Market Overview (Oct30 – Nov5): Fed’s Interest Rate Decision, Binance Lists TIA and Coinbase Strong Q3

Key Points

- Binance listed Celestia ($TIA) on their platform, with trading set to start on October 31, 2023. The listing was in response to a large number of requests for the allocation of $TIA tokens.

- Fed’s Interest Rate Decision decided to keep interest rates unchanged at 5.5% in the U.S. This decision reflects a shift in the Fed’s approach, introducing more uncertainty about future rate increases.

- Some people believe that the current bull season is not over and that investors are experiencing FOMO and awaiting significant news on the Bitcoin ETF.

Discover the latest highlights in the market overview and macroeconomic landscape, including the Fed’s Interest Rate decision, Coinbase’s financial performance, and Binance’s listing of Celestia.

Last week’s highlights big news

Binance recently announced the listing of Celestia ($TIA) on their platform, with trading expected to start on October 31, 2023. This move comes after a significant number of addresses, totaling 191,391, requested the allocation of 60 million $TIA tokens, which accounts for 6% of the total supply.

On the 15th anniversary of Satoshi Nakamoto’s release of the Bitcoin whitepaper, October 31 marks a significant milestone in the history of cryptocurrency. Satoshi Nakamoto introduced Bitcoin to the world for the first time with the publication of the whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Spot On Chain reports that addresses associated with FTX and Alameda have transferred a total of 13.6 million dollars to Binance and Coinbase. Notable transfers include $DYDX with 2.64 million dollars, $AXS with 1.05 million dollars, $AAVE with 520 thousand dollars, $GRT with 4.85 million dollars, $RNDR with 2.3 million dollars, and $MKR with 967 thousand dollars. So far, FTX and Alameda Research have sent a combined total of 26 EVM tokens worth $83.6 million to the exchange.

Coinbase has made an important announcement, allowing U.S. traders to engage in leveraged cryptocurrency futures through the Coinbase Financial Market. The offering includes futures contracts for $BTC and $ETH, with a minimum capital requirement of 1/100 BTC and 1/10 ETH.

Regarding financial performance, Coinbase reported revenue of $674.1 million in Q3, with a net loss of $2 million, an improvement compared to a net loss of $545 million during the same period last year. Additionally, Coinbase generated $172 million in interest income from USDC stablecoin in Q3, while its trading volume decreased from $159 billion in the same period last year to $76 billion.

Bitget global Exchange has also released its 12th asset reserve certificate, showing an increase of 6.3% in user assets for $BTC, a total of 2849.03. Furthermore, user assets for $ETH amount to 18k, and $USDT assets reach 437 million USD, marking a 14.9% increase.

In the NFT marketplace sector, opensea recently announced a restructuring, including layoffs for half of its employees. The company aims to focus on upgrading product technology, reliability, speed, quality, and user experience. Affected employees will receive four months of severance pay. OpenSea’s market share has declined from 73% in October 2022 to 18% as of November 3 this year.

ProShares is set to launch an innovative ETF that allows investors to take a bearish view of ETH. The ProShares’ Short Ether strategy aims to deliver the inverse performance of the Standard & Poor’s Ether Futures Index. In simpler terms, if the index drops 1%, the ETF will seek to return 1%. In other news, payment company PayPal Holdings announced that they have received a Wells notice from the SEC regarding their US dollar-backed stablecoin $PYUSD.

Macroeconomic

The Federal Reserve (Fed) has announced that they will not raise interest rates this time, keeping the current interest rate in the US at 5.5%. This decision comes after a careful evaluation of the economic situation and inflation prospects. Chairman Powell’s tone during the Fed meeting was mild, indicating a shift from a bias towards further rate increases to uncertainty about the need for them.

Fed’s Interest Rate process is now based on a synthesis of information, taking into account various factors rather than relying on any single indicator. This change introduces unpredictability into the market overview, making it difficult to ascertain whether the Fed will raise rates or not in the future.

Looking ahead, next year being a presidential election year in the US, the Treasury Department is faced with the task of selling a large amount of bonds. In order to maintain flexibility and the ability to lower interest rates if necessary, the Fed is leaving room for adjustments.

