Bitcoin Has The Potential To Bounce Back To The $32,000 Price Zone

Key Points:

- Bitcoin holds at $29,000, causing uncertainty due to low volatility.

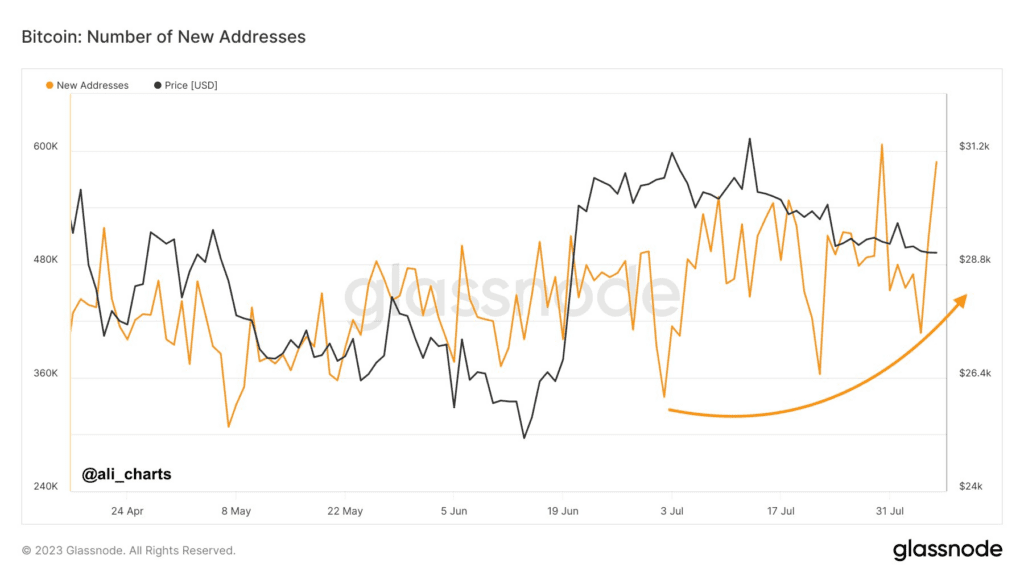

- New BTC addresses increase despite price corrections, indicating a strong long-term trend.

- Bitcoin’s dominance rises, but resistance at $29,500 and a bearish trend line at $29,100 present challenges.

Amidst a period of notable consolidation, Bitcoin (BTC) has been trading around the $29,000 mark, leaving investors uncertain due to subdued price volatility.

Yet, a promising trend emerges from Bitcoin’s on-chain data, suggesting a positive shift in network activity. Despite a recent correction from $32,000 to $29,000, the continuous increase in the total number of new BTC addresses stands as a promising indicator. Analysts interpret this as a bullish divergence between price and network growth, hinting at a stable, long-term upward trend for BTC.

Further bolstering optimism, various on-chain indicators point towards bullish momentum for Bitcoin. Its dominance in the market is gradually recapturing its 50% threshold, potentially marking the inception of an upcoming bull cycle.

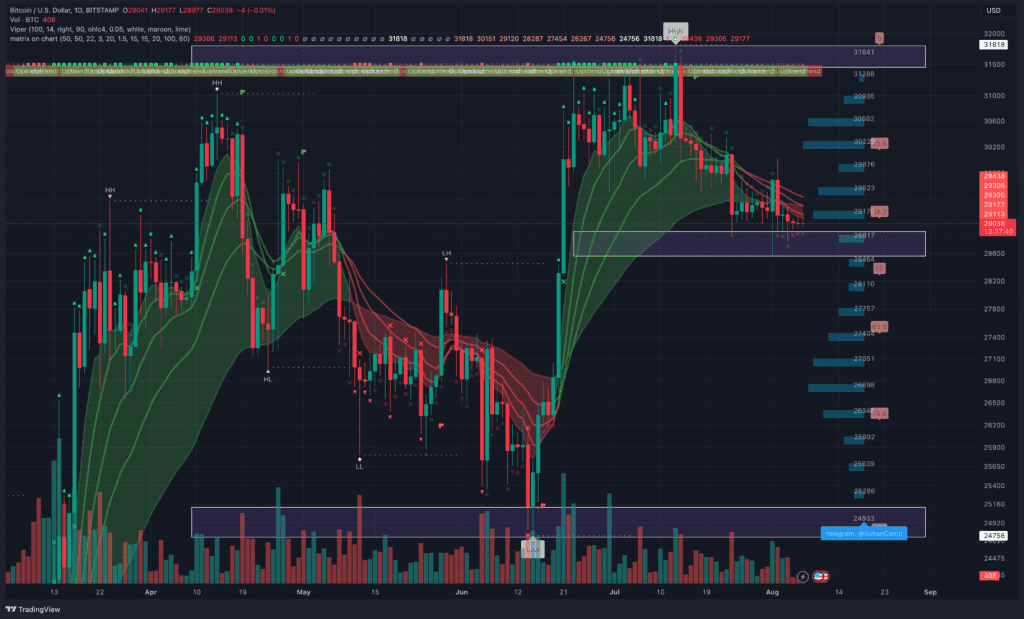

The journey hasn’t been without hurdles, though. Bitcoin struggled to breach the $29,500 resistance zone and experienced a fresh dip within its range, trading below the $29,250 level.

However, a ray of hope shone as the bulls rallied to protect the range’s support at $28,800. The price, having touched a low of $28,800, has recently embarked on a short-term corrective upswing.

Progress was evident as the price moved past the 38.2% Fibonacci retracement level from its downward trajectory between the $31,785 swing high and the $28,800 low. Nevertheless, the bears put up resistance around the $29,200 zone. Adding to the challenge is a notable bearish trend line forming, with a barrier close to $29,100 on the BTC/USD hourly chart.

Pointing towards potential breakthroughs, the first significant hurdle is the $29,380 level, followed by the $29,500 mark. Overcoming these could propel the price toward the $29,700 resistance zone. A close above this zone might initiate a noteworthy surge, possibly even pushing past the $30,000 barrier.

As the cryptocurrency landscape remains dynamic, investors watch closely, assessing the interplay between Bitcoin’s price movements and its underlying network dynamics.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.