Celsius Keeps Redeeming About $64M Altcoins Including LINK, MATIC, AAVE

Key Points:

- Bankruptcy platform Celsius is continuing to convert its altcoins following the court ruling.

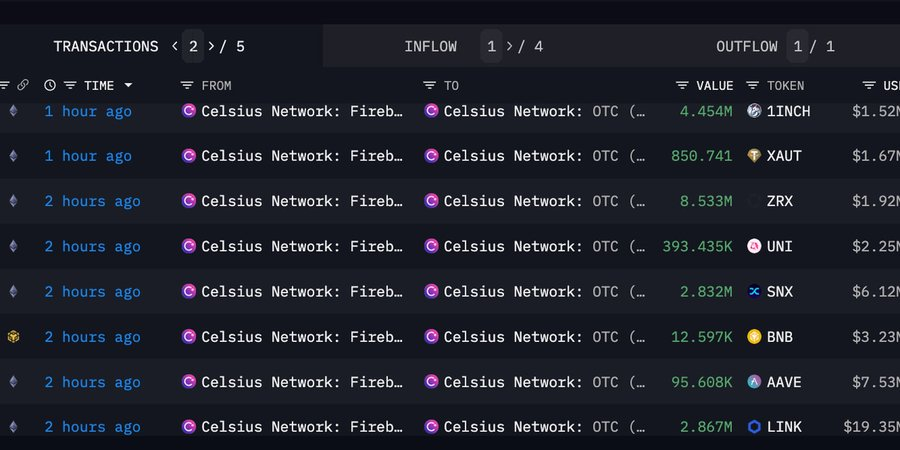

- Arkham Intelligence blockchain data shows that the company transferred at least $64 million in crypto.

- Prior to that, the bankrupt crypto lender was allowed to convert around $170 million in altcoins into BTC and ETH.

Celsius Network altcoins continue to move following the US bankruptcy court’s decision to allow a bankrupt crypto lender to exchange tokens for bitcoin and ether starting this month.

Arkham Intelligence blockchain data shows that the company moved at least $64 million in crypto to a wallet labeled “Celsius Network: OTC” from the company’s “Fireblocks Custody” wallet in multiple transactions on Wednesday afternoon.

The most significant transactions were $19.3 million in Chainlink’s LINK token, $14.7 million in Polygon’s MATIC, $7.5 million in AAVE, and $6.1 million in SNX. Other notable tokens transferred include Uniswap’s UNI, Binance’s BNB, and 1INCH.

Based on court documents, the court’s recent decision means Celsius has the potential to sell $170 million in smaller cryptocurrency. Switching a large number of tokens can put significant pressure on the market of smaller tokens, significantly as liquidity for these tokens has decreased over the past year.

However, with positive developments from the altcoin market after Ripple’s XRP token was declared by the court as not a security that is arguably more favorable for Celsius at this time.

The biggest problem right now is that the lending platform’s native token – CEL – is virtually illiquid yet makes up 65% of the total altcoin holdings the company holds.

It is known that since Celsius filed for bankruptcy, CEL has gradually lost interest in the community, and the token price also dropped below $1 after peaking at over $8 in 2021.

On July 13, 2022, crypto lending platform Celsius confirmed that it had commenced Chapter 11 bankruptcy proceedings in the Southern District Court of New York. The company said it plans to continue operating throughout the restructuring, although withdrawals will continue to be paused now.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.