Ambient Review: Emerging DEX On Ethereum Brings Exciting User Experience

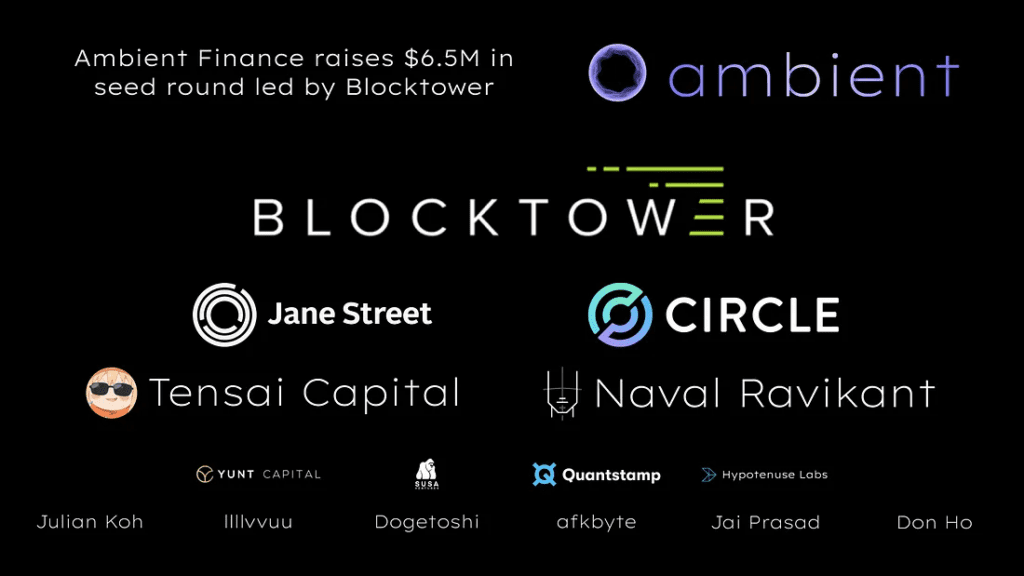

Recently, an AMM/DEX project on Ethereum called Ambient Finance has received an investment of $6.5 million in the seed round from funds such as Blocktower Capital, Jane Street, Circle,… The project attracts the community swimming it promises to allow users to experience optimal trading with low costs and high liquidity. In this Ambient Review, let’s find out through the article below.

What is Ambient?

Ambient (formerly CrocSwap) is a decentralized exchange (DEX) protocol that allows for two-sided AMMs combining concentrated and ambient constant-product liquidity on any arbitrary pair of blockchain assets.

Ambient runs the entire DEX inside a single, smart contract, where individual AMM pools are lightweight data structures instead of separate smart contracts. This and other design decisions make Ambient the most efficient Ethereum-based DEX in existence.

Besides the usual token swap, Ambient review also provides a feature that allows placing limit orders, providing liquidity to bring profits to users.

On July 12, the trading platform completed a $6.5 million seed funding round led by BlockTower Capital, with participation from Jane Street, Circle, Tensai Capital, Naval, Yunt Capital, Susa Ventures, Quantstamp and Hypotenuse Labs, as well as Ribbon Finance co-founder angel investor Julian, The Block researcher Steven, and more. The money raised will support the development of the team and R&D to create a sustainable decentralized market.

Ambient Review: Highlights

To start with Ambient review, this is developed as an entirely new codebase with best engineering practices and innovative smart contract architecture choices in mind. This gives it a number of core advantages over competing DEXs:

- Substantial gas savings compared to other leading DEXs

- Combines concentrated (i.e. “UniV3 style”), ambient (i.e. “UniV2 style”), and knockout liquidity (behaves like limit orders which atomically fill and lock in a position in a single direction) within the same pool all on a single liquidity curve.

- Dynamically adjusted pool fees, maximizing LP returns relative to market conditions and demand for liquidity.

- Fees accumulated by concentrated LP positions auto re-invest back into the pool as ambient liquidity. Users earn compounded even without manually harvesting positions.

- JIT (just-in-time) liquidity attacks are prevented through the use of minimum TTL parameters on concentrated liquidity positions. Ordinary LP positions therefore earn higher fees.

- Ability for users to pre-fund tokens at the DEX in the form of “surplus collateral”. Much higher efficiency for active traders by deferring token transfers to net settlement.

- “Gasless” transactions, where the user pays in the swapped token instead gas, through EIP-712 off-chain standard.

- Unique support for “permissioned pool” primitive where the ability to govern and restrict a pool can be offloaded to general purpose smart contract oracles running inside or outside the protocol.

