Market Overview (Oct 16 – Oct 22): Ripple Lawsuit Dismissed and Bitcoin Halving Milestone

Key Points

- Last week’s highlights include the dismissal of the lawsuit between the SEC and Ripple CEO Brad Garlinghouse, Binance US suspending USD withdrawals, and the launch of the Scroll blockchain platform.

- In macroeconomic news, the Federal Reserve plans to control inflation while monitoring economic indicators. Several economic events are scheduled in the US.

- Additionally, the bitcoin halving milestone and BTC dominance are influencing the market, while some altcoins like $Link, $Solana, $INJ, $Trx, and $APT show resilience and potential for growth.

Discover the latest developments in the market overview! Explore key news highlights, macroeconomic insights, market predictions, and Bitcoin Halving Milestone. Stay ahead in the fast-paced world of digital assets.

Last week’s highlights big news

In recent developments, the lawsuit between the US Securities and Exchange Commission (SEC) and Ripple CEO Brad Garlinghouse, along with Chris Larsen, has officially been dismissed. This comes after an agreement was reached between the two parties, marking a significant milestone in the legal battle.

Another important development is Binance US‘s decision to suspend USD withdrawals. This move has raised concerns among users and has sparked discussions about the implications for cryptocurrency trading in the United States.

Meitu, a renowned technology company, has announced its plan to sell $100 million worth of Bitcoin and Ethereum. This decision comes in the wake of financial losses and showcases the volatile nature of the crypto market.

Scroll, a promising blockchain project, has recently launched its mainnet. This platform aims to revolutionize the way content creators are compensated for their work, offering an innovative and decentralized approach.

The SUI token experienced a decline in price following reports of an investigation by South Korean authorities. This highlights the impact of regulatory actions on cryptocurrency markets and investor sentiment.

In a potential shift in business strategy, Twitter X is considering the introduction of user fees. This potential change has garnered attention and raised questions about the future of social media platforms and their revenue models.

Aptos network, a prominent player in the crypto space, faced a major setback when it experienced a power outage, resulting in several hours of downtime. This incident underscores the importance of infrastructure stability and reliability in the digital asset ecosystem.

Grayscale, a leading cryptocurrency asset management firm, continues its efforts to secure SEC approval for the Bitcoin ETF Spot. This development has significant implications for institutional investors and the wider adoption of cryptocurrencies.

Tesla, the electric vehicle manufacturer, has made headlines by holding Bitcoin for five consecutive quarters. This strategic move further solidifies Bitcoin’s position as a recognized store of value among mainstream companies.

Binance, a major cryptocurrency exchange, has signed agreements with new fiat partners to facilitate payment, deposit, and withdrawal in EUR. This expansion opens up new avenues for European users to access and utilize cryptocurrencies.

Coinbase, a prominent player in the crypto industry, has chosen Ireland as its operational and main operating center within the European Union. If approved, Coinbase will obtain a comprehensive “MiCA license” in Ireland, enabling it to extend its services to other EU countries.

Macroeconomic

In recent statements, Chairman Powell of the Federal Reserve (FED) acknowledged that inflation remains a concern, emphasizing the need to control it even if it means slowing down economic growth. The FED, however, plans to exercise caution and closely monitor economic indicators before making any decisions on interest rates.

According to Powell, the recent positive data is just the initial step in building confidence that inflation is being managed and moving towards the target. The duration and stability of low inflation in the coming quarters are yet to be determined.

Despite the challenges ahead, Powell and his colleagues are committed to achieving sustainable inflation reduction of 2%. The FED will carefully consider the overall economic data before deciding whether to continue tightening monetary policy.

FED Governor Christopher Waller has indicated that interest rates may remain unchanged as economic data is closely monitored.

This week, several significant economic events are scheduled in the United States. On Tuesday, the S&P Case-Shiller Home Price Index will provide insights into the housing market. On Thursday, the Q3 GDP will be released, with an estimated growth rate of 4.5% compared to the previous month’s 2.1%. Lastly, on Friday, the PCE Inflation Rate will be announced, shedding light on the inflationary pressures in the economy.

While the FED’s focus on inflation and interest rates is crucial for traditional financial markets, it also has implications for the cryptocurrency sector. Cryptocurrency enthusiasts and investors should pay attention to how monetary policy decisions and economic indicators influence the broader financial landscape.

