Key Points:

- Bitcoin and Ethereum options expiring soon, market sentiment cautious among participants.

- BTC options market shows more call options than put options despite recent highs. ETH options market shows a higher ratio of call options to put options.

- Whales waiting for market change, cautious sentiment due to historical trading patterns and uncertain market conditions.

Bitcoin (BTC) and Ethereum (ETH) options approaches, market sentiment reveals a cautious tone among participants.

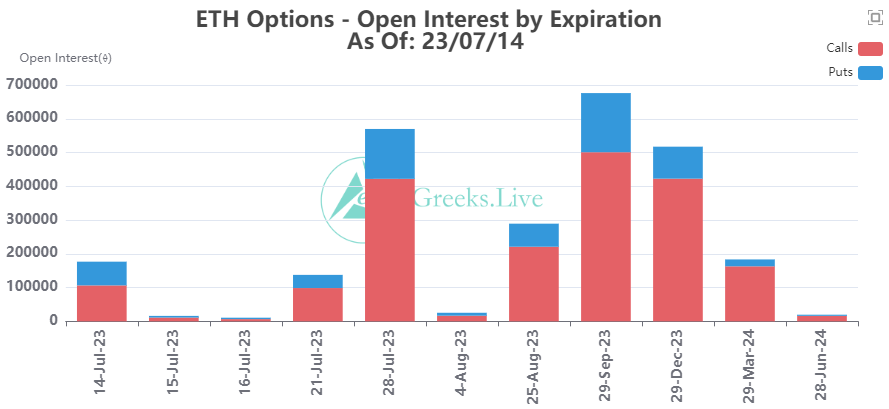

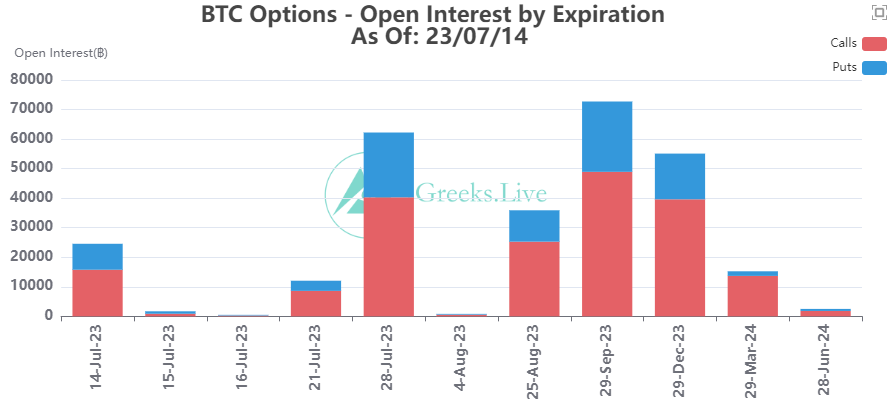

With 25,000 BTC options and 176,000 ETH options set to expire, the market dynamics and trading patterns are under scrutiny.

The BTC options market displays a Put Call Ratio of 0.56, indicating a higher proportion of call options compared to put options. However, despite BTC hitting a new high for the year, market sentiment suggests that many participants may not be profiting from the recent rally. This sentiment is further reinforced by the observation that options positions and volumes have remained below average this week, leading to a relatively fragmented options market.

Meanwhile, the ETH options market showcases a Put Call Ratio of 0.66, indicating a higher ratio of call options to put options. Similarly, participants seem to be exercising caution despite the significant rise in the ETH market. The notional value of the expiring ETH options stands at approximately $355 million.

Whales in the market appear to be waiting for a change in the market after establishing large positions earlier this month. This week’s trading activity primarily revolves around adjusting positions rather than initiating new ones. The current BTC call position is more than double the put position, while the ETH call position is more than triple the put position. These statistics suggest that once the market enters an uptrend, the existing options pattern will likely face disruption.

The cautious sentiment observed among market participants can be attributed to historical trading patterns and the desire to maximize profits during uncertain market conditions. As expiry dates near, traders closely monitor market dynamics and adjust their positions accordingly. This cautious approach reflects a broader sentiment of prudence amidst potential market shifts.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.