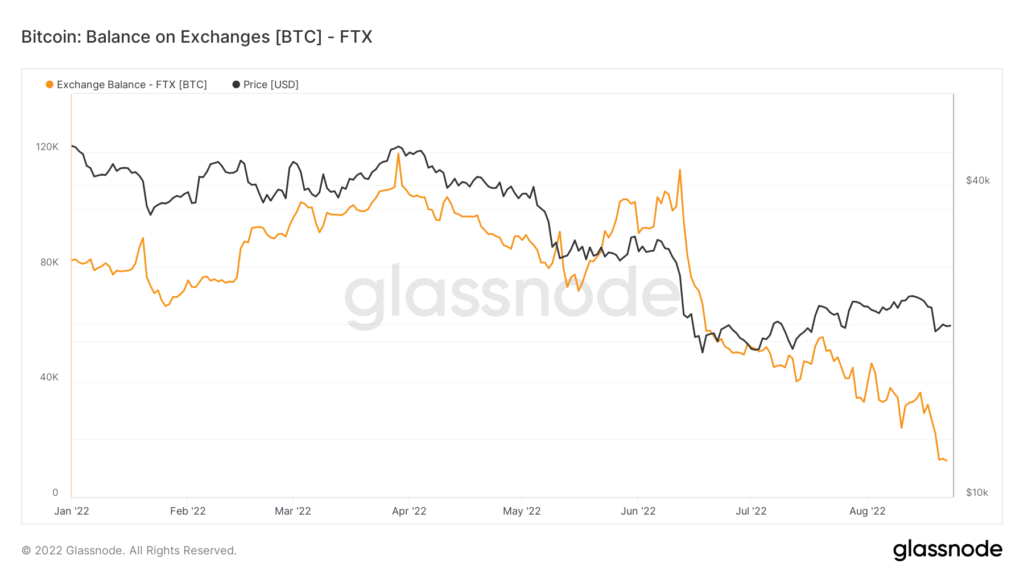

Further analysis of FTX’s BTC reserves shows that holdings have decreased significantly. In March, the company held over 120,000 BTC. But now, this has dropped to just 13,000 BTC, with the period from June showing the steepest drop, leading to a progressive decline in BTC holdings.

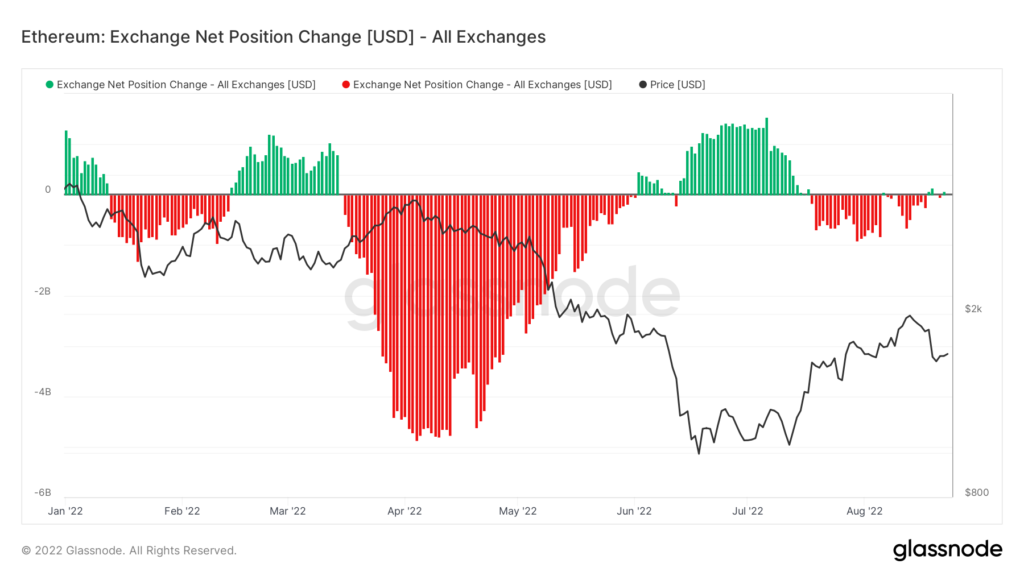

In contrast, Ethereum’s Net Position Change shows that despite large outflows from mid-March onwards, the number of tokens leaving the exchange reverted to close to zero.

This development is a negative sign, especially as The Merge upgrade is imminent. It shows investors think of the move to Proof-of-Stake (PoS) as a “buy the rumor, sell the news” event.

The contrasting activity between Bitcoin and Ethereum may suggest that investors view BTC, not ETH, as the long-term game against macro developments, such as inflation.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News