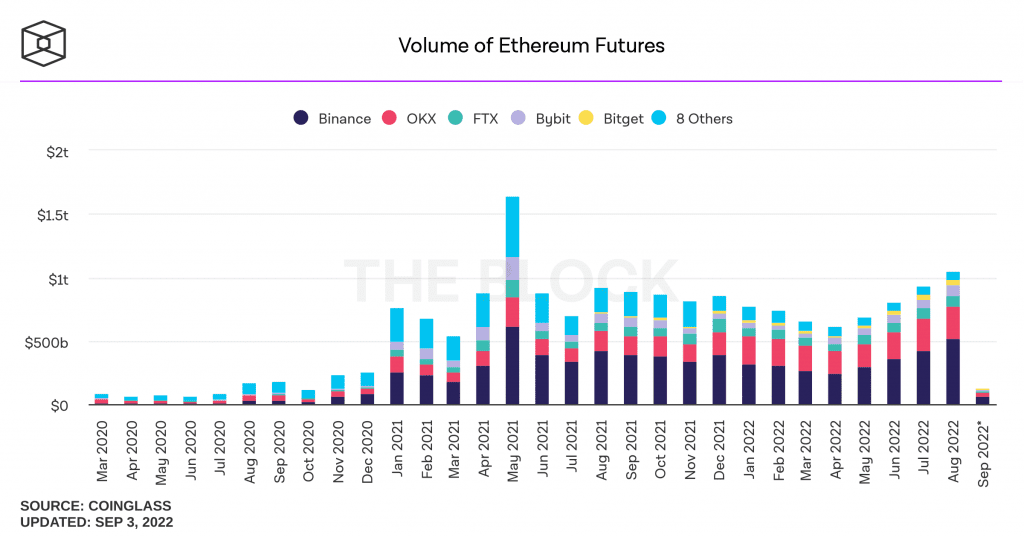

In preparation for The Merge, Ethereum derivatives trading increased by around 10% in the last month, accounting for up to 57% of total Bitcoin and Ether futures trading volume. In other words, it has outperformed Bitcoin in this regard.

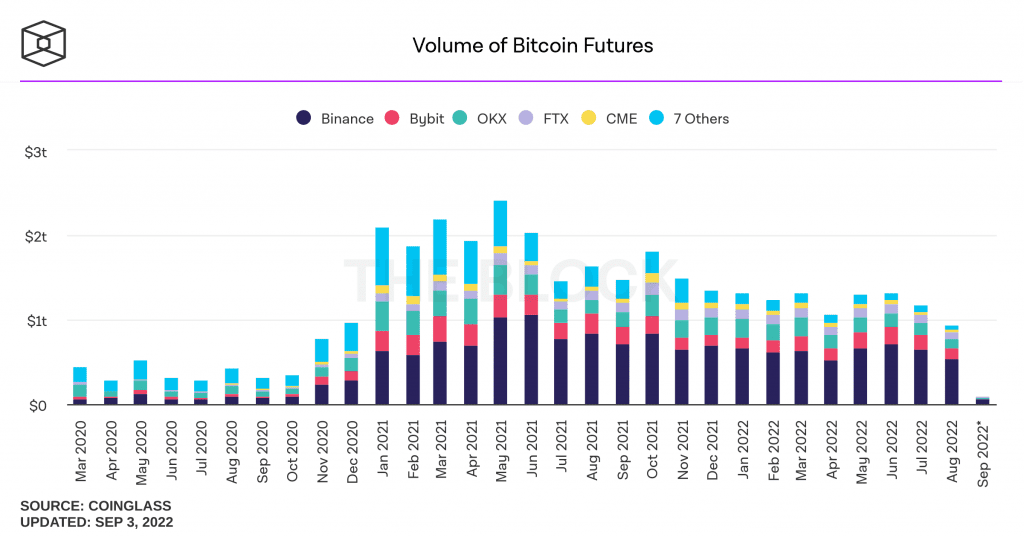

Over $35 billion in Ethereum futures have been traded in the last 24 hours, compared to $32 billion in Bitcoin futures. Furthermore, open interest, or the amount of unresolved ether contracts, has nearly doubled this week to $8.43 billion, data from Coinglass shows.

The entire derivatives volume traded for Ethereum since September 2022 is over $87 billion, compared to roughly $67 billion for Bitcoin.

If The Merge is successful, Ethereum’s issuance pattern will decelerate, reducing the number of ETH in circulation and eventually driving up the price. As prices rise, this deflationary effect may diminish the volume of investors holding short positions, lowering the current driver of futures trade.

Traders will earn ETHPOW for free if they retain ETH but will receive nothing if they take bullish positions in the futures or options markets. As a result, the price of Ether can be used to reflect the worth of Ethereum and a possible ETHPOW token.

However, keeping ETH to earn ETHPOW exposes you to the price volatility of ETH. A drop in the price of ETH would cut into the profits generated from receiving ETHPOW for free and liquidating in the spot market.

So, the best way to make risk-free money is to purchase ETH and short September futures – a method known as a spread trade. As a result, ETH holders can profit from ETHPOW without incurring any directional risk.

Paradigm said:

“If you had the notion that the PoW fork was going to be well used by market participants, you could put on a very simple spot vs. future for $18 and end up with a significant amount of PoW tokens which might end up being worth a good sum of money. So simplistically, you are betting $18 to potentially get a PoW token which hopefully is worth more than that $18 – it might look like a basis trade, but it feels like an option to me!”

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News