Camelot Review: DeFi Project On Arbitrum Needs More Breakthrough

Camelot is gaining traction in the Arbitrum ecosystem, and its native token, GRAIL is doing well. Let’s find out details about this project with Coincu through this Camelot Review article.

The project is a blockchain-based smart contract and data analysis platform. It offers tools for extracting data from human-generated documents like as financial statements and contracts and then employs artificial intelligence to evaluate and automate data-related tasks.

What is Camelot?

Camelot is a decentralized exchange – native DEX on the Arbitrum ecosystem geared toward customization and great flexibility. Moreover, transactions are optimized for users, and protocols may be tailored in a variety of ways to meet your needs.

Camelot Technologies Inc. created the project, which is a blockchain and cryptocurrency platform. The platform is intended to enable decentralized financial services such as payment, lending, leasing, and investing.

This platform employs a dual AMM paradigm to provide trading and swapping for both ordinary tokens and stablecoins. The protocol’s novel AMM also supports dynamic directional fees, allowing different rates to be defined for each pool and direction of swap. These distinguishing characteristics allow the building of more customized pool setups to suit certain trading pairs.

Camelot’s technology incorporates a Proof-of-Stake (PoS) network as well as a smart contract framework to allow safe and reliable decentralized financial services.

Unlike today’s prominent DEX exchanges like Uniswap or Sushiswap, which control the majority of cross-chain liquidity for top asset pairings such as USDC/ETH or ETH/wBTC, the initiative will operate independently. By concentrating on garnering liquidity from other initiatives in the Arbitrum ecosystem itself via partnerships, we can drive innovation.

Since most users pick projects with the greatest APR, user-provided liquidity is often variable. Projects, on the other hand, have long-term liquidity and often concentrate money on a single Exchange. Camelot opted to reward its partners for keeping liquidity on their platform based on these considerations. Now, the Camelot Review article will learn about the working mechanism of the project.

How does it work?

Camelot created two tokens exclusively for the system, GRAIL and xGRAIL. Farming on Camelot will reward users with two tokens.

xGRAIL will provide greater advantages than GRAIL. As a result, if you wish to convert xGRAIL to GRAIL, you must go through the vesting procedure, and GRAIL to xGRAIL conversion may occur at any moment.

This Dual-token System enables Camelot to limit the selling pressure from users after farming on the platform, allowing the protocol to be proactive in preserving the balance of supply and demand and the ecosystem’s stability. In addition, individuals who agree to transition to xGRAIL will earn additional incentives and interest.

UniSwap V3 is now in first place in the Arbitrum system’s DEX array, alongside Camelot.

The project’s income will be generated by transaction fees, fees from Launchpad projects on the platform, or fees from partners that use Camelot products such as spNFT or Nitro Pools.

Its revenue will be given proportionately among the following items when it has been collected:

- 60% bonus for liquidity providers

- xGRAIL holders get a 22.5% payout

- GRAIL buy back and burn: 12.5%

- 5% excerpt for core contributors

Products

AMM

Camelot’s main product is AMM (Automated Market Maker). Camelot AMM will have a dual-liquidity system that will help customers reduce slippage while trading both high-volatility (altcoin) and low-volatility (stablecoin) currency pairings.

Camelot AMM proposes a method of “variable transaction costs” that alter dependent on market circumstances and the protocol’s own intents, in addition to Dual – Liquidity. This approach enables the transaction fee to be tailored to each currency pair, as well as computed differently depending on the purchasing or selling direction.

The Dual-Liquidity type idea, which implies Camelot’s AMM has two models, one for volatile assets Uniswap V2 (x * y = k) and one for solidly parity assets (x3y + y3x = k).

Users that have a Dual-Liquidity type may trade any asset on Camelot’s platform. The 3xcaliSwap model of the 3xcalibur project is comparable to the Dual-Liquidity type concept.

In addition to the Dual-Liquidity type, Gamelot presents the Dynamic Directional Fees model, which allows you to adjust transaction fees (buy-sell) for various trading pairs based on the time and market circumstances.

Lastly, Camelot offers a referral code that allows customers to promote their friends and collect a portion of the invitee’s transaction cost.