Ambient Review: Mechanism of action

Automated Market Maker (AMM)

In Ambient review, liquidity is provided by a liquidity pool instead of individual orders. This means that there is a market between two tokens represented by each pool, and a single exchange rate is determined by a virtual reserve ratio. This allows for a stable and consistent exchange rate. The Constant Product Market Maker (CPMM) algorithm ensures that the product of the virtual reserves remains constant. This algorithm is used to adjust prices based on the size and direction of trades, thus balancing supply and demand and resulting in a price impact.

Accordingly, CPMM ensures that the value of assets in the pool will not change regardless of their quantity by adjusting the price of tokens based on token supply and demand, and liquidity in the pool:

- When a user buys more tokens, the price of that token will increase as the number of tokens remaining in the pool decreases.

- Conversely, when users sell a lot, the price of that token will decrease.

The CPMM model allows users to swap tokens anytime, as long as there is enough liquidity.

In addition, exchangers are required to pay a fee for liquidity based on the amount they trade. This fee is then redistributed among Liquidity Providers (LPs) based on their contribution to the pool. The fee rates may vary, but usually fall within the range of 0-1%.

Concentrated Liquidity

Concentrated liquidity helps users provide liquidity within a predefined price range on an individual AMM curve, with the advantage of capital efficiency. The liquidity provider only needs to commit the necessary collateral to support liquidity to a limited extent.

However, if the price curve goes beyond the order range, the LP will no longer accumulate charges. To get around this, Centralized Liquidity Providers can wisely define their price ranges or periodically “rebalance” orders by moving them back into the range.

Ambient review also supports native liquidity with the advantage that the fees earned by Ambient Liquidity Providers will automatically pool back to their original positions without any manual management, costing The significantly lower gas fees required for the surrounding Liquidity Provider minting and burning positions, and the placement of all the surrounding Liquidity Providers on a given curve are interchangeable natively and can easily be bundled as “LP tokens”.

Knockout Liquidity

Knockout liquidity behaves identical to range-based concentrated liquidity, except the liquidity is atomically and permanently removed from the AMM curve at any point the curve price moves past the edge of the range. Knockout liquidity can either be set to remove when curve price falls below the bottom of the range (bids) or when curve price rises above the top of the range (asks).

Eliminate liquid orders that offer better prices:

- Waiting for cheaper price

- Receive instead of swap payment

- Avoid slippage on the AMM line

Ambient Review: Services

Swap

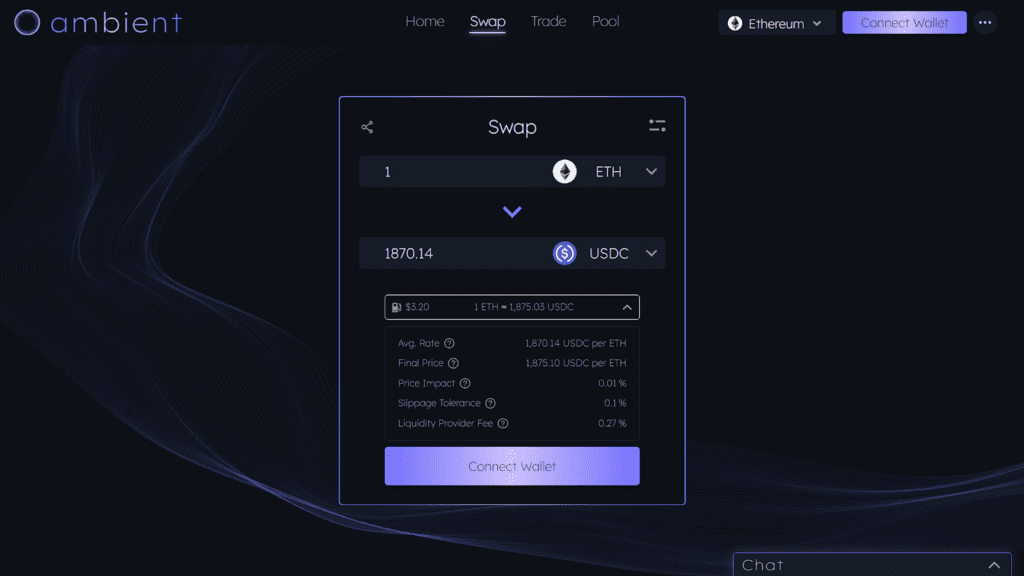

The core functionality of Ambient review is to allow users to exchange one type of token for another at fair market prices. If liquidity exists for a given pair in the DEX contract, then users will be able to swap between tokens. The frontend web app provides an interface for general-purpose swaps.