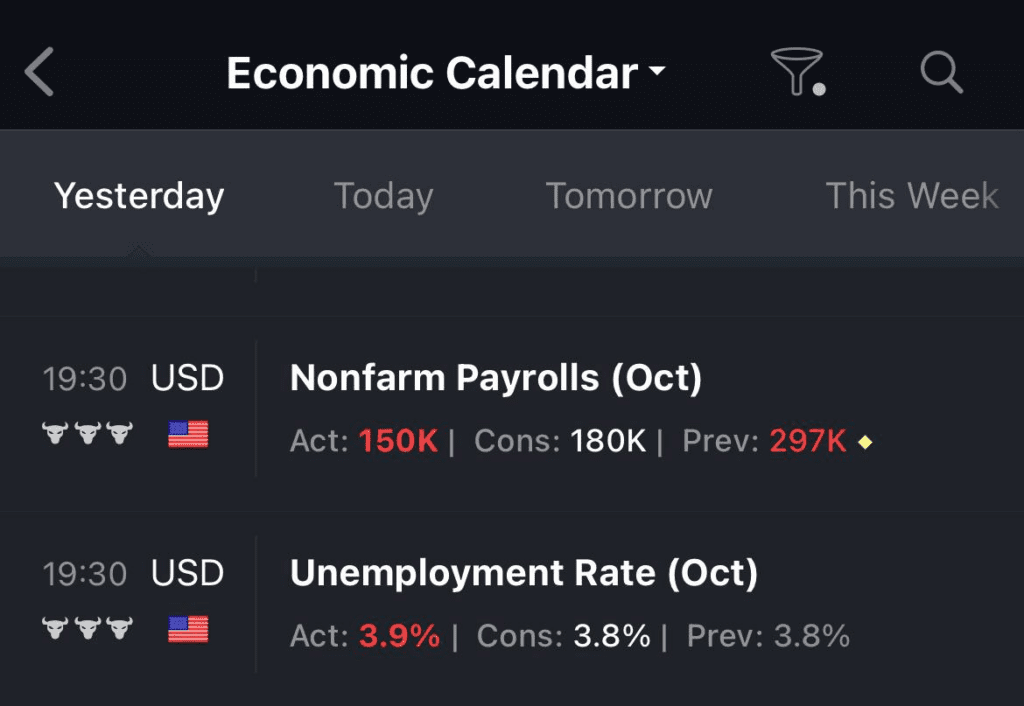

In terms of the current economic landscape, the unemployment rate stands at 3.9%, which is still relatively low but represents the highest level since January 2022. Additionally, non-farm payrolls increased by 150,000, falling short of the forecasted 170,000 and experiencing a significant decline compared to the previous month’s increase of 297,000.

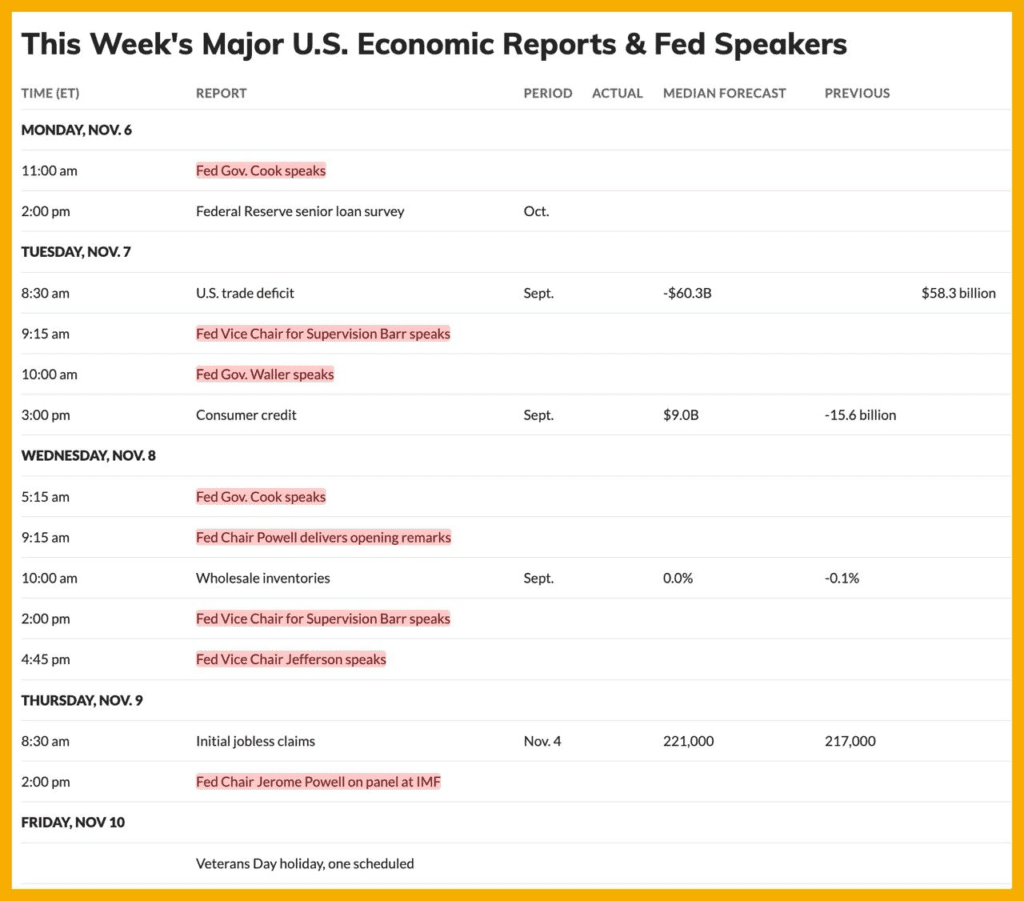

While there are no significant economic data released this week, there will be a series of statements from Fed officials, including Chairman Powell. These statements will provide further insights into the Fed’s stance and its potential impact on the economy.

Prediction Market Crypto

After the Fed decided to keep interest rates unchanged, $BTC had a positive reaction and reached near the $36K milestone. We may not be thinking about the next bull season yet, but we can consider the current bull season as many people are experiencing FOMO and awaiting significant news on the Bitcoin ETF.

