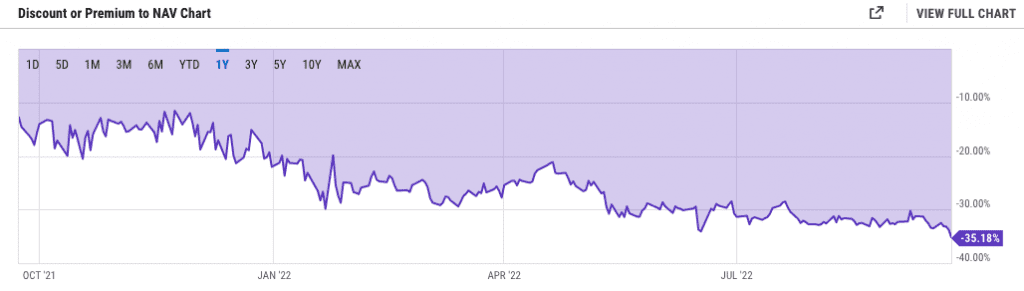

Grayscale Bitcoin Trust (GBTC), a crypto fund that currently holds 3.12% of the total supply of Bitcoin (BTC) or over 640,000 BTC, is trading at a record discount to the value of its underlying asset.

According to the most recent data, the $12.55 billion closed-end trust was selling at a 35.18% discount on September 23.

Despite its 2% yearly management charge, GBTC has long been a wonderful way to obtain exposure in the Bitcoin market. This is partly due to the fact that GBTC is easier for institutional investors to keep because it can be handled through a brokerage account.

GBTC traded at a significant premium over spot Bitcoin pricing throughout most of its life. However, it began trading at a discount following the launch of Canada’s first North American Bitcoin exchange-traded fund (ETF) in February 2021.

The Grayscale Bitcoin Trust, unlike an ETF, does not have a redemption mechanism. In other words, GBTC shares cannot be destroyed or generated depending on shifting demand, which explains why its prices are significantly lower than spot Bitcoin.

Grayscale’s efforts to convert its trust into an ETF were thwarted by the Securities and Exchange Commission (SEC) in June. Grayscale filed a lawsuit against the SEC when their ETF registration was denied. However, it might take years for the courts to make a decision, meaning investors would be trapped with their already-decreased GBTC shares.

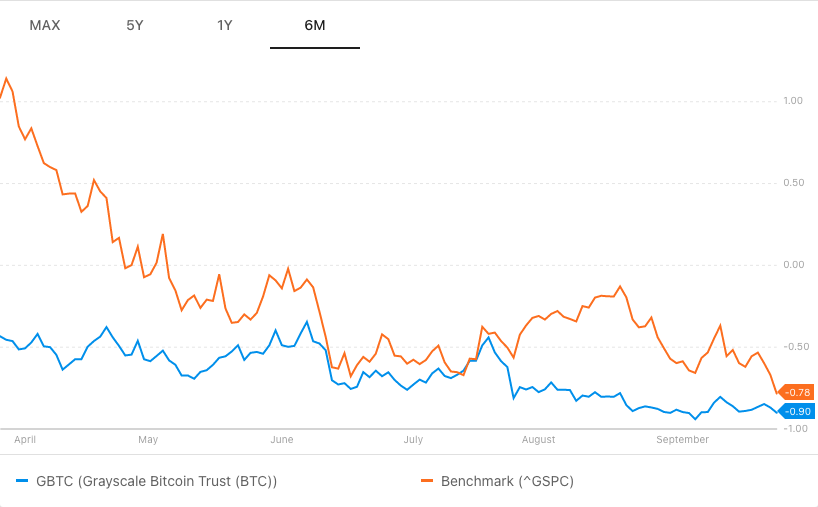

Additionally, GBTC’s 12-month Adjusted Sharpe Ratio fell to -0.78, which shows that expected returns from the stock are relatively low compared to its remarkably high volatility.

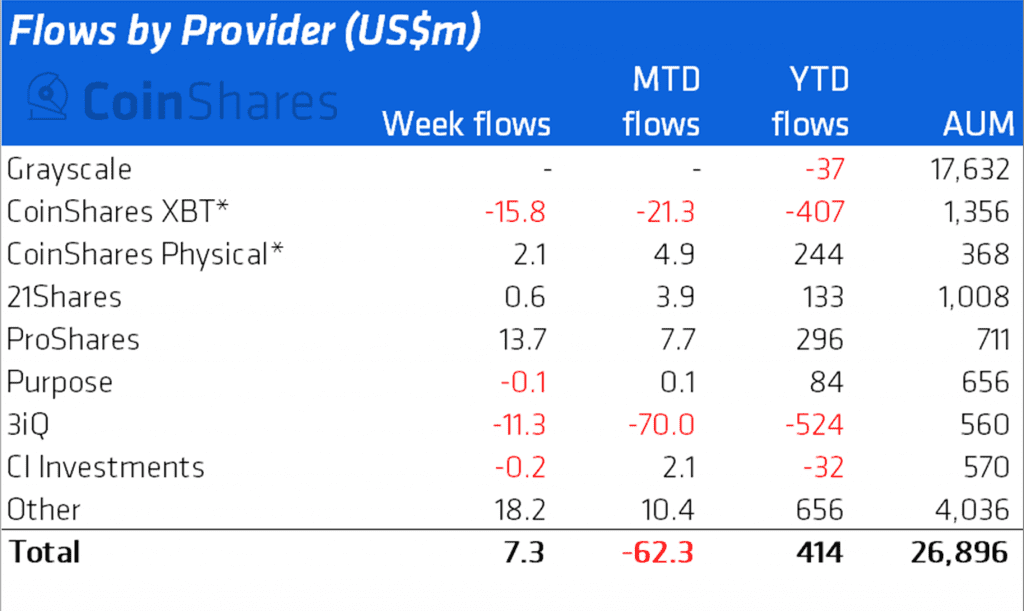

By assets under management, Grayscale is the world’s largest passive Bitcoin investment vehicle. However, with the advent of other ETF vehicles, it no longer has a big effect on the spot BTC market. According to CoinShares’ weekly report, crypto investment funds have gathered a total of about $414 million in 2022. Grayscale, on the other hand, has seen $37 million in withdrawals from its Bitcoin, Ethereum, and other token trusts.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News