Key Points:

- Coinbase will offer regulated derivatives products to eligible US customers for safe and regulated access to the crypto derivatives market.

- Customers can trade using margin for leverage and access to the market with less upfront investment.

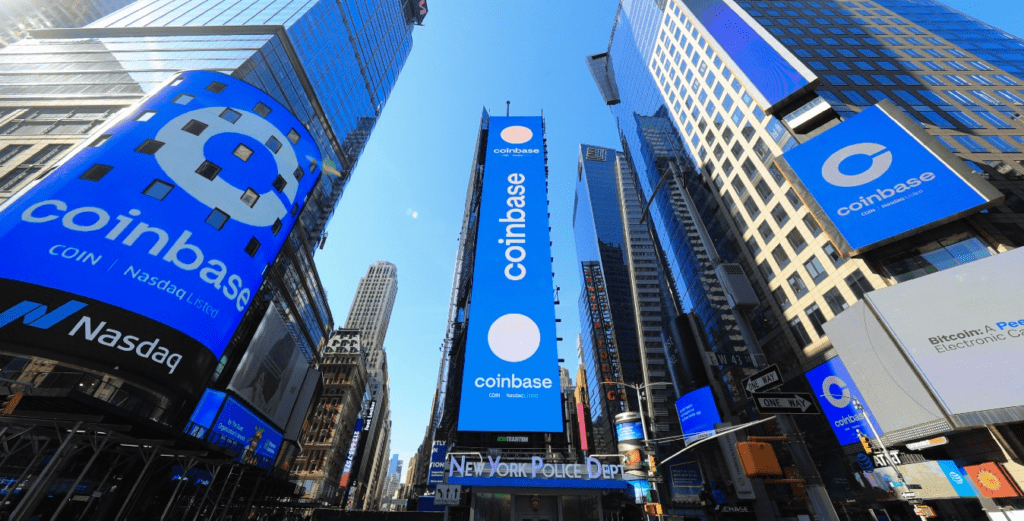

Coinbase will offer regulated derivatives products, allowing eligible US customers access to the crypto derivatives market in a safe and regulated manner. Customers can trade using margin, giving leverage and access to the market with less upfront investment.

Coinbase has announced that its customers will soon be able to access regulated derivatives products through Coinbase Financial Markets. This will allow eligible US customers to access the crypto derivatives market in a safe and regulated manner.

The ability to trade using margin gives customers leverage and access to the crypto market with less upfront investment than traditional spot trading, making it an attractive option for retail investors.

Coinbase acquired FairX 2022, a CFTC-regulated futures exchange, and renamed it the Coinbase Derivatives Exchange. Since then, the exchange has successfully launched nano Bitcoin and Ethereum futures contracts for retail investors and larger versions for the institutional market.

The Coinbase Derivatives Exchange has established a deep liquidity pool, with $4.7bn BTC and $2.0bn ETH futures traded in notional volume in 2023. This move comes after Coinbase filed an application with the NFA to register an FCM in September 2021. The company has worked with regulators to ensure compliance with all necessary regulations and customer protection requirements.

This is an important milestone, as the global crypto derivatives market represents approximately 75% of crypto trading volume worldwide. The company will continue to work with regulators to receive the authorizations needed to offer products that align with its purpose and to offer additional information on how verified US customers can access the futures offering.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.