Staked Positions (spNFTs)

Camelot’s new liquidity model, spNFTs – Staked Position Non-Fungible Tokens, is based on a novel approach to liquidity. That is, each Camelot LP will have a unique stake position, and you may mint that position into an NFT by wrapping it in a smart contract. After that, spNFTs will be considered user deposits and will have the following advantages over ordinary LPs:

- Unique ID

- Save all of the user’s position parameters, such as the number of tokens

- Token APY value and lock time using Multipliers Point.

spNFTs will then have the following applications:

- Increase/decrease the number of tokens in the position by depositing/withdrawing.

- Edit lock time should be increased.

- Combine positions; if positions have lock time, the position after merging will compute the position with the longest lock time.

- If positions have lock time, positions after splitting will have lock time equal to the original.

Yield Farming

When users supply liquidity to Camelot through dual liquidity, they will get benefits from both the LP pair as well as the incentive programs GRAIL and xGRAIL in an 80/20 split.

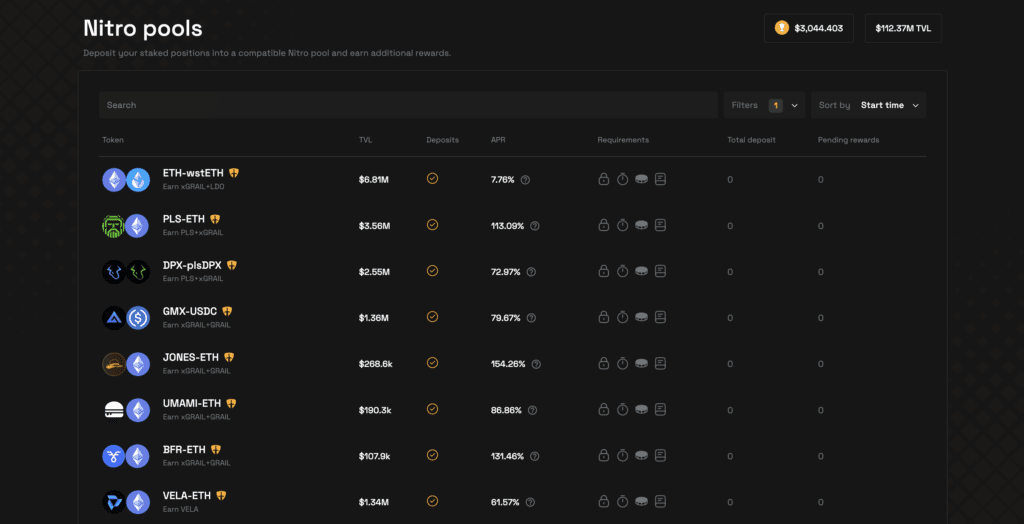

Nitro Pools

Nitro Pools are liquidity pools made up of locked LPs or spNFTs that have a set unlock date and time. Users, projects, or the Camelot platform itself may establish Nitro Pools.

It is quite possible that Camelot will provide this service to projects who wish to build a liquidity pool from the ground up with an ample liquidity supply from the community.

Users may still contribute, withdraw, or harvest their rewards while utilizing the Nitro Pool. Nitro Pool developers are additionally subjected to the following factors in order to favor holders and genuine project contributors:

- When staking into the pool, provide the minimum quantity of spNFT.

- Set a minimum lock time or a set unlock date.

- Specify which wallet addresses are eligible to participate in the pool’s spNFT stake.