Prediction Market Crypto

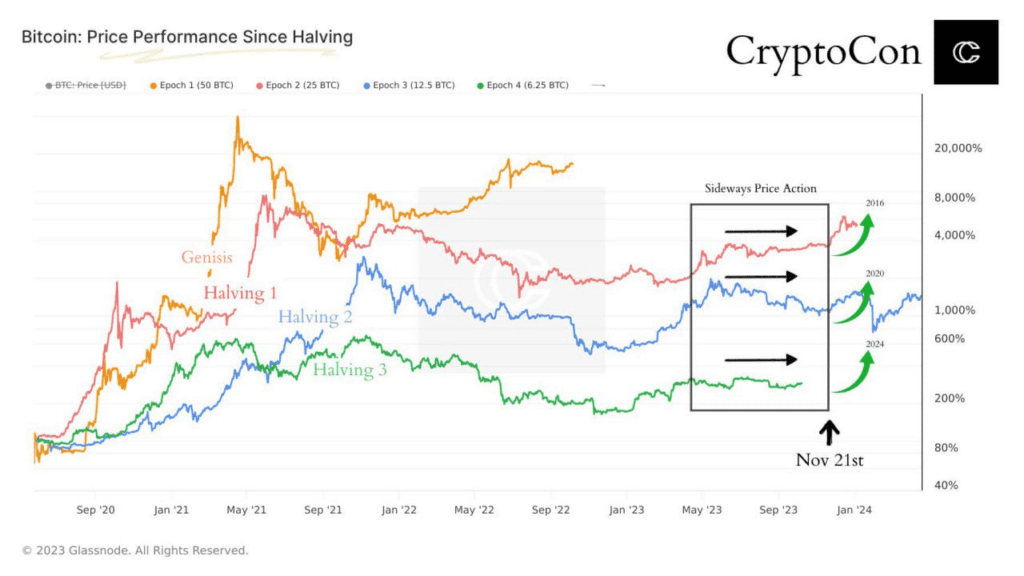

One significant event that has historically influenced BTC’s price is the Bitcoin halving milestone. This event marks a reduction in the reward given to Bitcoin miners, which occurs approximately every four years. Interestingly, previous price actions have shown that the market tends to shift towards a bull run around November 21, following the bitcoin halving milestone. This is certainly something to pay attention to for investors and traders.

Regarding the current market context:

- BTC dominance is increasing.

- Altcoins are bleeding (some low-cap coins can be pumped/dumped, with a few exceptions).

- Projects are not focusing on operations, marketing, and partnerships.

- Retail investors are leaving the game due to the high number of killings.

- Liquidity is almost non-existent.

- News sometimes has real impact, sometimes not.

While many altcoins are struggling, some projects and ecosystems are showing resilience and recovering alongside BTC’s strong growth. Here are a few notable examples:

- $Link (Oracle Leader): Link has recently released a hot CCIP feature, which is crucial for banks and international payment providers. Its data is widely used by reputable blockchains, and its ecosystem has gained significant traction with major banks utilizing its services. Link’s price is gradually increasing, independent of BTC’s movements.

- $Solana: Solana Foundation’s partnership with the Dubai Multi-Commodity Centre (DMCC) and their collaboration with Messari for the Q3 report demonstrate their commitment to development. This partnership showcases their confidence in the ecosystem’s growth and dispels concerns about FUD and the FTX collapse. Solana’s ecosystem includes potential projects such as #RAY, #FTT, #SNM, #Fida, and #SRM.

- $INJ: INJ has transitioned into a layer1 solution and successfully raised $120M in funding. With most of the funds unlocked, INJ has a market maker for jump trading. Chart analysis reveals that INJ consistently rebounds whenever BTC recovers, often experiencing price increases of more than 8 times during downtrends.

- $Trx: Despite market fluctuations, TRX’s trading volume remains stable. When BTC starts to recover, TRX also experiences rebounds. With Justin Sun, a prominent figure in the cryptocurrency space, backing TRX, the project is positioned for potential growth in the upcoming market season.

- $APT: Celebrating its 1-year token launch anniversary, APT has captured attention through a previous airdrop campaign. This time, APT is offering NFT minting for the anniversary event, creating anticipation for potential rewards. It is worth monitoring whether this event will lead to another airdrop giveaway.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.