If adequate liquidity exists in a given for the pair, a swap will most likely be executed as a single hop. Single hops incur lower liquidity and gas fees, so they are preferred. A multihop swap is when swaps across multiple pools are chained, usually in the case when there’s little to no liquidity in any pair between the input and output token. The on-chain contracts take a pre-determined path. They were finding a cost efficient price multihop path, or routing.

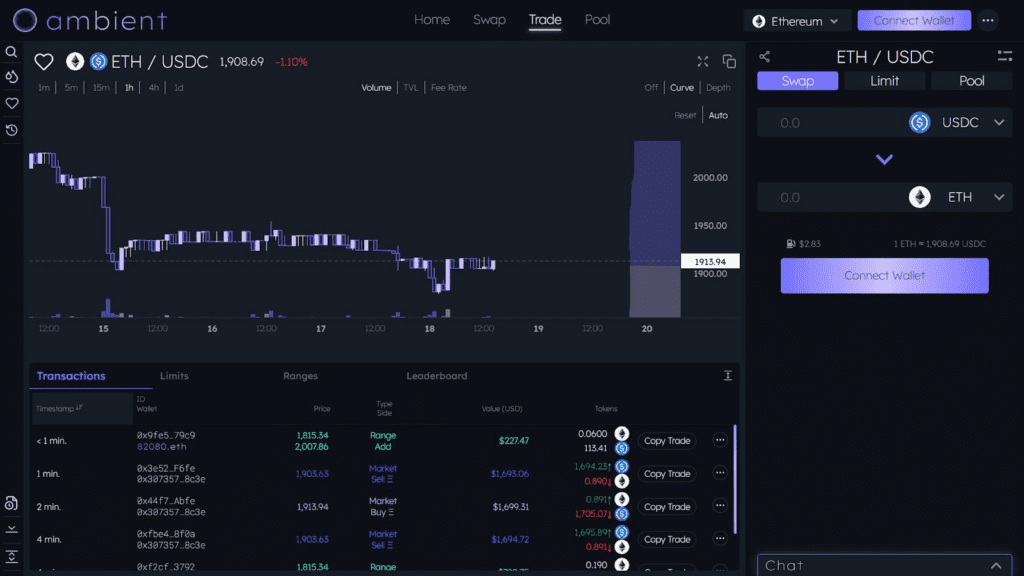

Trade

The Trade feature in Ambient allows users to make trades by placing limit orders. Unlike other DEXs that support limit orders, Ambient Finance will execute users’ orders gradually when the price is within a certain price range. This price range is typically 0.64% for highly volatile token pairs and 0.01% for stable token pairs. Ambient will also display information about the starting and ending price of order execution on the platform’s interface.

Pool

Ambient Finance’s Pool feature allows users to participate in the liquidity provision and receive a transaction fee reward from the protocol. There are two modes of liquidity provision including centralized liquidity provision and direct liquidity provision.

In centralized liquidity provisioning mode, users can provide liquidity within a predefined price range. This increases the efficiency of the liquidity provider’s investment and creates a deeper order gap in the token’s price range.

Meanwhile, in direct liquidity mode, users provide liquidity across the entire price range of the token, creating liquidity across the entire price range. However, the reward received will be lower than the centralized liquidity mode.

Ambient Review: Governance & Policy

Ambient protocol uses a three-layer division of responsibility:

- Governance fills the traditional role of a DAO. It includes full power over the protocol, and is controlled by M-of-N multisigs and timelock resolutions.

- Policy is an intermediate layer that sits between the DAO governance and the DEX contract itself. It can ether directly relay resolutions from the governance layer, or delegate limited administrative control of the DEX to external smart contract policy oracles explicitly installed by DAO governance.

- Mechanism is the underlying DEX contract itself. CrocSwapDex (the core smart contract holding dex liquidity and positions) is built with tunable parameters that can be dynamically adjusted by external policy oracles. That allows the protocol to improve and experiment with new functionality in a way that’s safer and more contained than directly upgrading the underlying DEX smart contract.

Conclusion

The liquidity provision model in Ambient review combines the characteristics of a decentralized exchange and a centralized exchange. And unlike other AMMs, liquidity is not fragmented for trading pairs. Ambient can also run the entire DEX system in a single smart contract, thus achieving lower transaction fees, greater liquidity rewards, and a fairer trading experience. As a trading protocol that combines the features of CEX and DEX, Ambient introduces new DeFi native functions to give users a first-class experience.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.