Key Points

- Several significant events have occurred in the world of cryptocurrency, including the end of Checkout.com’s partnership with Binance and the shut down of Binance Connect. OpenSea has also stopped supporting NFTs on the BNB Chain network, causing some instability in the market.

- Developments in cryptocurrency ETFs have been ongoing, including the Ethereum Futures ETF gaining approval from the SEC and the first Bitcoin Spot ETF launching in Europe.

Stay updated on the latest developments in the cryptocurrency world. Discover the impact of macroeconomic events on the market overview and gain insights into upcoming trends and predictions.

Last week’s highlights big news

Checkout.com has ended its partnership with Binance and, at the same time, Binance has shut down its Binance Connect platform. Additionally, OpenSea has stopped supporting NFTs on the BNB Chain network. These developments have caused some instability in the market, with over $205M of the hacker’s BNB Chain being liquidated as BNB falls below $217. However, there has also been intervention in the market to prevent a sharp drop in the price of BNB.

In other news, Binance.US has requested a court order to protect itself against the SEC, while Coinbase has been granted permission by the CFTC to trade BTC and ETH futures in the US. Coinbase recently opened in Canada but had to temporarily suspend trading of 3 stablecoins: USDT, DAI, and RAI. Finally, Coinbase and Tornado Cash have lost their lawsuit against the US Treasury Department’s sanctions order.

These events highlight the rapidly changing landscape of cryptocurrency and the importance of staying informed. As always, it is recommended that investors and traders exercise caution and do their due diligence before making any decisions in the market.

Spot ETF pressure continues

Cryptocurrency exchange-traded funds (ETFs) have been a hot topic in the industry for some time now. These investment products allow investors to gain exposure to digital assets without having to buy and store them directly. However, the regulatory landscape for cryptocurrency ETFs has been uncertain, with the US Securities and Exchange Commission (SEC) repeatedly rejecting proposals for Bitcoin ETFs.

Recently, there have been some interesting updates on the ETF front. Here are some of the latest developments:

- Former SEC official Join Reed Stark believes: “The committee will not approve the Bitcoin Spot ETF until a Republican president is elected in 2024.”

- Grayscale, a leading crypto investment firm, is recruiting for its ETF team, indicating that they are serious about launching a cryptocurrency ETF in the future.

- Valkyrie, an asset management firm, has filed more applications for the Ether Futures ETF, which currently has up to 16 similar applications awaiting SEC approval.

- The SEC has given the green light to the Ethereum Futures ETF, which will allow investors to gain exposure to the second-largest cryptocurrency by market cap. The SEC may also approve Ether Futures ETFs at the same time in October.

- Europe has its first Bitcoin Spot ETF launched, issued by Jacobi Investment Funds. The ETF is listed on the Frankfurt and Xetra exchanges and has already attracted significant investor interest.

While the news of the Ethereum Futures ETF approval is certainly exciting, it remains to be seen whether the SEC will eventually approve a Bitcoin Spot ETF. Some experts believe that political factors may play a role in the decision, as suggested by the comment from former SEC official Join Reed Stark. Others argue that the SEC is simply being cautious and wants to ensure that investor protection is a top priority.

Macroeconomic

Recent events in the financial world have impacted the cryptocurrency market in various ways. In the United States, Fitch warned of potential downgrades to several banks, including JP Morgan and Bank of America, causing a ripple effect in the stock market. Additionally, Prime Trust filed for bankruptcy under Chapter 11, adding to the challenges faced by the financial sector.

The release of the Fed meeting’s minutes also caused a stir in the market, with the warning of the need for continued tightening to reduce inflation leading to a surge in investor activity. However, the Fed’s decision to stop operating Farmington Bank, which was associated with FTX & Alameda, had a dampening effect on the market.

In other news, the SEC appealed the Ripple case, requiring approval from the New York Court before the Court of Appeals could take over the case. Meanwhile, China faced a red alert as real estate giants Country Garden and Zhongzhi faced the risk of default, while Evergrande Real Estate Group filed for Chapter 11 bankruptcy protection in the United States with a staggering $340 billion in debt.

On the brighter side, GrayScale’s appeal for the Bitcoin Spot ETF is expected to yield results next week. Moreover, five presidential candidates have either expressed support for or hosted cryptocurrency, highlighting the growing mainstream acceptance of the digital asset.