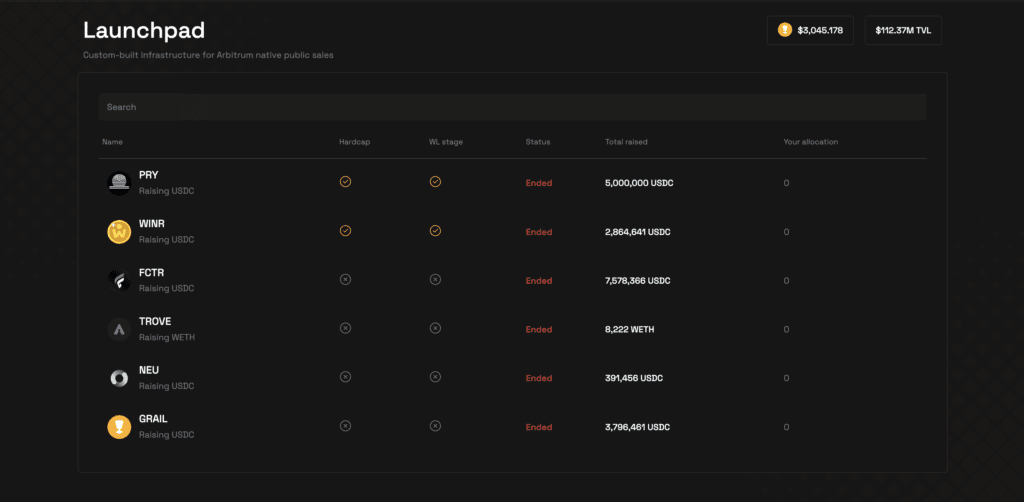

Launchpad

Camelot, like other DEXs, has Launchpad embedded directly into the UI. Here is where new projects created in the Arbitrum ecosystem may launch tokens to the community.

So far, six Launchpad projects have used the protocol, including its GRAIL token.

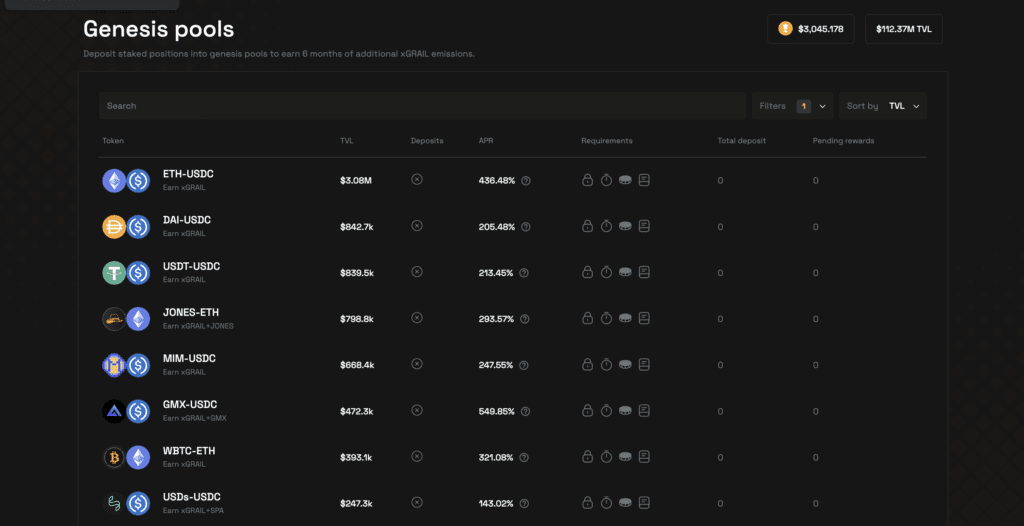

Genesis Pools

This is a liquidity pool built with the goal of increasing liquidity for partner projects in Camelot through Liquidity Farming. The majority of the incentives, however, are paid in tokens depending on that project and some GRAIL + xGRAIL.

Plugin xGRAIL

Plugins are contracts that are linked to the xGRAIL contract. Anybody in the Camelot ecosystem may design and integrate them. Among the first Plugins developed directly by the Camelot team are:

- Dividends Plugin: The Dividends Plugin redistributes the bulk of protocol revenues to users in the form of xGrail. In each weekly cycle, dividends are delivered constantly (reward/second).

- Yield Booster: The YieldBooster plugin allows any user to utilize their xGRAIL for a staking position (spNFT) in order to gain greater profit. The increment factor will vary depending on the LP of the stake position, although it will often be x2 more than the default number.

- Community Plugins: Because of xGRAIL allocations, any user or protocol may offer or install its own plugins, but they must adhere to certain universal technological constraints. protocol set. Camelot will also not be liable for any Plugins permitted by third parties, thus, users should exercise caution before allowing new contracts to prevent excessive losses.

