Key Points:

- Bitcoin network produces 800,000th block, a significant milestone for network security and resilience.

- Block height measures blockchain immutability and maintains mining difficulty for PoW-based networks.

- Block height also determines BTC rewards for miners and predicts market trends with halving events every 210,000 blocks.

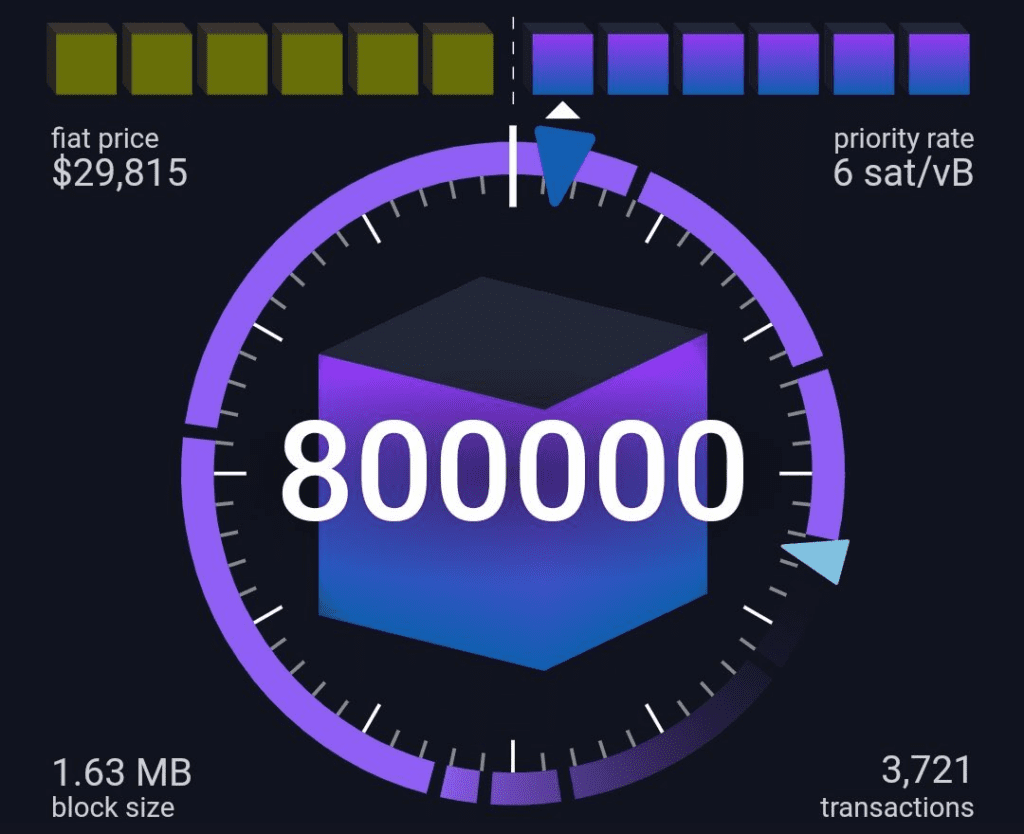

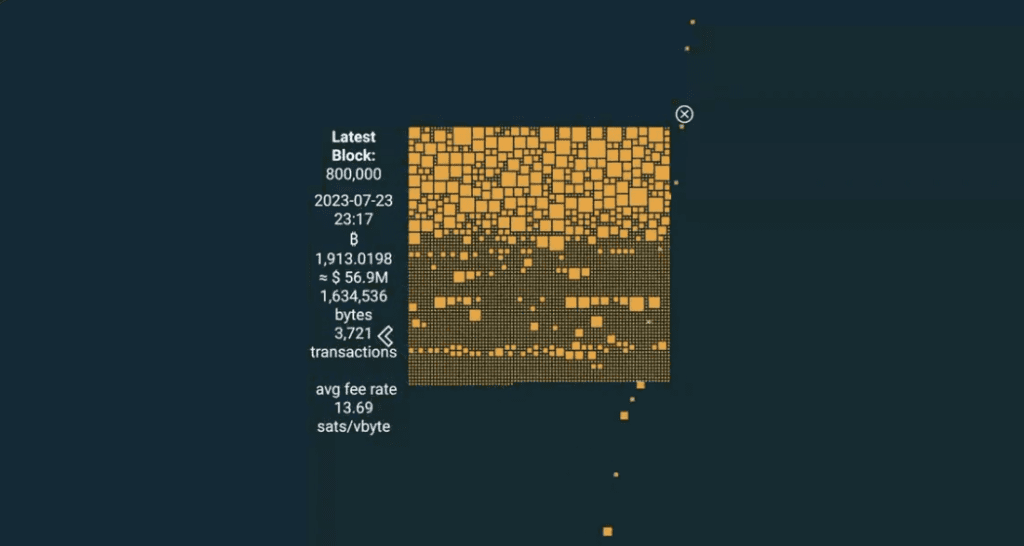

Since its inception in 2009, the Bitcoin network has reached a significant milestone, producing its 800,000th block.

This is a remarkable achievement and an indicator of the network’s security and resilience. The 800,000th block consisted of 3721 transactions at 1.64MB, with the price of BTC trading at $29,815 on July 24, as noted by market researcher Dylan LeClair on Twitter.