In international news, Russia’s central bank raised interest rates from +3.5% to 12% at an emergency meeting, while the Monetary Authority of Singapore (MAS) has finalized the rules governing stablecoins. As the world of finance continues to evolve, it remains to be seen what impact these recent events will have on the cryptocurrency market and the wider financial industry.

Last week’s highlights big news

Cryptocurrency is a fast-moving industry that is constantly evolving. Here are some of the latest developments that have been making headlines in the crypto world.

Coca-Cola has issued an NFT on the Base network, with a mint expiration until August 16 and a price range of 0.0011-0.014 ETH/NFT. Meanwhile, Elon Musk’s SpaceX sold $373 million worth of Bitcoin in the second quarter, causing the BTC price to crash to $25,000.

In other news, Tether has introduced Moria, a software that combines IoT and AI for BTC mining. CYBER and SEI have been listed on Binance and other major exchanges, while Michael Burry held a short position with a nominal value of $1.6 billion for the S&P 500 and Nasdaq 100 at the end of Q2.

CoinDesk, a leading cryptocurrency news outlet, is cutting 45% of its staff and preparing to sell the company. Blockchain Stellar has announced an investment and holds a seat on the Board of Directors of the large money transfer company, MoneyGram.

Former President Donald Trump made headlines by reportedly owning up to $2.8 million of Ethereum assets from the sale of NFTs, instead of $250,000. On the other hand, the newly launched layer-2 Shibarium has a bridge error, and SHIB and BONE crashes.

In addition, Tether has stopped issuing USDT on Kusama, Omni, and Bitcoin Cash due to low demand. Mastercard is opening a CBDC program that includes leading partners such as Ripple, Consensys, and Fireblocks. Finally, a $140 million dispute involving NFT and crypto is ongoing between Teneo and DeFinance Capital.

This week’s prediction

Notable events

Wednesday, August 23:

- Flash Manufacturing PMI

- Flash Services PMI

Thursday, August 24:

- Unemployment Claims

Friday, August 25:

- Revised UoM Consumer Sentiment

- Fed Chair Powell Speaks

Market overview forecast

The cryptocurrency market is facing a period of uncertainty as the DXY Index stands at a difficult-to-predict level of 103. While this level is uncomfortable for many, it is favoring a continuation of the rally to 104, which could cause asset prices, including BTC and Altcoins, to fall.

Additionally, the BTC chart has broken its uptrend line, indicating a potential continuation towards the 24k to 21.5k area. The BTC weekly candle is also a strong bearish Marubozu candle, which suggests extremely strong selling force and supports the hypothesis that BTC will continue to decrease.

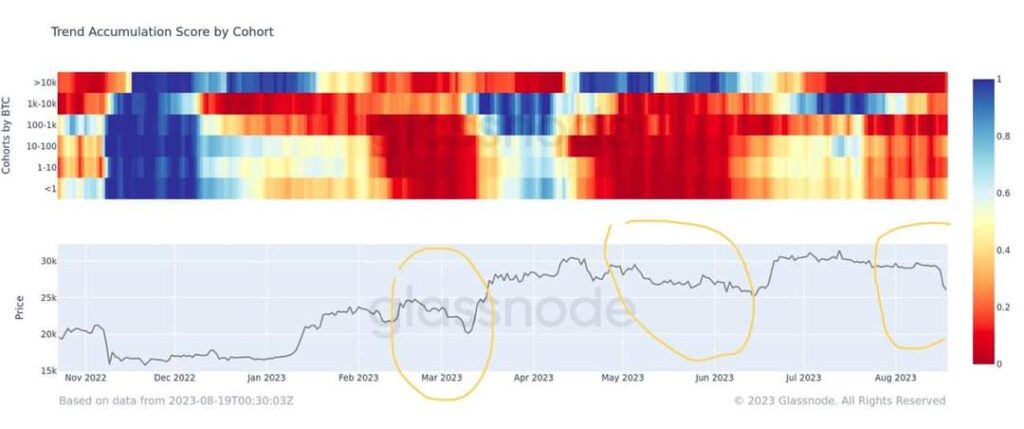

The heatmap chart shows that all the fish are selling their BTC. This week, BTC may continue to move sideways at around 26.XX K, and a quick recovery like the last correction is unlikely.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.