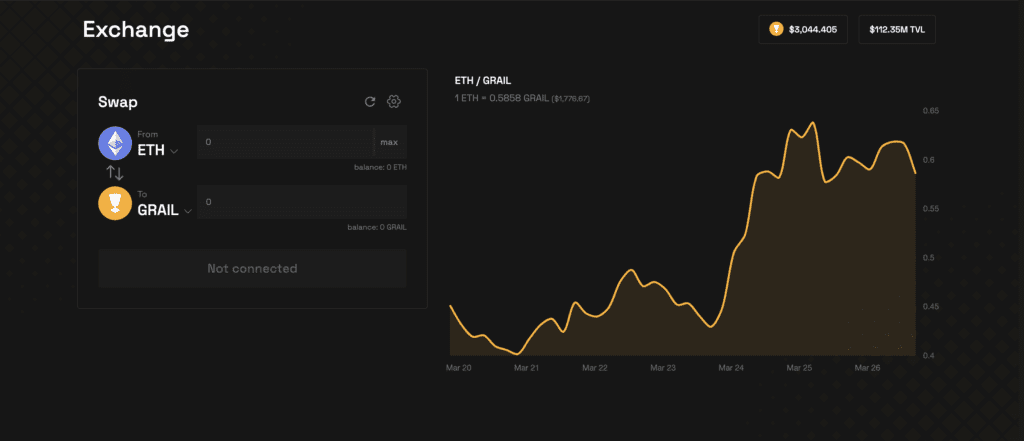

GRAIL token

Camelot uses two tokens for the project’s system.

- GRAIL is a liquidity token

- xGRAIL is a profit-sharing token and empowers DEX.

