The NFT sector has long been seen as a promising market with plenty of room for initiatives to enter and dominate. OpenSea was originally regarded as the market’s No. 1 NFT Marketplace platform, however, the recent advent of LookRare, X2Y2, or Blur has resulted in a severe NFT marketplace battle.

Today, let’s learn about one of the hottest topics in the NFT market with Coincu.

What is an NFT marketplace?

The NFT marketplace is a public blockchain platform that also serves as a marketplace. Despite its infancy, this platform is gaining popularity and inspiring developers and companies to build a marketplace.

Internet markets for digital assets have recently been the buzz of the finance world. Nevertheless, if you want to enter the digital market, you must first create your own marketplace. The terms bitcoin trading and blockchain technology are no longer obscure, and many individuals exchange items across many platforms.

Cause of the NFT marketplace war

The NFT market’s immense potential and the substantial revenue streams it offers have captivated the attention of both investors and creators alike. As the NFT phenomenon continues to gain momentum, a new wave of marketplace platforms has emerged, eager to leave their mark on the rapidly evolving landscape.

In the ever-evolving NFT ecosystem, the once unchallenged dominance of OpenSea is facing competition from a cohort of innovative platforms. Throughout 2022 and extending into 2023, these up-and-coming contenders have begun to reshape the dynamics of the market, altering the traditional balance of power.

The initial half of 2022 witnessed the entrance of LookRare and X2Y2 into the arena, launching a fierce challenge to OpenSea’s supremacy. Both platforms adopted a strategic approach to attract users, employing “vampire attacks” by means of airdrops of LOOKS and X2Y2 tokens.

These tactics certainly garnered attention, leading to a substantial surge in transaction volume. However, some experts argue that this initial surge may have been spurred by speculative interests rather than genuine user demand.

A pivotal moment unfolded as OpenSea, seeking to fortify its position, acquired Gem, a prominent NFT marketplace aggregator platform, which has now been rebranded as OpenSea Pro.

This strategic move aimed to provide traders with a comprehensive aggregator platform, presenting them with an array of top-tier options. The conclusion of 2022 was marked by the emergence of Blur, a relative newcomer to the scene, yet it has ignited a new chapter in the ongoing NFT marketplace rivalry.

Amidst the intensifying battle for supremacy, one significant casualty has been the royalties paid to NFT creators. As various platforms vie for dominance, the competitive landscape has led to a situation where royalties often dissipate. In response, creators are seeking solace in platforms that remain committed to upholding the payout of royalties, thereby securing the rewards they rightfully deserve.

The contentious arena of NFT marketplaces is further fueled by the rise of Blur, a platform that has swiftly ascended to the forefront, commanding trading volumes that were once synonymous with OpenSea’s reign. This unexpected shift in market dynamics indicates the rapid evolution and fluidity characteristic of the NFT space.

