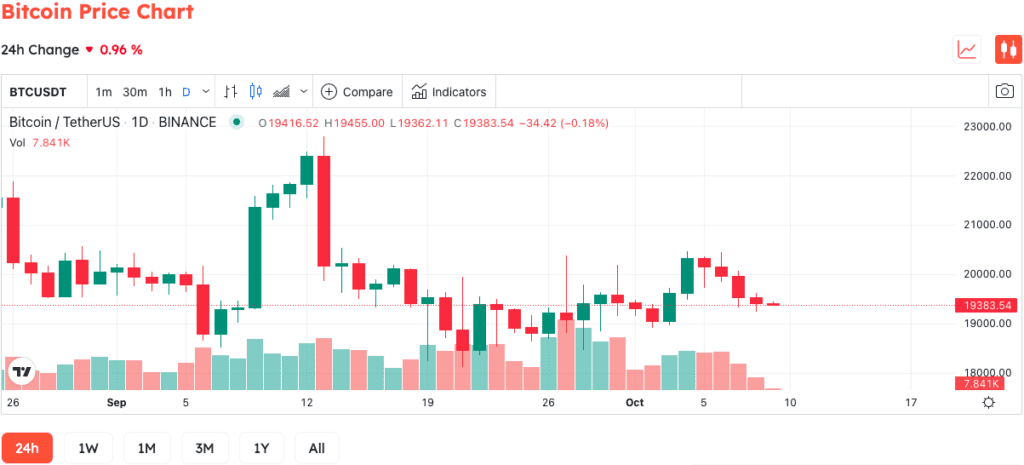

Bitcoin (BTC) is now moving in tandem with stocks since both asset classes are dealing with common macroeconomic variables such as increasing inflation and interest rates. However, relative to traditional equities, Bitcoin’s volatility appears to have moderated as the main cryptocurrency shows indications of detaching from the stock market.

According to statistics given by ZeroHedge, the Dow Jones index, which monitors the 30 top industrial firms, was more volatile than Bitcoin as of October 7.

Bitcoin has always been characterized by volatility, whereas traditional financial markets are significantly more stable. The change in volatility, however, may be linked to the fall from all-time highs, which has seen the commodity settle around $20,000 for weeks.

It seems that the market gloom has brought “stability” to Bitcoin in recent times, with investors in some locations resorting to the asset as a hedge against increasing costs. At the time of writing, BTC is trading at $19,383.

At the same time, BTC’s lower volatility has evolved as a result of a strong dollar, which has caused global fiat currencies to lose value in comparison to the US currency. In this regard, the rising dollar, together with falling commodity prices, may have a negative influence on stock portfolios.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News