Worldcoin Circulating Supply Revealed 111 Million Tokens Available: Report

Key Points:

- Worldcoin’s launch involved market makers who were loaned 100 million tokens, creating an interesting game theory dynamic around the token’s price.

- Binance experienced a significant increase in trading volume after listing Worldcoin, doing $65 million in volume in the first hour.

- The circulating supply of Worldcoin is 111 million, with 100 million sent to market makers and 11 million claimed by users during the pre-launch phase.

Worldcoin’s launch was impressive with a circulating supply of 111 million. Binance saw a sharp increase in trading volume after listing.

Recently, the circulating supply of Worldcoin was revealed to be 111 million, with 100 million of those tokens being loaned to market makers. The other 11 million tokens were claimed by users who participated in the pre-launch phase. As more users claim their tokens, the circulating supply will increase, with 1.6 billion WLD tokens set to unlock by next year.

What makes Worldcoin unique is the involvement of market makers in the token’s launch. Five market makers were loaned 100 million WLD tokens for a period of three months, after which they can return the tokens or purchase them for $2.00 plus ($0.04 * X), where X is the number of tokens purchased divided by 1 million. This arrangement creates an interesting game theory dynamic, which anchors the token’s price around $2 and incentivizes users to participate in the pre-launch phase.

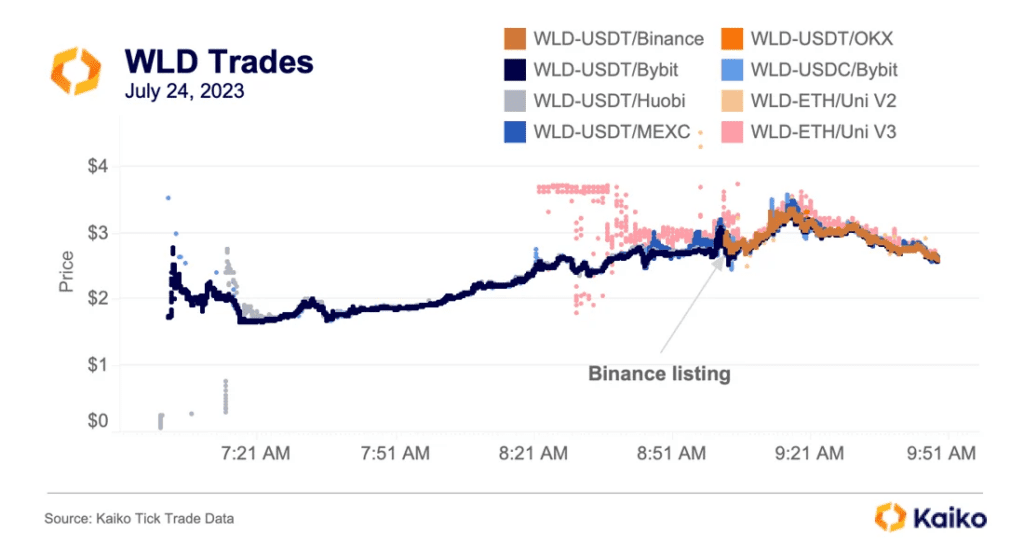

The launch of Worldcoin was one of the most orderly launches in recent memory. Bybit and Huobi were the first exchanges to list the token, with Huobi experiencing some false starts before trading began in earnest. Uniswap joined the fray next, with its price eventually converging with other centralized exchanges over a 45-minute period. Binance’s listing caused a spike in volatility before prices quickly converged and began to trade in lockstep. Despite some price divergences, this was a clean launch in terms of price discovery.

In the first two hours, the combined volume for other exchanges was $16 million. In Binance’s first hour of listing, it did $65 million in volume, followed by Bybit at $14 million. Huobi’s hourly volume was also steady compared to other exchanges.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.