Block height is at the core of Bitcoin’s blockchain technology. Block height is a measure of the sequential blocks of the blockchain, which contain transactions and data that are bundled into blocks by network miners. This metric acts as a chronological order of transactions and blocks of the network, with each new block connected to the previous one in the chain, allowing users to identify the order in which transactions are recorded.

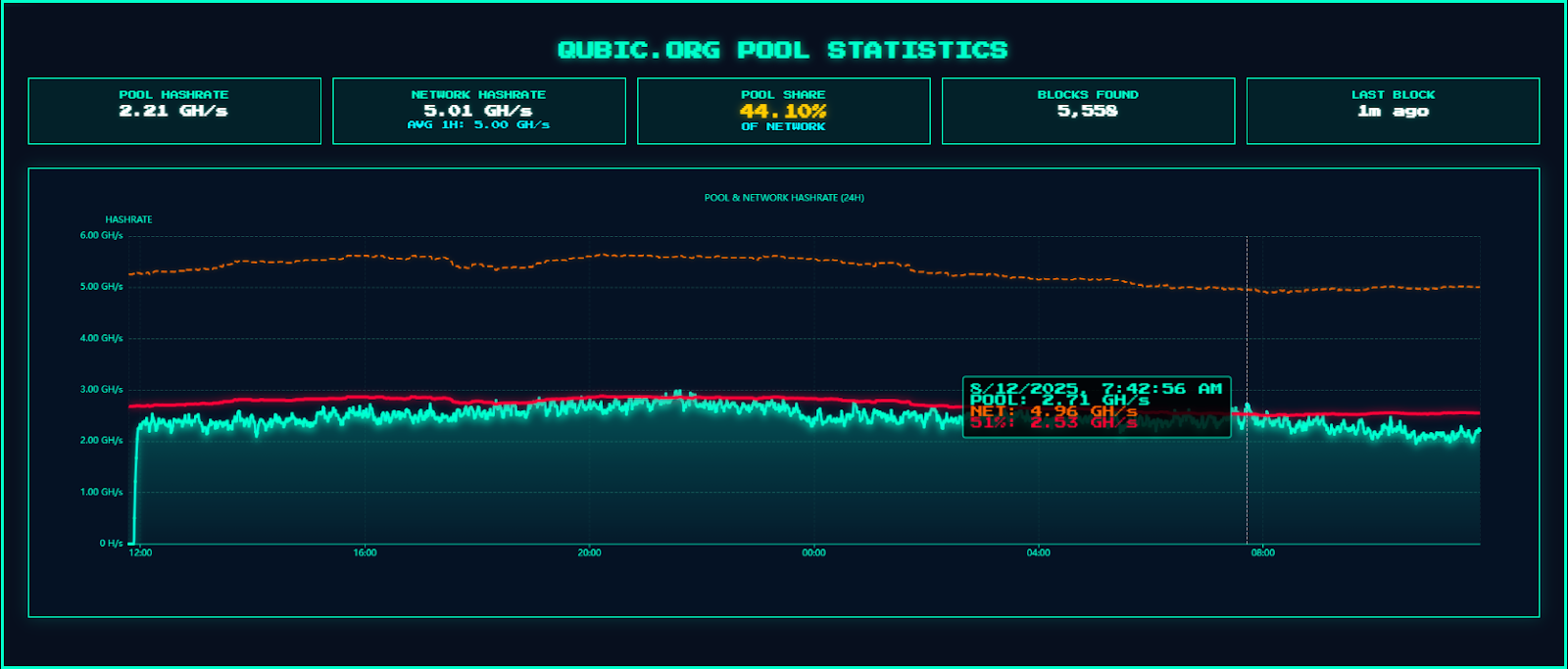

Block height is also a measure of Bitcoin’s immutability. The more blocks added to the chain, the more computing power is required for a malicious actor to attempt to tamper with previous blocks. For instance, a 50 percent attack would require an attacker to acquire enough computing power to recalculate the proof-of-work of every subsequent block of a tampered transaction-containing block.

Besides, block height is also used to maintain Bitcoin’s mining difficulty. Proof-of-work-based blockchain networks have their mining difficulty adjusted periodically based on the total computational power of the network and the time it took to mine a certain number of previous blocks. Bitcoin’s network aims to have a new block generated every 10 minutes. If more hashing power is added to the network at a given time, this would influence this metric, and the network automatically adjusts the mining difficulty every two weeks to maintain equilibrium.

Bitcoin’s block height also determines the amount of Bitcoin rewarded to miners for adding a new block to the network. Bitcoin’s protocol is designed to have block halving events every four years, or 210,000 blocks on the chain. The initial block reward was 50 BTC back in 2009, before it subsequently halved to 25 BTC, 12.5 BTC, and currently 6.25 BTC in 2012, 2016, and 2020.

With Bitcoin’s next halving earmarked to take place in April 2024, and the latest block reward halving to 3.125 BTC, the cryptocurrency market is keenly watching the market trend. Historically, halving events coincide with major price rallies for BTC and the wider cryptocurrency markets.

Other macro events have also arrested Bitcoin’s price decline following its last major peak at $69,000. Analysts and commentators have speculated that the latest ETF filings from the likes of global asset managers BlackRock and Fidelity indicate renewed institutional interest in Bitcoin. This renewed interest in Bitcoin has caused a stir in the cryptocurrency market, and it remains to be seen how prices will be affected in the future.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.