Key Points:

- Bitcoin whale Michael Saylor says MicroStrategy is planning to accumulate more Bitcoin from the sale of $750 million in stock.

- In its Q2/2023 financial report, MicroStrategy revealed it purchased an additional 467 Bitcoin (BTC) in July at a cost of $14.4 million.

- The company owns 152,800 bitcoins as of July 31, currently worth around $4.5 billion.

According to a document filed with the U.S. Securities and Exchange Commission (SEC) on Tuesday, MicroStrategy plans to raise $750 million by selling more shares and using the proceeds to buy Bitcoin and working capital.

In the document, MicroStrategy announced that it had reached an agreement to offer $750 million in shares to interested investors, with the intention of continuing to use the money to buy more Bitcoin.

In addition, MicroStrategy’s latest Financial Report published on Tuesday revealed it purchased an additional 467 Bitcoin (BTC) in July at a cost of $14.4 million. As such, the company has raised the value of Bitcoin in its treasury to 152,800 BTC, with an average purchase price of $29,672/BTC or $4.53 billion. The report also said the company accrued $24.1 million in bitcoin loss fees in the second quarter of this year, up from $18.9 million in the first quarter.

Previously, in June, MicroStrategy announced buying 12,333 BTC with $ 347 million in cash because it believes in the potential of the world’s largest cryptocurrency following news that asset management group BlackRock has applied for a fund. ETF Bitcoin spot to the SEC.

As of August 2020, regardless of the high or low Bitcoin price, the software company has maintained a long stance. MicroStrategy said the investment is part of a new capital allocation strategy that seeks to maximize long-term value for the company’s shareholders.

According to Michael Saylor, co-founder of MicroStrategy, the investment reflects the belief that Bitcoin, the most widely used cryptocurrency in the world, is a trusted store of value and an attractive investment asset with longer-term upside potential than holding cash.

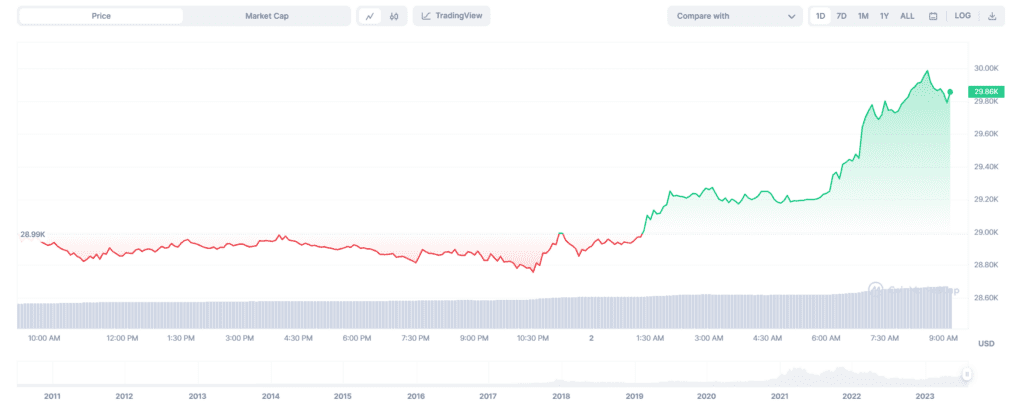

With this momentum, Bitcoin price over the past 24 hours has turned positive with a 3% increase and is currently trading at $29.86.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.