Key Metrics

- Token Name: Camelot Token

- Ticker: GRAIL

- Blockchain: Arbitrum

- Token Contract: 0x3d9907F9a368ad0a51Be60f7Da3b97cf940982D8

- Token Type: Utility

- Total Supply: 73,506 GRAIL

- Circulating Supply: 9,427.33 GRAIL

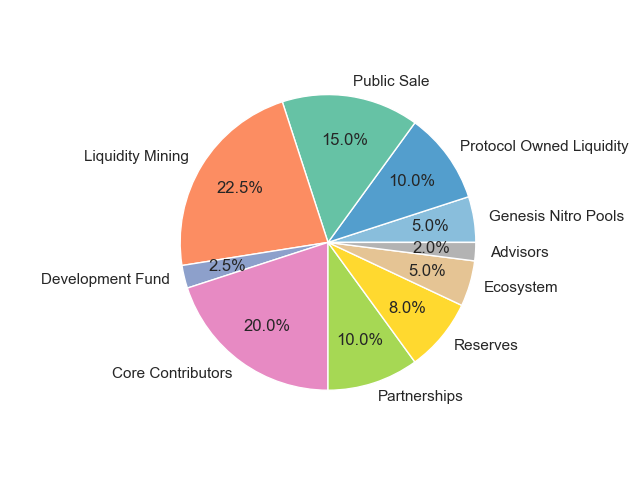

Token Allocation

- Liquidity Mining: 22.5%

- Public Sale: 15%

- Protocol Owned Liquidity: 10%

- Genesis Nitro Pool: 5%

- Advisor: 2%

- Ecosystem: 5%

- Reserves: 8%

- Partnerships: 10%

- Core Contributor: 20%

- Development Fund: 2.5%

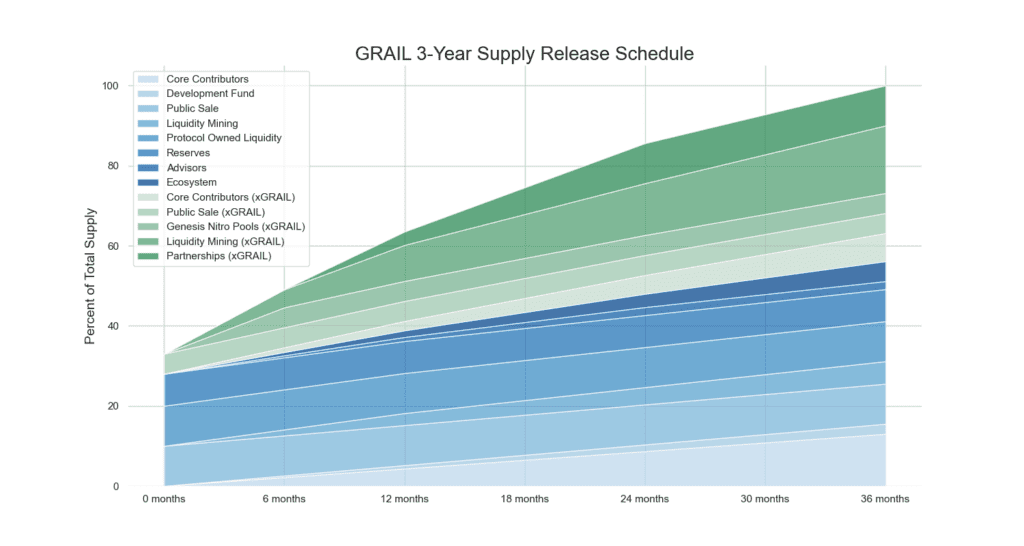

Token Release Schedule

GRAIL (blue) and xGRAIL (green) will be assigned on a three-year cycle, as illustrated below. GRAIL has 31% of the market’s initial floating tokens, while xGRAIL has 5%.

Use Case

xGRAIL is a token earned by participating in farming on Camelot. The user may convert from xGRAIL to GRAIL (during 15 days, 1 xGRAIL = 0.5 GAIL, and after 6 months, the conversion rate is 1:1). This is the point that contributes to GRAIL not being introduced into the market.

xGRAIL is used for platform voting.

Also, a portion of the transaction fee is burnt, acquire and burn GRAIL tokens.

xGRAIL, on the other hand, cannot be transmitted to other wallets or freely exchanged on the market. Meanwhile, GRAIL may be freely sold on the market and swapped at any moment for xGRAIL. This technique will assist Camelot in paying the appropriate incentives to those who really wish to support the project through xGRAIL, reducing the selling pressure on GRAIL.

What makes Camelot different from other DeFi platforms?

Another important feature is its next-generation yield and incentives system, which includes non-fungible positions staked in addition to the normal LP tokens.

These positions create income, improve capital efficiency, and provide flexible staking tactics that may be employed both within and outside of the protocol.

Nitro Pools provide projects total control over their incentives as well as the ability to establish customized liquidity solutions. Custom launchpads are also completely permissionless, allowing any companies to bootstrap their token launch and liquidity in a decentralized, community-driven manner.

Camelot’s tokenomics, which include a dual token system, represent the company’s long-term viability.

As farming rewards, the native GRAIL and its escrowed equivalent xGRAIL, a non-transferable governance token, are used. The bulk of emissions is received by xGRAIL, providing control over supply flow.

The protocol’s profits are used to give a real income to xGRAIL holders as well as to execute buybacks and burns, which assist in maintaining purchase pressure on the platform’s native token, GRAIL.

Investor and partners

Despite the fact that it has just recently migrated to Arbitrum, Camelot has collaborated with several well-known projects in the system, including GMX, GMD, Hop Protocol, Jones DAO, Abracadabra… and many more partners, to grow the ecosystem. When there are firm levers, the project may develop more confidently.

Conclusion of Camelot Review

Camelot provides customers with several advantages, including decentralization, cheaper transaction fees, better transparency, and higher security than typically centralized exchanges. As a result, the Camelot trading platform has been a popular solution for people wishing to swap tokens on Arbiturm in a secure and quick manner.

The most concerning aspect is that 35% of the entire token supply was unlocked during the TGE, which is a rather big percentage for regular projects, which is only around 5-10%. Also, the percentage of the development team is not fixed, which raises the issue of whether the team will remain committed to the project for a long period.

As for the platform’s products, they need to have better breakthroughs and offers to be able to attract users. Hopefully the Camelot Review article has helped you understand more about the project.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News