Key Points:

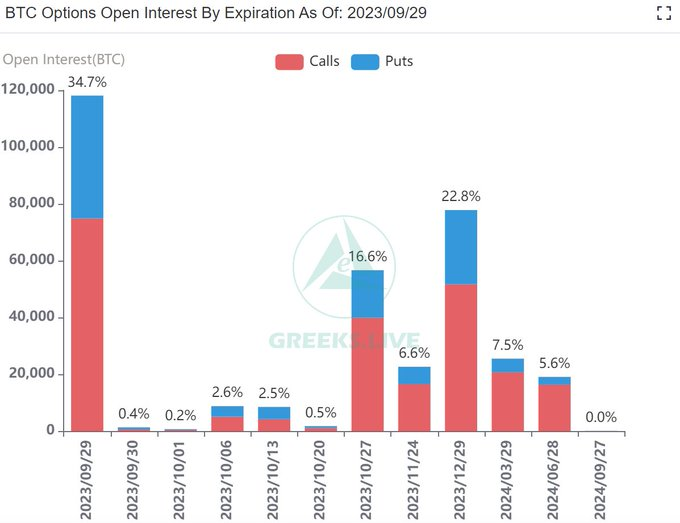

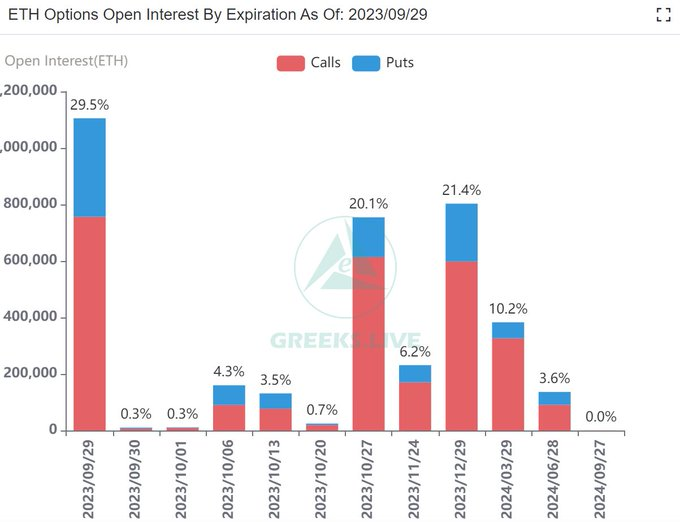

- 118,000 BTC options and 1.11 million ETH options set to expire on Sept. 29.

- $3.2 billion and $1.8 billion notional values, with key Put Call Ratios and max pain points.

- Q3’s subdued market, lower Put positions.

Traders and investors are closely eyeing the options data for BTC and ETH expiry on September 29th.

This quarterly delivery date brings with it significant expiration of options contracts for both Bitcoin (BTC) and Ethereum (ETH), offering insights into market sentiment and potential price movements.

In particular, a staggering 118,000 BTC options are set to expire on September 29th. These options have a Put Call Ratio of 0.58, indicating a relatively balanced mix of bearish and bullish sentiment among traders. The max pain point, a level where the most options contracts would expire worthless, stands at $26,500. This suggests that there may be notable interest in keeping Bitcoin’s price above this threshold. The notional value of these BTC and ETH expiry options reaches an impressive $3.2 billion, underscoring the significance of this expiration.

BTC and ETH Expiry Options Data Paints a Unique Picture

Ethereum is in focus, with 1.11 million ETH options nearing their expiry. The Put Call Ratio for ETH options is 0.46, indicating a slightly more bullish bias compared to Bitcoin. The max pain point for Ethereum is $1650, a level that may influence price action as the BTC and ETH expiry date approaches. The notional value of these ETH options is a substantial $1.8 billion.

The third quarter (Q3) of the year is historically a less active period for cryptocurrency markets, with lower options volumes. Additionally, the Put position share is significantly lower compared to more frequent weekly deliveries, suggesting a relatively optimistic sentiment among traders.

Liquidity in the market has been on the decline recently, with larger positions being a dominant trading driver leading up to this quarterly expiration. As the delivery date approaches, implied volatility (IV) continues its downward trend, possibly indicating reduced expectations for significant price fluctuations in the near term.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.