The NFT season is back. It’s fun when the NFT price goes up, and there’s always someone willing to buy it, but it’s not fun when the volume slows down, and you can’t find anyone willing to take it for your Jpeg. NFTs rarely go to zero, and people just stop buying them because they are illiquid assets. Sudoswap is the first protocol to solve this problem by creating an NFT liquidity pool that pairs NFTs with ETH via a bonding curve.

The Gumball Protocol takes a slightly different approach to ensuring that NFTs on its platform is always liquid.

What is the Gumball Protocol?

Gumball is a platform that facilitates the creation of NFTs and the trading of assets. They aim to solve the lack of liquidity of NFTs by creating a unique ERC-20 token for each collection, thus enabling instant liquidity.

While some NFT collectibles can rise to high valuations, there are not always buyers, making these valuations difficult to convert into liquid assets. This is the problem Gumball aims to alleviate by determining the bonding curve of how NFTs and ERC-20 tokens are interchangeable.

On Arbitrum, the GumBall Protocol is now operational. Retweeting the announcement entitles followers to one free LiquiCat, an NFT collection that is presently being produced.

Leading the effort to provide the finest Web3 experience is Arbitrum. Projects are joining up to take use of a variety of scaling options for Ethereum. Its products are the finest on the market because of a number of benefits, including quicker transactions, an additional layer of security, and interoperability with EVMs. Through Arbitrum, users also benefit economically.

How does it work?

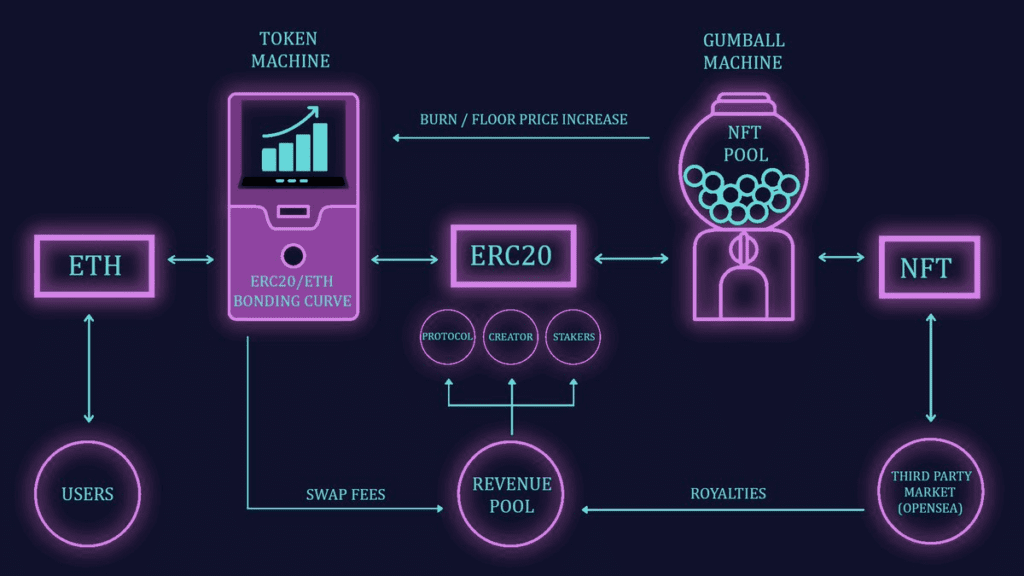

The protocol architecture is divided into three distinct main parts. The first is Gumball Factory, which deploys new collections of NFTs by creating gNFTs (Gumball NFTs). When a pool is created, it interacts with an ERC-20 bonding curve, which is similar to Sudoswap, but uses native GBT tokens instead of just ETH. Making all this possible is the Gumball Factory, which facilitates conversions between GBT and gNFT at any time.

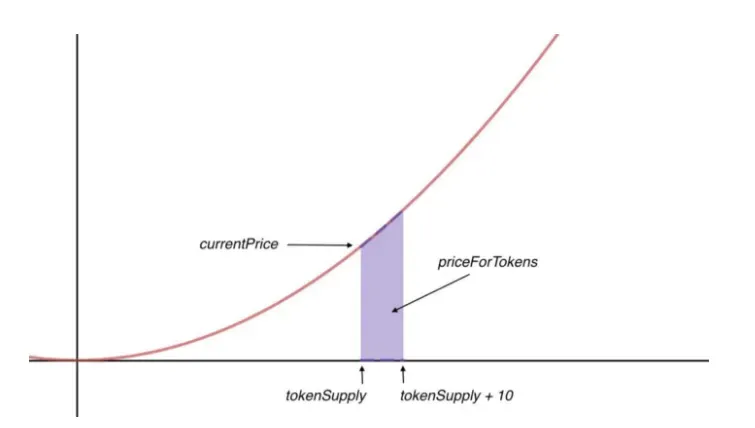

Bonding curve

The price is determined by the Gumball Token (GBT) paired with ETH, rather than the NFT floor price being determined by ETH trading activity. The price of GBT is governed by a bonding curve, with each purchase increasing the price of GBT and each sale decreasing it.