Current situation

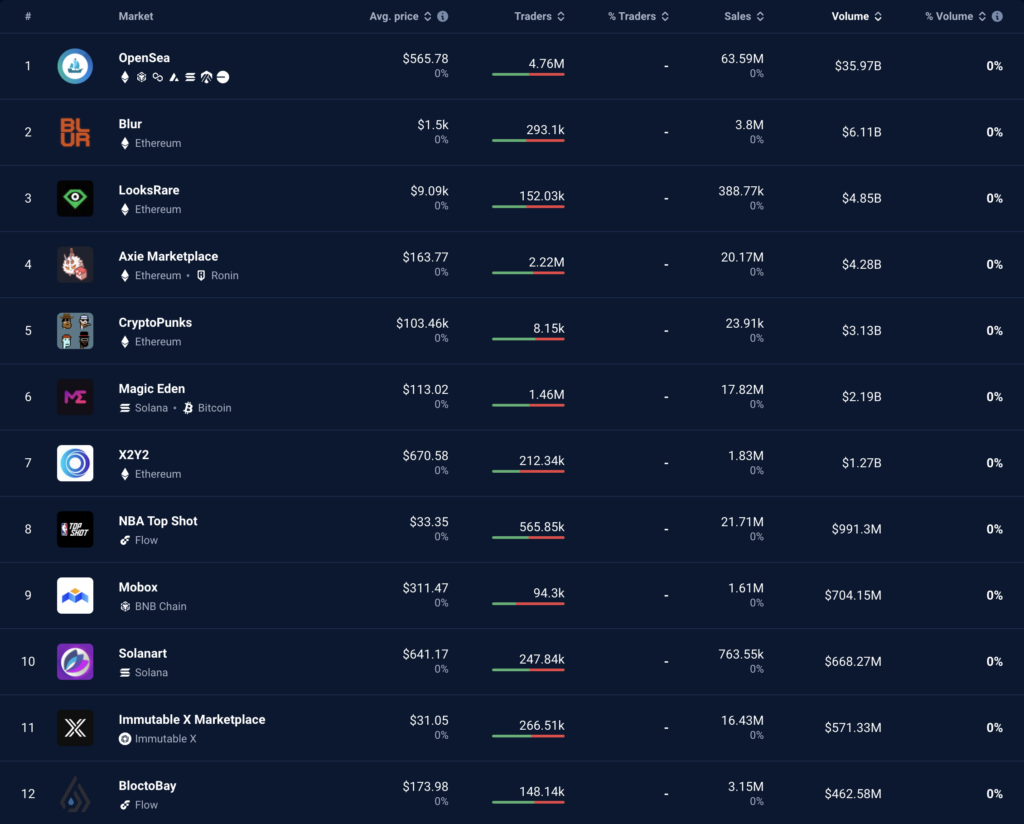

Although the NFT market remains a fraction of the crypto landscape, surprising revelations have come to light. The past year has shown OpenSea’s continued dominance within a 365-day timeframe. Still, Blur has shaken up the scene by securing the second spot, surpassing competitors such as LookRare, Axie Marketplace, and CryptoPunks.

In terms of recent proportions, Blur’s ascent has been truly remarkable, securing the top position. Even though OpenSea holds the distinction of being an established platform, its performance pales in comparison to the vibrancy of this emerging contender.

OpenSea and Blur have been competing fiercely for several months to claim the top spot in the NFT marketplace hierarchy. Recently, OpenSea executed a significant move that has garnered attention across the industry.

OpenSea has boldly decided to abolish royalties on its platform, likely in response to the increasing prevalence of royalty evasion on Blur. The surge of Blur to the peak of the rankings is possibly linked to reduced royalty payments on other platforms, leading some creators to block specific marketplaces from handling their collections altogether.

OpenSea’s challenges have been exacerbated by implementing a blocking feature on certain NFTs. This has generated dissatisfaction among creators, stemming from OpenSea’s decision to cease enforcing creator royalties.

In a blog post dated February 15, Blur’s team encouraged users to block OpenSea’s NFT marketplace. The rationale behind this was the existing conflict where creators cannot earn full royalties on both Blur and OpenSea. Instead, creators must choose between the two platforms to receive full royalties.

The root of this issue lies in OpenSea’s automatic adjustment of royalties to optional when detecting trading on Blur. OpenSea defends this policy, asserting that it aims to safeguard creators and maintain its own financial stability.

Despite challenges, OpenSea has not reversed its stance on the creator royalty matter, setting the stage for an ongoing battle for NFT creators and traders. Emerging platforms like Blur are poised to challenge for the top positions in this evolving landscape.

To enforce full creator fees on OpenSea’s platform, individuals who created smart contracts after January 2, 2023, must undertake on-chain actions to make royalties binding. Essentially, OpenSea requires creators to utilize on-chain tools that prevent the sale of NFTs on platforms that do not adhere to creator royalties. Blur is a royalty-optional platform, requiring users to block their NFTs from Blur to secure full royalties on OpenSea. Failure to do so prompts OpenSea to categorize royalties as “optional” for these collections.

Blur contests this approach, contending that creators should retain the autonomy to decide where and how their items are traded rather than having companies dictate terms. They expressed their viewpoint in a blog post, advocating for the ability of creators to earn royalties on all whitelisted marketplaces.

This recent development has ignited conversations within the NFT community, sparking debates over creator fees, concerns about market manipulation, and the level of centralization desired within the Web3 framework.

In response to Blur’s encroachment on its territory, OpenSea has introduced its own pro-trader-focused marketplace: OpenSea Pro (OS Pro). This strategic move taps into various contentious topics, offering a fresh perspective.

Promoted as a platform with zero percent marketplace fees (in contrast to OpenSea’s standard 2.5 percent fee), OS Pro aims to ensure creator royalties with a minimum of 0.5 percent. However, the zero percent fee structure is temporary, reverting to the standard fee after the promotional period.

The platform’s genesis lies in the rebranding of Gem, an aggregator that OpenSea acquired in early 2022. The transformation to OpenSea Pro emerged as a response to increased activity by notable NFT collectors. On April 4, 2023, OpenSea unveiled Gem v2, which marked the evolution of the aggregator into OpenSea Pro, reflecting the ongoing evolution and adaptability of the NFT landscape.

Conclusion

The recent entry of new NFT markets adds to the heat and produces the present NFT marketplace war. In addition, one of the major issues that NFT markets face is a lack of user loyalty. Most NFT traders are unconcerned with the platform they use as long as they can trade at the best available price.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.