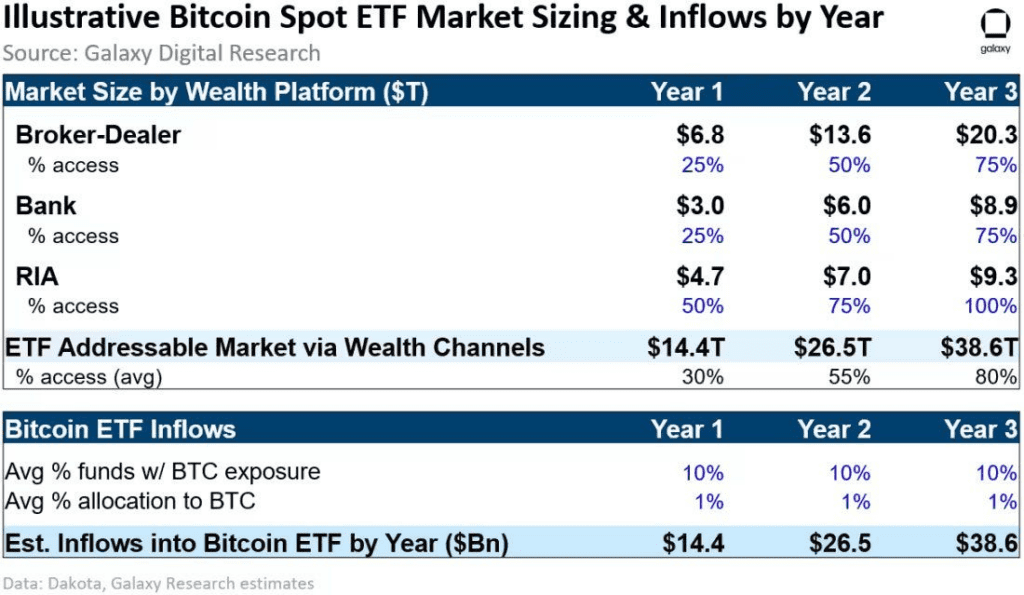

According to estimates, there will be $14 billion in the first year after the launch of the Bitcoin ETF, increasing to $27 billion in the second year and $39 billion in the third year.

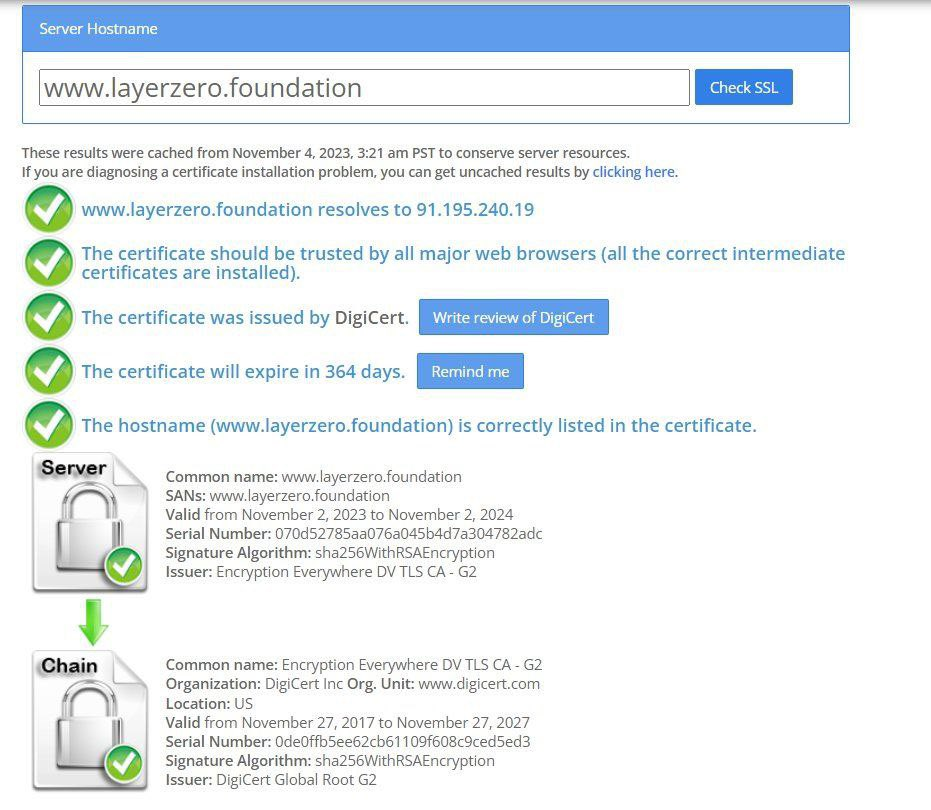

Recently, the SSL certificate for the domain http://LayerZero.foundation has been registered, which potentially indicates the establishment of a dedicated domain for the purpose of claiming the airdrop $ZRO. As we are aware, it is common for projects to create a Foundation website prior to conducting an Airdrop. This practice has been observed in projects such as Aptos, Sui, and Arbitrum.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.