High volatility at a particular price point will stabilize the price as buyers and sellers find an equilibrium in the value of the token. Trading activity from users interacting with the bonding curve generates transaction fees and reserves liquidity inside the protocol via Gumbar.

Gumbar

Gumbar allows users to earn transaction fees generated by hot pairs by staking GBT and gNFT, thereby benefiting from the transaction activity of NFT collections. This helps the protocol maintain liquidity, which is the most critical component of DeFi and a persistent challenge surrounding NFTs.

Agreement value accumulation

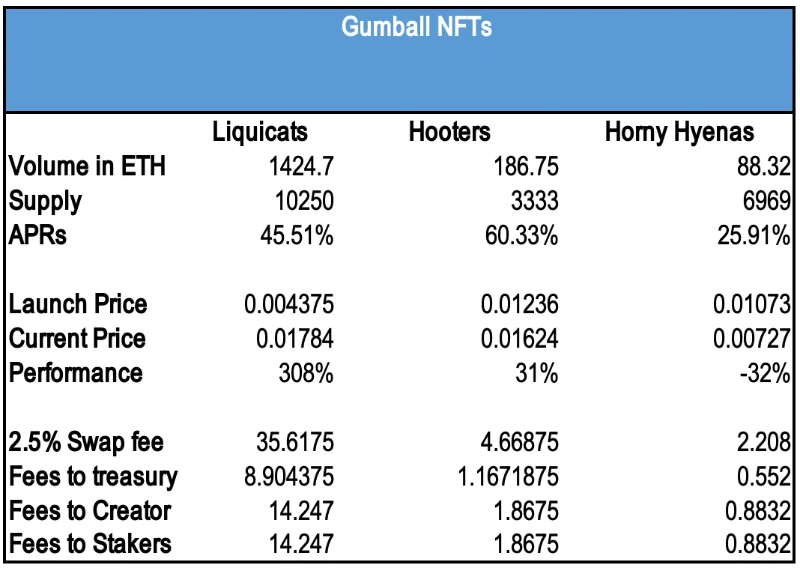

While Gumball Protocol has yet to release any signs of a token, there are still some ways for the protocol to add value. If we look at the top three NFT collections on the platform, we get the following numbers:

This is based on the three NFT collectibles being added separately on the platform now, and we can expect that if the marketing is ramped up, the fees incurred will increase as Gumball launches more collections. Considering that the protocol assists creators in marketing their products to their communities, it partially removes one of the hurdles creators fear the most.

Based on the 2.5% fee generated by the exchange, it is distributed as follows:

- 0.5% of the exchange fee goes to the Gumball treasury.

- 1% of the swap fee goes to the creator.

- 1% swap fee goes to GBT/GNFT stakers who facilitate the swap and maintain liquidity within the protocol.

At ETH prices on February 6, the protocol has generated around $17,688.37 since January 10. Daily earnings of $707 since 25 days after posting.

On an annual basis, the revenue for this agreement is $707.53 * 365 days = $258,248.

While the protocol’s economics are well set up to align creators, protocol, and users accordingly, it doesn’t make sense for the protocol to launch tokens because no governance is required (unless you want to whitelist the protocol’s hurdles), and revenue Not yet high enough to generate any demand for a share of the charge.

Opportunities and pitfalls

Given that gNFTs are freely swappable with their own GBT, successful tokens give the creator more control and allow it to be used outside of the protocol, over-collateralizing and integrating with other protocols, which drives NFT Further utility of collectibles (probably only reasonable for blue chips) however, it also dents liquidity compared to just using ETH, which is clearly the most liquid asset in the market outside of USDC.

Still, many NFT series end up creating their own ERC-20 tokens anyway.

Also, considering that these NFTs created on the Gumball protocol can also be listed on other exchanges such as Opensea, arbitrage opportunities, and inefficiencies will arise, creating some discrepancy between the ETH value and GT value on Gumball. The danger with this premise is that if these NFTs gain traction after being listed on Opensea, NFT holders will flock to where the liquidity is highest. This leaves no revenue for stakers related to NFT collection, including protocols.

Safety

Gumball was audited by A-rated audit firm Peckshield in December 2022. They determined that while they found a few issues, including 1 medium-severity bug and 2 low-severity bugs, overall, the smart contracts were well-designed by the team.

They were also audited by Zokyo prior to the Peckshield audit in June 2022 and passed the initial audit with flying colors (although the contract was later amended, hence the second audit).

Conclusion

Gumball is a new iteration of the NFT/ERC-20 pair that Sudoswap will revolutionize in the summer of 2022. In terms of creating instant liquidity for NFTs, it’s an interesting concept that can create instant liquidity for NFTs while ensuring that users, creators, and protocols are all on board to steer the course by aligning incentives.

It competes with other exchanges operating on ethereum in the fierce NFT market, but Gumball would be in a good position if an NFT explosion happened to Arbitrum. While they haven’t shared any indication of a token launch, engaging with the platform at an early stage may pay off in the long run.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

Coincu News