RWA: Detailed Working Mechanism With Positive Potential For DeFi

Key Points:

- RWA is the tokenization of real-world assets, such as real estate, gold, and cars, on the blockchain for use in DeFi platforms.

- The integration of RWA with DeFi has the potential to disrupt traditional finance by eliminating intermediaries and enhancing transparency in financial transactions.

- RWA’s entrance into the crypto market presents new opportunities for investment and improves the overall efficiency of traditional finance. Despite challenges, RWA is set to revolutionize the way assets are handled and create a more accessible financial ecosystem.

In the near future, you will constantly come across the word RWA while reading stories concerning cryptocurrency trends/narratives. The asset transfer between CeFi and DeFi might be one of the most significant long-term jumps in the cryptocurrency sector. Real World Assets (RWA) are external actual assets that have been tokenized and placed on the blockchain. This will open up enormous opportunities for the whole crypto business in the future. Let’s look into RWA’s operating mechanism today with Coincu.

What is RWA?

In recent times, the DeFi (Decentralized Finance) sector has experienced a downturn, with token inflation and market downtrends diminishing the appeal of many projects for investors seeking high returns. The profits from yield farming and liquidity provision are now comparable to traditional finance (TradeFi), resulting in a decline in interest. Furthermore, the practice of rewarding participants with tokens has led to a sharp decline in the native token prices of several DeFi projects.

However, amidst this shift, the application of blockchain and DeFi technologies is proving to be transformative not only for the DeFi market but also for traditional finance and various traditional asset classes. One significant development is the rise of Real World Assets (RWA) – tangible assets like real estate, cars, gold, diamonds, and more – being tokenized as tokens or Non-Fungible Tokens (NFTs) for use in DeFi platforms.

The integration of blockchain and DeFi applications has the potential to disrupt traditional finance by eliminating intermediaries and streamlining financial activities. In conventional financial systems, intermediaries have always played a crucial role, leading to cumbersome procedures and additional costs for users. However, with the implementation of blockchain technology and DeFi applications, these intermediaries can be bypassed, offering users a more efficient and cost-effective means of participating in financial activities.

Transparency is another crucial aspect addressed by RWA in DeFi. Blockchain technology ensures an immutable and transparent ledger, allowing for increased trust and visibility in financial transactions involving traditional assets such as bonds, stocks, real estate, and precious metals like gold and silver. Tokenization of these assets for use in DeFi platforms further enhances their liquidity, which is typically limited in traditional markets.

The emergence of RWA in DeFi not only opens new avenues for investment but also offers a way to improve the overall efficiency of traditional finance. By tokenizing real-life assets, DeFi platforms can unlock liquidity and foster a more accessible and inclusive financial ecosystem.

While DeFi may have experienced a downturn in its meteoric rise, the integration of Real World Assets and the application of blockchain technology are poised to revolutionize both the DeFi and traditional finance landscapes. As the technology continues to mature, it will be exciting to witness the impact of RWA on financial markets and how it transforms the way we interact with assets, bringing greater efficiency, transparency, and accessibility to the world of finance.

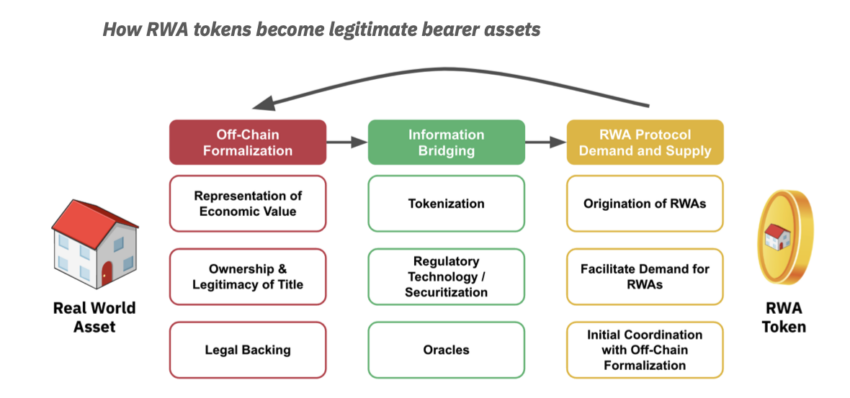

Simulation of the working mechanism of RWA

Coincu will create a simple model right below to help you see how to introduce actual assets into crypto and DeFi markets:

Step 1: Off-chain Formalization

The first crucial stage involves thoroughly verifying and validating actual assets before they are brought on the chain. To achieve this, Coincu emphasizes three main factors:

Ownership & Legitimacy of Title

Prior to on-chain representation, real-world assets must possess verifiable ownership documentation such as deeds, invoices, and sales contracts. This step ensures the legitimacy of property ownership.

Representation of Economic Value

We address the valuation of assets, especially for volatile classes like gold, real estate, and scarce collectibles. To maintain accuracy, the platform identifies reliable data sources to update asset valuations accordingly.

Legal Backing

Ensuring compliance with regulations is paramount in the tokenization process. Coincu ensures a robust legal framework to govern the determination of ownership, asset valuation, and dispute resolution in case of any issues related to on-chain assets.

Step 2: Information Bridging

The second stage focuses on transferring real-world asset information, formalized in Step 1, onto the blockchain for secure storage and usage. This involves the following key steps:

- Tokenization: The data collected in Step 1 is converted into tokens, typically in the form of non-fungible tokens (NFTs) or other token formats.

- Regulatory Technology/Securitization: For assets that require additional management and supervision, we employ regulatory technology or securitization methods to ensure proper oversight.

- Oracles: Similar to DeFi protocols, oracles play a critical role in transmitting real-time data on the fluctuations in the value of actual assets.

Step 3: Bring Tokenization into RWA Protocols

In this final step, we integrate tokenized real-world assets into DeFi protocols, making them accessible and usable for crypto users. An exemplary project, RealIT, showcases how this process works:

RealIT, a pioneering real estate project, facilitates the tokenization of real estate assets. The project allows investors to buy and hold tokens representing a portion of the real estate, with rental income distributed among token holders.

Real estate properties undergo thorough appraisal by third-party experts, and clear ownership documentation is established to handle situations like tenant nonpayment or legal disputes.

After formalization, RealIT encrypts the real estate information into tokens, and the management of the assets is entrusted to a specialized company, which further tokenizes the shares of the real estate.

Conclusion

The narrative around RWA is heating up, and it may be the main instrument for broad crypto and blockchain adoption. Everyone is aware that traditional finance is hampered by obsolete and fragmented technology, resulting in an inefficient fiat banking and securities system. As a result, RWA tokens were created to compensate for these flaws.

Real World Asset will continue to be a massive and long-term story that you should keep an eye on over the next years. Presently, the entrance of RWA into the crypto market is fraught with difficulties. Stories of massive bank failures, inappropriate capital management, and the loss of depositors’ funds have recently been highly hot subjects. Silvergate Bank and Silicon Valley Bank have recently had major issues.

Moreover, huge investment funds and organizations have historically accessed resources and circulated cash flow to regions with significant earnings. The combination of TradFi and DeFi through RWA may hold the answer to resolving the aforementioned issues.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.